What real estate developers do is far more complex than simply building houses or apartments. It’s a multifaceted process encompassing land acquisition, meticulous planning, securing financing, managing construction, and ultimately, marketing and selling the completed project. This journey involves navigating intricate legal frameworks, collaborating with diverse teams, and managing significant financial risks to deliver successful developments that meet market demands and contribute to the built environment.

Understanding the entire lifecycle, from initial concept to final sale, reveals the intricate skillset and dedication required of these professionals.

Real estate development is a dynamic field requiring a blend of business acumen, technical expertise, and creative vision. From identifying promising land parcels and navigating complex zoning regulations to overseeing construction and marketing the finished product, developers play a crucial role in shaping our communities. This exploration will delve into the key stages involved, highlighting the challenges and rewards inherent in this demanding yet rewarding career path.

Land Acquisition and Development

Real estate development begins with the crucial step of land acquisition. This involves identifying, securing, and preparing land parcels for construction projects, ranging from residential complexes to commercial buildings and infrastructure projects. The process is complex, requiring a deep understanding of legal frameworks, financial markets, and environmental regulations.

Identifying and Securing Suitable Land Parcels

The initial phase focuses on identifying potential land parcels that align with the developer’s project goals and market analysis. This involves extensive research, considering factors like zoning regulations, accessibility, proximity to amenities, and environmental impact. Developers often utilize Geographic Information Systems (GIS) and market research data to pinpoint promising locations. Once suitable parcels are identified, negotiations with landowners commence, leading to offers and counteroffers, ultimately resulting in a purchase agreement.

Securing the land involves navigating legal processes, ensuring clear title, and addressing any potential encumbrances or easements.

Legal and Financial Aspects of Land Acquisition

Land acquisition involves navigating a complex legal landscape. Developers must ensure the land’s title is clear and free from any liens or disputes. This requires thorough title searches and legal due diligence. Financing plays a significant role, with developers often securing loans or attracting investors to fund the purchase. Negotiating favorable terms with lenders is crucial, as is understanding the implications of different financing structures.

The legal process can involve various contracts, including purchase agreements, options contracts, and land development agreements, each demanding careful review and legal counsel.

Due Diligence in Evaluating Land Suitability

Before committing to a purchase, developers conduct thorough due diligence to assess the land’s suitability for the intended project. This involves environmental assessments to identify potential contamination or hazards, geotechnical surveys to determine soil conditions and bearing capacity, and title searches to ensure clear ownership and absence of encumbrances. Zoning regulations and building codes are meticulously reviewed to ensure the proposed development complies with all legal requirements.

Furthermore, market analysis is conducted to confirm the project’s viability and potential profitability in the chosen location. Any potential risks or challenges identified during due diligence are carefully evaluated and mitigated.

Comparison of Land Acquisition Strategies

The choice of land acquisition strategy depends on various factors, including the developer’s financial resources, risk tolerance, and project goals. Different strategies offer varying levels of control, risk, and financial commitment.

| Acquisition Strategy | Advantages | Disadvantages | Example |

|---|---|---|---|

| Direct Purchase | Full control, clear ownership | Higher upfront capital required, potential for higher risk | A developer directly purchasing a vacant lot from a private landowner. |

| Joint Ventures | Shared risk and capital, access to expertise | Shared control, potential for conflicts | A developer partnering with a landowner to develop a property, sharing profits and responsibilities. |

| Land Assembly | Ability to acquire larger parcels | Complex negotiations, potential for delays | A developer acquiring multiple smaller adjacent plots to create a larger development site. |

| Option Contracts | Secures the right to purchase land without immediate commitment | Requires upfront payment for the option, potential for loss if the option is not exercised | A developer securing the right to buy a property within a specific timeframe, giving them time to conduct due diligence and secure financing. |

Financing and Budgeting

Securing adequate financing and meticulous budgeting are critical for the success of any real estate development project. The complexities involved necessitate a thorough understanding of funding sources, cost breakdowns, and risk management strategies. Without careful planning in these areas, even the most promising projects can falter.

Funding Sources for Real Estate Development, What real estate developers do

Real estate developers utilize a diverse range of funding sources to finance their projects. These sources often involve a combination of equity and debt financing, tailored to the specific project’s needs and the developer’s financial position. The choice of funding source impacts the project’s overall financial structure and risk profile.

- Equity Financing: This involves using personal funds, attracting private investors, or seeking venture capital. Equity investors typically receive a share of the project’s profits in exchange for their investment.

- Debt Financing: This includes traditional bank loans, construction loans, mezzanine financing, and bonds. Debt financing requires repayment of the principal and interest, often with specific terms and conditions.

- Government Grants and Subsidies: Depending on the project’s location and purpose (e.g., affordable housing, infrastructure development), government grants and subsidies may be available to offset development costs.

- Joint Ventures: Partnering with other developers or investors can provide access to additional capital and expertise.

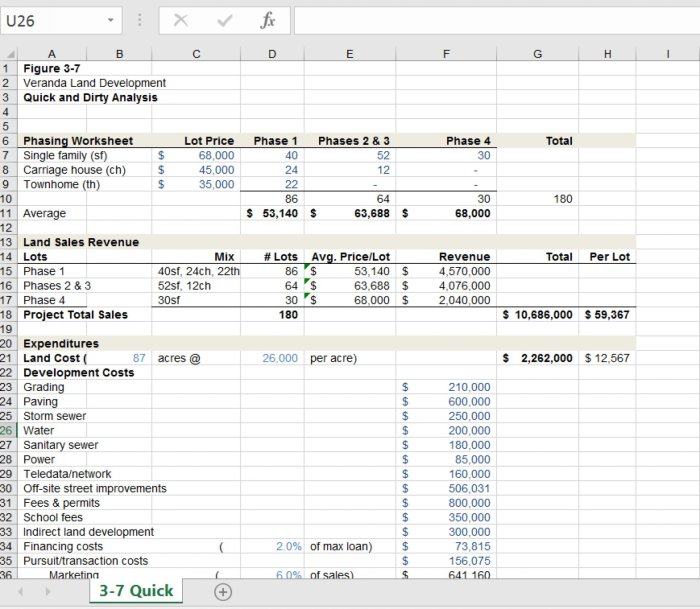

Typical Development Costs

Development costs encompass a broad range of expenses incurred throughout the project lifecycle. Accurate cost estimation is crucial for successful budgeting and financial planning. Underestimating costs can lead to significant financial strain and project delays.

- Land Acquisition: This is often the most significant initial expense, varying greatly depending on location, size, and market conditions.

- Construction Costs: These include materials, labor, permits, and contractor fees. Construction costs can fluctuate based on market conditions, material availability, and project complexity.

- Marketing and Sales Costs: Expenses related to advertising, sales commissions, and other marketing activities are essential for attracting buyers or tenants.

- Professional Fees: Architects, engineers, lawyers, and other professionals contribute significantly to the overall cost.

- Interest and Financing Costs: Interest payments on loans and other financing arrangements represent a substantial portion of the overall expenses.

- Contingency Reserves: A crucial component of any budget, contingency reserves account for unforeseen expenses and risks.

Strategies for Managing Financial Risks

Effective risk management is paramount in real estate development. Strategies should be implemented to mitigate potential financial losses and ensure project viability.

- Thorough Due Diligence: Comprehensive market research, site analysis, and legal review are essential to identify and assess potential risks.

- Contingency Planning: Developing detailed plans to address potential delays, cost overruns, and market fluctuations is crucial.

- Hedging Strategies: Using financial instruments to protect against adverse market movements (e.g., interest rate swaps, commodity futures).

- Insurance: Securing appropriate insurance coverage against various risks, such as construction delays, property damage, and liability claims.

- Diversification: Investing in multiple projects or asset classes can reduce overall risk exposure.

Sample Budget for a Hypothetical Residential Development

This example illustrates a simplified budget for a hypothetical residential development project involving 10 single-family homes. Actual costs will vary significantly based on location, project specifics, and market conditions.

| Cost Item | Estimated Cost | % of Total Cost |

|---|---|---|

| Land Acquisition | $1,000,000 | 25% |

| Construction Costs | $2,000,000 | 50% |

| Marketing and Sales | $200,000 | 5% |

| Professional Fees | $300,000 | 7.5% |

| Financing Costs | $200,000 | 5% |

| Contingency Reserve | $300,000 | 7.5% |

| Total Estimated Cost | $4,000,000 | 100% |

Construction Management: What Real Estate Developers Do

Construction management is a critical phase in real estate development, bridging the gap between design and the final product. It involves the meticulous planning, coordination, and execution of all construction activities to ensure the project is completed on time, within budget, and to the required quality standards. Effective construction management minimizes risks, maximizes efficiency, and ultimately contributes to the overall success of the development.

The Role of the Construction Manager

The construction manager acts as the central point of contact and control for all construction-related activities. Their responsibilities encompass a wide range of tasks, including developing and managing the project schedule, overseeing the procurement and management of materials, coordinating the work of various contractors and subcontractors, ensuring adherence to safety regulations, and resolving conflicts that may arise during construction. They are responsible for maintaining open communication with all stakeholders, including the developer, architects, engineers, and contractors, to keep the project on track.

Their expertise in construction techniques, contract law, and risk management is crucial for successful project delivery.

Selecting and Managing Contractors and Subcontractors

The process of selecting contractors and subcontractors begins with a thorough review of bids and proposals. This involves evaluating the experience, qualifications, and financial stability of potential contractors. The selection criteria should align with the project’s specific needs and priorities. Once selected, the construction manager establishes clear contracts that Artikel the scope of work, payment schedules, and timelines.

Ongoing management involves regular monitoring of contractor performance, ensuring compliance with contract terms, and addressing any issues or disputes that may arise. This often includes regular site visits and progress meetings to track performance against the project schedule and budget. Effective communication and proactive problem-solving are key to maintaining positive working relationships and ensuring project success.

Quality Control and Risk Management During Construction

Quality control is an ongoing process that ensures the construction adheres to the approved plans and specifications. This involves regular inspections, testing of materials, and verification of workmanship. The construction manager implements a quality control plan that defines the methods and procedures for ensuring quality throughout the construction process. This might involve third-party inspections or employing dedicated quality control personnel.

Risk management involves identifying and mitigating potential problems before they occur. This could include developing contingency plans for unforeseen circumstances, such as weather delays or material shortages, and implementing safety protocols to prevent accidents. Regular risk assessments are conducted to identify and address potential issues proactively. For example, a risk assessment might identify the potential for cost overruns due to unforeseen ground conditions, leading to the implementation of a contingency plan involving additional budget allocation or alternative construction methods.

A Step-by-Step Guide to the Construction Phase

The construction phase typically begins with obtaining the necessary building permits. This involves submitting detailed plans and specifications to the relevant authorities for review and approval. Following permit approval, site preparation commences, including clearing the land, excavating, and grading. Next, the foundation is laid, followed by the framing, roofing, and exterior finishes. Interior work, including plumbing, electrical, and HVAC systems, is then completed.

Throughout the construction process, regular inspections are conducted by building inspectors to ensure compliance with building codes and regulations. Any necessary corrections or modifications are addressed before moving to the next stage. Finally, the project undergoes a final inspection, and upon successful completion, the occupancy permit is issued. This systematic approach ensures a smooth and efficient construction process, minimizing delays and potential issues.

Marketing and Sales

Effective marketing and sales strategies are crucial for the success of any real estate development project. They bridge the gap between the completed development and the potential buyers or tenants, ensuring a strong return on investment. A well-executed marketing plan considers the target audience, chosen marketing channels, and a realistic budget to achieve optimal results.

Effective Marketing Strategies

Attracting potential buyers or tenants requires a multi-faceted approach that leverages various marketing channels. Digital marketing, including targeted online advertising, social media engagement, and search engine optimization (), plays a significant role. High-quality photography and virtual tours are essential for showcasing properties online. Print advertising in relevant publications can also reach a specific demographic. Public relations and community engagement initiatives build brand awareness and foster positive relationships.

Finally, leveraging partnerships with real estate agents and brokers expands the reach of marketing efforts. A well-rounded strategy combines these elements to maximize exposure and generate leads.

Examples of Successful Marketing Campaigns

Several successful real estate marketing campaigns illustrate the effectiveness of targeted strategies. For example, the campaign for “The Shard” in London utilized stunning visuals and emphasized the iconic building’s unique features and prime location. This strategy successfully attracted high-net-worth individuals seeking luxury accommodations. Another successful example is the marketing of “The Grove” in Los Angeles, which emphasized the community aspects and lifestyle benefits of living in the development, appealing to families and young professionals.

These campaigns highlight the importance of understanding the target audience and tailoring marketing messages accordingly.

Competitive Property Pricing

Pricing properties competitively involves a thorough market analysis to determine the appropriate price point. This analysis considers comparable properties in the area, market trends, economic conditions, and the unique features of the property. A pricing strategy that is too high may deter potential buyers, while a price that is too low may undervalue the property. Sophisticated pricing models that factor in location, size, amenities, and market demand are often employed to arrive at an optimal price.

Real estate professionals often utilize comparative market analysis (CMA) reports to justify pricing decisions.

Marketing Plan for a New Condominium Development

This marketing plan Artikels a strategy for a new condominium development targeting young professionals in a bustling urban center.

Target Audience:

Young professionals (ages 25-40) with high disposable income, seeking modern, convenient, and amenity-rich living spaces. They value walkability, proximity to work and entertainment, and a vibrant community.

Marketing Channels:

- Digital Marketing: Targeted online advertising on platforms frequented by young professionals (e.g., Instagram, Facebook, LinkedIn). Utilizing to improve organic search rankings. Development of a visually appealing website with virtual tours and interactive floor plans.

- Public Relations: Press releases announcing the development and highlighting its unique features. Partnerships with local influencers and bloggers to generate buzz.

- Print Advertising: Advertisements in lifestyle magazines and newspapers targeting the desired demographic.

- Broker Partnerships: Collaborating with real estate agents and brokers to reach a wider audience and generate sales leads.

Budget:

A total marketing budget of $150,000 is allocated across the various channels, with the majority directed towards digital marketing initiatives. A detailed breakdown of the budget will be created to track expenditures and measure ROI.

Legal and Regulatory Compliance

Navigating the complex web of legal and regulatory requirements is crucial for successful real estate development. Failure to comply can lead to significant delays, financial penalties, and even project failure. Understanding and proactively addressing these requirements from the outset is paramount.Legal and regulatory compliance in real estate development encompasses a broad range of laws, ordinances, and regulations that govern every stage of a project, from land acquisition to final occupancy.

These regulations vary significantly by jurisdiction and are constantly evolving, necessitating ongoing vigilance and expert legal counsel.

Key Legal and Regulatory Requirements

Real estate developers must adhere to a multitude of federal, state, and local laws and regulations. These include, but are not limited to, zoning laws, building codes, environmental regulations (such as the Clean Water Act and the Endangered Species Act), fair housing laws (like the Fair Housing Act), and accessibility standards (like the Americans with Disabilities Act). Specific requirements will also depend on the type of development (residential, commercial, industrial) and its location.

For example, a project near a wetland might require extensive environmental impact assessments and mitigation measures.

Obtaining Necessary Permits and Approvals

The process of obtaining permits and approvals is often lengthy and complex, requiring meticulous planning and documentation. Developers typically need to submit detailed plans and applications to various government agencies, including planning departments, building departments, and environmental agencies. These applications usually involve multiple reviews and approvals, potentially requiring revisions based on agency feedback. Delays are common, and developers must factor in ample time for the permitting process.

For instance, obtaining a building permit might involve submitting architectural drawings, engineering plans, and environmental impact statements, which are then reviewed by the relevant authorities. Failure to submit complete and accurate documentation can result in delays and rejections.

Adherence to Building Codes and Safety Regulations

Building codes and safety regulations are designed to protect public health and safety. Developers must ensure that their projects comply with all applicable codes and regulations throughout the construction process. This includes requirements related to structural integrity, fire safety, electrical systems, plumbing, and accessibility. Regular inspections by building inspectors are conducted to verify compliance. Non-compliance can lead to stop-work orders, fines, and even project demolition in severe cases.

For example, failure to meet fire safety standards could result in significant penalties and legal action.

Common Legal Issues and Mitigation Strategies

Real estate developers frequently encounter legal challenges. Common issues include zoning disputes, environmental concerns, litigation related to construction defects, and disputes with contractors or subcontractors. Effective risk management strategies include thorough due diligence during land acquisition, engaging experienced legal counsel, securing appropriate insurance coverage (such as errors and omissions insurance), and maintaining detailed documentation throughout the project lifecycle.

For example, a developer facing a zoning dispute might need to negotiate with local authorities or pursue legal action to obtain necessary variances or approvals. Proactive engagement with stakeholders and transparent communication can significantly reduce the risk of disputes.

Post-Construction Activities

The final stage of real estate development, post-construction, is crucial for ensuring project success and maximizing return on investment. It encompasses a range of activities, from the formal handover of properties to ongoing management and maintenance, all impacting the developer’s long-term profitability and reputation. Effective post-construction management minimizes risks and enhances the overall value proposition for buyers and tenants.Property handover to buyers or tenants involves a meticulously planned process designed to ensure a smooth transition.

This includes a thorough inspection of the property, verification of all fixtures and fittings, and the provision of necessary documentation such as occupancy permits and warranties. The developer typically schedules individual handover appointments, providing opportunities for buyers or tenants to raise any concerns or clarify any ambiguities. Clear communication and a well-defined handover checklist are essential to minimize disputes and ensure client satisfaction.

Property Handover Procedures

A typical property handover includes a comprehensive inspection with the buyer or tenant, identifying any outstanding issues. This is documented using a detailed checklist and photographic evidence. The process also involves the transfer of keys and access codes, the explanation of building systems and utilities, and the provision of all relevant documentation, including the title deed (for buyers) or lease agreement (for tenants).

Any outstanding repairs or defects are noted and addressed according to a pre-agreed timeframe and process. Finally, the handover is formally documented and signed by both parties, confirming the completion of the transfer.

Ongoing Developer Responsibilities

Developers typically have ongoing responsibilities, even after project completion. These include providing warranty coverage for defects in workmanship or materials, often for a period of one to two years. The developer may also be responsible for managing common areas in multi-unit developments, including landscaping, security, and maintenance of shared facilities. This often involves establishing a homeowner’s association (HOA) or employing a property management company.

Proactive communication with owners or tenants is essential to address any issues promptly and maintain positive relationships.

Strategies for Maximizing Return on Investment

Post-construction ROI maximization involves strategies focused on both short-term and long-term value creation. Short-term strategies might include efficient property sales or leasing, leveraging strong market demand, and effective marketing and advertising. Long-term strategies focus on property maintenance, ensuring tenant satisfaction, and potentially increasing property value through upgrades or renovations. Effective property management, which can include implementing energy-efficient practices and proactive maintenance to minimize repair costs, plays a significant role in maximizing long-term ROI.

For example, a developer could implement smart home technology to attract higher-paying tenants, thus increasing rental income.

Property Management Strategies

Effective property management is critical for maximizing post-construction returns and maintaining property value. Different strategies exist, each with its own advantages and disadvantages.

- Self-Management: The developer directly manages the property. This offers greater control but can be time-consuming and require specialized expertise.

- Hiring a Property Management Company: Outsourcing management to a specialized firm allows the developer to focus on other projects. This is often more cost-effective but sacrifices some control.

- Establishing a Homeowners Association (HOA): For multi-unit developments, an HOA manages common areas and enforces rules. This distributes responsibility among owners but requires careful establishment and ongoing oversight.

The choice of strategy depends on the size and complexity of the development, the developer’s resources, and the specific needs of the property. A well-structured management plan, regardless of the chosen strategy, is essential for long-term success.

Team Management and Collaboration

Successful real estate development hinges on effective team management and seamless collaboration. A complex project requires a diverse team of skilled professionals, each with specific roles and responsibilities, working cohesively towards a shared goal. Open communication, clear roles, and a collaborative spirit are crucial for navigating the challenges inherent in bringing a development from concept to completion.Effective team management in real estate development necessitates a well-defined organizational structure and clear communication protocols.

The project’s success relies heavily on the coordination of various disciplines and the ability to resolve conflicts swiftly and efficiently.

Key Personnel Roles and Responsibilities

A typical real estate development project involves a range of professionals, each contributing unique expertise. The interplay between their roles ensures the project progresses smoothly and efficiently. For instance, the architect is responsible for the design and aesthetics of the building, while the structural engineer ensures its structural integrity and compliance with building codes. The general contractor manages the construction process, overseeing subcontractors and ensuring the project stays on schedule and within budget.

Other key roles include project managers, who oversee the entire development process, and legal counsel, who ensures compliance with all relevant regulations.

Effective Communication Strategies for Diverse Teams

Managing a diverse team requires implementing effective communication strategies. Regular meetings, both formal and informal, are essential to keep everyone informed and aligned. These meetings should have clear agendas and defined outcomes. Utilizing project management software that facilitates communication and document sharing can streamline workflows and improve transparency. Moreover, establishing clear communication protocols, including preferred methods of contact and response times, helps avoid misunderstandings and delays.

Open-door policies encourage team members to voice concerns and suggestions proactively. Conflict resolution mechanisms should also be in place to address disagreements constructively. Consider using visual aids, such as project timelines and progress reports, to enhance communication and ensure everyone is on the same page.

Collaboration and Coordination Among Stakeholders

Collaboration and coordination are paramount throughout the development process. Successful projects require effective communication and collaboration not only within the development team but also with external stakeholders, including investors, lenders, local authorities, and community members. Regular updates to stakeholders on project progress, potential challenges, and risk mitigation strategies are crucial for maintaining trust and support. This collaborative approach fosters a shared understanding of project goals and promotes a shared sense of ownership and accountability.

Open dialogue and a willingness to compromise are essential to navigate differing opinions and perspectives.

Typical Real Estate Development Team Organizational Chart

The following describes a typical organizational structure, although variations exist depending on project size and complexity.

| Position | Responsibilities | Reports To |

|---|---|---|

| Project Manager | Overall project oversight, coordination, and budget management | Development Director |

| Development Director | Strategic direction and overall project success | CEO/Owner |

| Architect | Building design and aesthetics | Project Manager |

| Structural Engineer | Structural integrity and compliance | Project Manager |

| General Contractor | Construction management and oversight | Project Manager |

| Legal Counsel | Legal compliance and risk management | Development Director |

| Marketing & Sales Manager | Sales and marketing strategies | Development Director |

Conclusion

In conclusion, the role of a real estate developer extends far beyond the construction site. It requires a strategic mind, a keen eye for detail, and the ability to manage diverse teams and navigate complex regulatory landscapes. From the initial vision to the final sale, every stage demands careful planning, financial acumen, and a commitment to delivering high-quality projects that meet market needs and enhance the surrounding community.

The rewards are substantial, but success hinges on a comprehensive understanding of the entire development lifecycle and a dedication to excellence at every step.