What is payment resolution service on my bank statement? Understanding this often-mysterious bank statement entry is crucial for maintaining accurate financial records and ensuring your transactions are correctly processed. This guide will demystify payment resolution services, explaining their purpose, the various types offered by banks, and how they impact your account balance. We’ll explore common scenarios leading to these entries, the steps involved in resolving any issues, and preventative measures you can take to avoid them altogether.

This comprehensive overview aims to empower you with the knowledge to navigate your banking statements with confidence.

Payment resolution services are essentially your bank’s way of addressing discrepancies or irregularities in transactions. These services can involve rectifying errors, handling disputes, or processing returns. Understanding the different types of payment resolution and how they appear on your statement is key to reconciling your accounts accurately. We will cover various transaction types, common terminology, and the overall process of resolving payment issues, helping you to understand your bank statement more effectively.

Understanding Payment Resolution Services

Payment resolution services are a crucial aspect of banking, ensuring the accurate and timely processing of transactions. These services address discrepancies or issues that may arise during the payment process, ultimately protecting both the bank and its customers. Understanding these services can help you better manage your finances and resolve any payment-related problems efficiently.Payment resolution services encompass a range of activities undertaken by banks to rectify payment-related problems.

These services aim to reconcile discrepancies between accounts, correct errors, and ensure the smooth flow of funds. The specific services offered can vary between banks, but they generally share the common goal of resolving payment issues effectively and fairly.

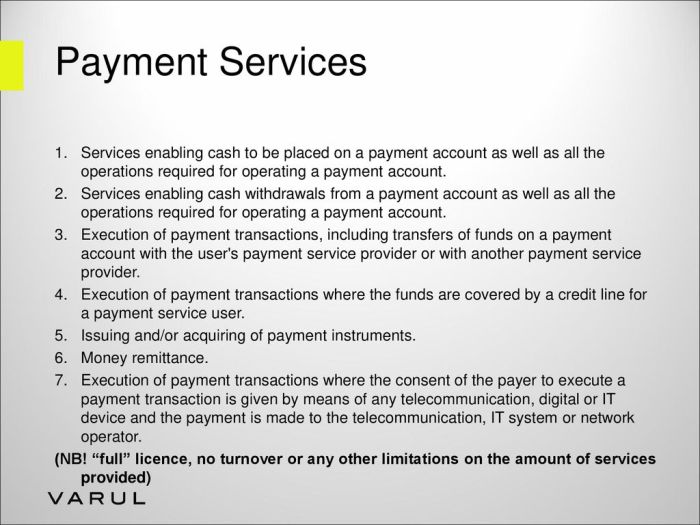

Types of Payment Resolution Services

Banks offer a variety of payment resolution services to address diverse situations. These services may include investigating disputed transactions, correcting incorrect payments, reversing fraudulent charges, and managing returned payments. The specific services available will depend on the nature of the transaction and the bank’s internal policies.

Examples of Transactions Leading to Payment Resolution Entries

Several transaction types can trigger a payment resolution entry on your bank statement. These often involve situations where there’s a discrepancy between the intended payment and the actual outcome. For instance, a payment might be declined, returned, or require further investigation due to insufficient funds, incorrect account details, or other issues.

Examples of Payment Resolution Scenarios

The following table illustrates various transaction types that might lead to a payment resolution entry, along with the typical reasons, resolution methods, and examples.

| Transaction Type | Reason for Resolution | Typical Resolution Method | Example |

|---|---|---|---|

| ACH Debit | Insufficient Funds | Return of Payment | A recurring bill payment is returned because the account lacked sufficient funds to cover the transaction. |

| Credit Card Payment | Merchant Dispute | Investigation and potential refund | A customer disputes a credit card charge with the merchant, leading to a bank investigation and possible credit to the customer’s account. |

| Wire Transfer | Incorrect Account Number | Reclamation of funds and re-transmission | A wire transfer is sent to the wrong account number. The bank works to reclaim the funds and re-transmit the payment to the correct recipient. |

| Check Payment | Stop Payment Request | Cancellation of the check | A customer requests a stop payment on a check before it clears, preventing the payment from being processed. |

Identifying Payment Resolution Entries on Bank Statements

Understanding how payment resolution entries appear on your bank statement is crucial for accurate record-keeping and reconciliation. These entries reflect adjustments or corrections made to your account related to transactions that have been disputed, reversed, or otherwise require clarification. Familiarizing yourself with the common terminology and formats will help you easily identify and understand these entries.Payment resolution entries often involve specific terminology to indicate the nature of the adjustment.

Banks may use different terms, but they generally convey the same information. For instance, a “chargeback” indicates a reversal of a payment due to a customer dispute. A “refund” denotes a return of funds to the customer’s account. Terms like “adjustment,” “correction,” or “reversal” are also frequently employed to describe various payment resolution activities. The specific description accompanying the entry will provide further detail on the reason for the adjustment.

Common Terminology Used in Payment Resolution Entries

Understanding the language used on your bank statement is key to interpreting payment resolution entries. While terminology varies slightly between banks, certain terms consistently appear. “Debit Adjustment” usually indicates money leaving your account due to a correction. Conversely, “Credit Adjustment” signifies money added to your account, often as a correction or refund. The terms “Chargeback,” “Return,” and “Refund” all signify a reversal of a previous transaction, often due to a dispute or error.

Finally, descriptions such as “Payment reversal due to insufficient funds” or “Merchant refund processed” provide more context to the specific transaction involved.

Examples of Payment Resolution Entries on Different Bank Statement Formats

Payment resolution entries appear differently depending on the bank and its statement format. Some banks might use a separate line item with a detailed explanation. Others might include the adjustment within the main transaction record, indicating the original amount and the adjustment. For example, a bank using a simple, tabular format might show a “debit” for an original purchase followed by a separate line item showing a “credit adjustment” for the same amount, marked with a note like “chargeback.” In contrast, a more detailed online statement might present the original transaction and the adjustment within a single line, with a clear notation explaining the reason for the adjustment.

A more visually oriented statement might use color-coding to distinguish between the original transaction and the resolution.

Sample Bank Statement Excerpt Showing Payment Resolution Entries

The following is a hypothetical excerpt illustrating different payment resolution entries:

| Date | Description | Debit | Credit | Balance |

|---|---|---|---|---|

| 2024-10-26 | Grocery Store Purchase | $50.00 | $500.00 | |

| 2024-10-27 | Credit Adjustment – Chargeback | $50.00 | $550.00 | |

| 2024-10-28 | Online Payment | $200.00 | $350.00 | |

| 2024-10-29 | Refund – Item Return | $50.00 | $400.00 | |

| 2024-10-30 | Debit Adjustment – Overdraft Fee | $35.00 | $365.00 |

Common Abbreviations or Codes Used in Payment Resolution Entries

Banks often use abbreviations and codes to concisely represent payment resolution entries. Understanding these codes is essential for quick interpretation. While specific codes vary by bank, common examples include:

- CB: Chargeback

- ADJ: Adjustment

- REF: Refund

- RTN: Return

- ODF: Overdraft Fee

It is important to consult your bank’s statement legend or contact customer service if you encounter unfamiliar abbreviations or codes.

Reasons for Payment Resolution

Payment resolution entries on your bank statement indicate that a transaction has undergone some form of adjustment or correction. These adjustments are necessary because of discrepancies between the initial transaction and the final settled amount. Understanding the reasons behind these resolutions is crucial for accurate record-keeping and reconciliation of your account.Several factors can trigger the need for payment resolution, impacting your account balance in various ways.

These scenarios often involve interactions between you, the merchant, and potentially a third-party payment processor. The resolution process aims to correct any inaccuracies and ensure the final balance reflects the actual financial transactions.

Returned Checks

Returned checks represent a common reason for payment resolution. This occurs when a check you’ve written is rejected by the recipient’s bank, typically due to insufficient funds in your account, incorrect account information, or a stopped payment order. The effect on your account balance is a reduction of the originally debited amount, as the payment is ultimately reversed. For example, if you wrote a check for $500 that was returned, your account would be credited $500, negating the initial debit, and you would likely incur a returned check fee.

Disputes

Payment disputes arise when there’s a disagreement between you and a merchant regarding a transaction. This could be due to a faulty product, an incorrect charge, or a service not rendered as agreed. Resolving a dispute might involve contacting your bank and the merchant to provide evidence supporting your claim. Depending on the outcome, the dispute resolution may result in a credit to your account if the charge is deemed invalid, or the transaction might remain unchanged if the dispute is resolved in the merchant’s favor.

The impact on your account balance is dependent on the resolution of the dispute.

Reversals, What is payment resolution service on my bank statement

Payment reversals occur when a transaction is cancelled or undone. This can happen for various reasons, including unauthorized charges, duplicate payments, or errors made during the processing of a transaction. For instance, if a fraudulent charge is reversed, your account balance will be increased by the amount of the fraudulent charge. Similarly, if a duplicate payment is reversed, your account will be credited the duplicated amount.

Reversals directly impact your account balance, either increasing or decreasing it, depending on the nature of the original transaction.

Discrepancies Leading to Payment Resolution

Several potential causes can lead to discrepancies necessitating payment resolution. These include data entry errors by the merchant or your bank, incorrect account numbers, timing issues in transaction processing, and system glitches. These errors can lead to mismatched records, prompting investigations and resulting in payment adjustments. For example, a wrongly entered amount by a merchant could lead to a payment resolution to correct the discrepancy.

The identification and correction of these discrepancies are crucial for maintaining accurate account balances.

The Role of Merchants and Third-Party Processors

Merchants and third-party payment processors play a significant role in payment resolution processes. Merchants are responsible for verifying transactions and investigating disputes. Third-party processors handle the technical aspects of payment processing and often act as intermediaries between you, the merchant, and your bank. Their involvement is crucial in tracking down the source of the error and implementing the necessary corrections.

Their cooperation is essential for a smooth and efficient resolution process. For example, if a card payment is disputed, the merchant will likely involve the payment processor to gather evidence and determine the validity of the claim.

The Resolution Process

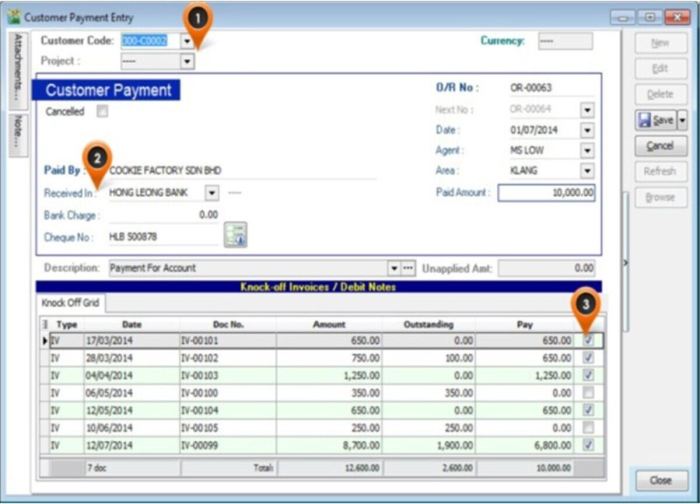

Resolving a payment issue involves several steps, from identifying the discrepancy to reaching a final resolution with your bank. Understanding this process can significantly expedite the resolution and minimize any inconvenience. The steps are generally straightforward, but careful documentation and clear communication are crucial.The process typically begins with identifying the payment discrepancy on your bank statement. This might involve comparing your records with the bank statement, noting any missing payments, incorrect amounts, or duplicate entries.

Once the issue is identified, you’ll need to gather supporting documentation to support your claim. This will help the bank verify your account details and the nature of the problem. Finally, contacting the bank to report the issue and follow up on its resolution is vital to a successful outcome.

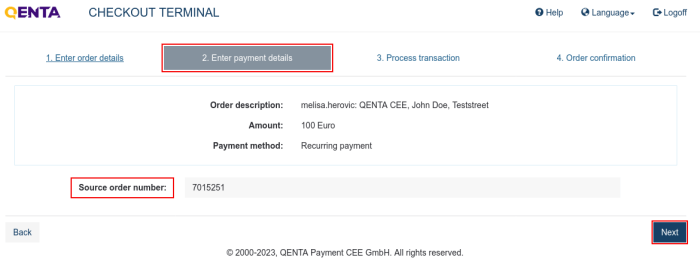

Steps Involved in Resolving a Payment Issue

The resolution process involves a series of steps to ensure a fair and efficient outcome. First, you must clearly identify the payment issue, including the date, amount, and description of the transaction. Then, gather supporting documentation to substantiate your claim. Next, contact your bank using their preferred method of communication (phone, email, or online portal) to report the issue and provide the necessary documentation.

The bank will then investigate the discrepancy, and finally, they will communicate the resolution to you. This may involve a correction to your account balance, a refund, or other appropriate action.

Necessary Documentation for Payment Resolution Requests

Providing comprehensive documentation is vital to support your payment resolution request. The specific documents required may vary depending on the nature of the issue. However, common supporting documents include canceled checks, receipts, invoices, online payment confirmations, and transaction records from your personal accounting software. For example, if you’re disputing a charge, a copy of the merchant’s invoice clearly showing the incorrect amount or description will be essential.

Similarly, if a payment is missing, a copy of the check or online payment confirmation will be crucial evidence. In the case of duplicate charges, providing both transaction records will aid the bank’s investigation.

Contacting the Bank to Inquire About a Payment Resolution Entry

Contacting your bank should be done using their official channels to ensure secure and documented communication. Before contacting them, gather all relevant information, including your account number, the date of the transaction, the amount involved, and a clear description of the issue. When you contact the bank, be polite and professional, clearly explaining the problem and providing the supporting documentation you have collected.

Keep a record of your communication with the bank, including dates, times, and the names of the individuals you spoke with. This record will be helpful should further action be required.

Flowchart Illustrating the Typical Payment Resolution Process

Imagine a flowchart with the following steps:

1. Identify the Payment Issue

A box representing the identification of discrepancies between personal records and bank statements.

2. Gather Supporting Documentation

A box indicating the collection of relevant documents like receipts, canceled checks, etc.

3. Contact the Bank

A box showing the process of contacting the bank via phone, email, or online portal.

4. Bank Investigation

A box illustrating the bank’s investigation into the reported issue.

5. Resolution Communication

A box indicating the bank’s communication of the resolution to the customer. This might include a corrected statement or a refund.The boxes are connected with arrows indicating the flow from one step to the next. The flowchart visually represents the sequential nature of the payment resolution process, making it easy to understand and follow.

Impact on Account Balances

Payment resolution entries directly affect your account balance, sometimes in ways that aren’t immediately obvious. Understanding how these entries impact your available funds and credit is crucial for maintaining accurate financial records and avoiding potential issues. These entries can lead to increases, decreases, or adjustments to your overall balance, depending on the nature of the resolution.Payment resolution entries can increase, decrease, or adjust your account balance.

For instance, a successful reversal of a fraudulent charge will increase your available balance, while a confirmed payment for a disputed transaction will decrease your available balance. Corrections to billing errors might result in adjustments, either increasing or decreasing the balance depending on the error. It’s essential to review your statement carefully to understand the impact of each entry.

Impact on Available Funds and Credit Limits

A payment resolution can significantly impact your available funds. For example, if a large disputed charge is ultimately deemed valid and processed, it will reduce your available balance accordingly. Conversely, if a charge is successfully reversed, this will increase your available funds. Similarly, payment resolutions involving credit card transactions can affect your available credit limit. A wrongly applied payment that’s reversed will increase your available credit, while a payment successfully processed will decrease it.

Consider a scenario where a customer disputes a $500 charge; if the dispute is resolved in their favor, their available balance increases by $500. Conversely, if the dispute is resolved against them, their available balance decreases by $500.

Implications of Unresolved Payment Issues

Unresolved payment issues can have serious consequences. Prolonged disputes can negatively impact your credit score, making it harder to obtain loans or credit in the future. Late payments, even if eventually resolved, often remain on your credit report for several years, affecting your creditworthiness. Furthermore, unresolved issues might lead to account restrictions, preventing you from making further transactions or accessing certain banking services.

For example, a consistently unresolved dispute could lead to a temporary freeze on your account or even account closure.

Potential Fees and Penalties

Depending on the nature of the payment resolution and the underlying issue, you might incur fees or penalties. For example, if a payment is returned due to insufficient funds, you’ll likely be charged a returned item fee. Similarly, fees may apply if you repeatedly dispute legitimate charges or if there are administrative costs associated with resolving a complex payment issue.

In some cases, interest charges might accrue on outstanding balances during the resolution process, adding to the overall cost. A common example is a late payment fee incurred if a payment is ultimately determined to be your responsibility.

Preventing Payment Resolution Issues

Proactive measures significantly reduce the chances of encountering payment resolution issues, saving you time, stress, and potential financial complications. By implementing best practices and developing sound financial habits, you can maintain a smooth and accurate payment process. This section details strategies to minimize the likelihood of encountering such issues.Implementing these strategies will contribute to a more efficient and reliable payment system, minimizing disruptions and ensuring your financial transactions are processed smoothly.

Best Practices for Minimizing Payment Resolution Issues

Adopting specific practices can greatly reduce the probability of payment discrepancies. These practices involve careful planning, accurate record-keeping, and regular monitoring of financial accounts. Paying close attention to detail at every stage of the payment process is crucial.

- Verify Payment Details: Before submitting any payment, meticulously double-check all details, including the recipient’s name, account number, and amount. A simple error can trigger a payment resolution.

- Use Secure Payment Methods: Opt for secure online payment platforms or trusted banking apps to minimize the risk of fraud or errors. Avoid using untrusted websites or applications for financial transactions.

- Maintain Accurate Records: Keep detailed records of all payments made, including dates, amounts, transaction IDs, and supporting documentation. This facilitates reconciliation and simplifies the resolution of any discrepancies.

- Communicate Clearly with Payees: If you anticipate any issues with a payment, communicate proactively with the recipient to avoid misunderstandings and potential delays. Open communication can prevent many payment problems.

Ensuring Accurate and Timely Payments

Timely and accurate payments are essential for maintaining positive relationships with vendors, creditors, and other parties. Delays or inaccuracies can lead to late fees, damaged credit scores, and strained relationships.

- Schedule Payments in Advance: Set up automatic payments or reminders for recurring bills to ensure timely payments and avoid late fees. This eliminates the risk of forgetting due dates.

- Allow Sufficient Processing Time: Account for potential processing delays, especially for international or wire transfers. Submit payments well in advance of deadlines to prevent late payments.

- Use Electronic Payments When Possible: Electronic payments offer greater accuracy and speed compared to paper checks or cash. They also provide digital records for easy tracking.

- Review Payment Confirmations: Always review payment confirmations carefully to ensure accuracy and identify any potential discrepancies. This is a crucial step in preventing payment resolution issues.

The Importance of Regular Bank Statement Reconciliation

Regularly reconciling your bank statements is a crucial step in preventing and detecting payment resolution issues early. It involves comparing your bank statement with your own financial records to identify any discrepancies.Reconciliation helps identify errors, fraud, or missing transactions promptly, allowing for timely resolution before they escalate into significant problems. It’s a proactive measure that provides a comprehensive overview of your financial activity.

Failure to reconcile regularly increases the likelihood of overlooking errors and facing more complex resolution processes later.

Checklist for Payment Resolution Entries

When a payment resolution entry appears on your bank statement, a structured approach is crucial for efficient resolution. This checklist Artikels the necessary steps to take.

- Review the Entry Details: Carefully examine the entry, noting the date, amount, description, and any reference numbers. Understanding the specifics is the first step towards resolution.

- Compare with Your Records: Cross-reference the entry with your own financial records, such as receipts, invoices, and payment confirmations. Identify any discrepancies between your records and the bank statement.

- Contact the Relevant Parties: Contact the payee or your bank to inquire about the discrepancy. Provide them with all relevant documentation to support your claim.

- Document All Communication: Maintain detailed records of all communication with the payee and your bank. This documentation is essential if further action is required.

- Follow Up: If the issue is not resolved promptly, follow up with the relevant parties to ensure the matter is addressed efficiently.

Final Conclusion: What Is Payment Resolution Service On My Bank Statement

In conclusion, understanding payment resolution services is vital for maintaining accurate financial records and preventing potential problems. By familiarizing yourself with the common reasons for payment resolutions, the resolution process, and preventative measures, you can proactively manage your finances and avoid any negative impacts on your account balance or credit score. Regularly reconciling your bank statements and promptly addressing any discrepancies are key to maintaining financial health.

Remember, proactive financial management is the best way to ensure smooth and accurate transactions.