What is IRR in real estate? Understanding Internal Rate of Return (IRR) is crucial for anyone involved in real estate investment. IRR represents the discount rate at which the net present value (NPV) of all cash flows from a project equals zero. In simpler terms, it’s the annualized percentage rate of return that an investment is expected to generate.

This metric provides a powerful tool for comparing the profitability of different real estate ventures, helping investors make informed decisions about where to allocate their capital. This guide will explore the intricacies of IRR in real estate, providing a clear understanding of its calculation, application, and limitations.

We will delve into practical examples, demonstrating how to calculate IRR manually and using it within larger financial models. Furthermore, we will examine how factors such as financing options, property values, rental income, and tax implications can significantly influence the calculated IRR. By comparing IRR to other key metrics and exploring its application across diverse real estate asset classes, this comprehensive guide will equip you with the knowledge to confidently utilize IRR in your real estate investment strategies.

Defining IRR in Real Estate

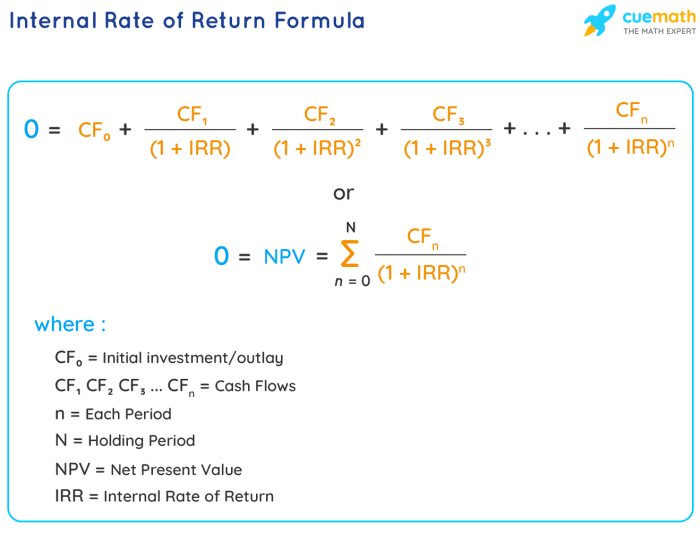

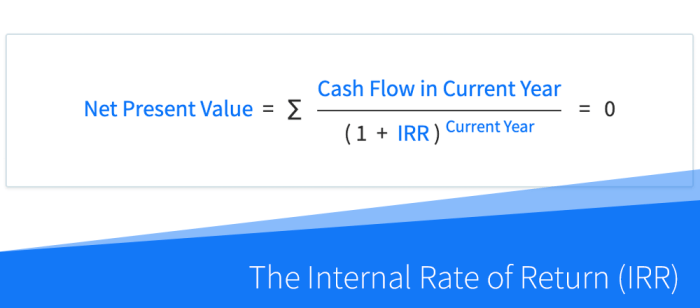

Internal Rate of Return (IRR) is a crucial metric in real estate investment analysis. It represents the discount rate that makes the net present value (NPV) of all cash flows from a project equal to zero. In simpler terms, it’s the average annual rate of return an investment is expected to generate. A higher IRR indicates a more profitable investment.

Understanding IRR allows investors to compare the profitability of different real estate ventures and make informed decisions. It considers the time value of money, meaning that a dollar received today is worth more than a dollar received in the future due to its potential earning capacity. This is a key advantage over simpler metrics that don’t account for this crucial factor.

IRR Calculation in a Real Estate Investment Scenario

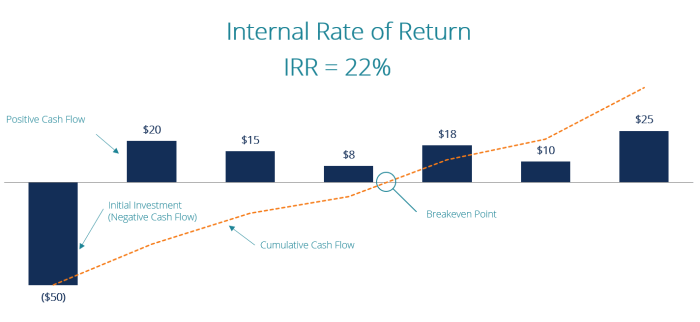

Let’s imagine an investor purchasing a rental property for $200,000. They anticipate annual rental income of $24,000, annual expenses of $6,000, and a sale price of $250,000 after five years. The IRR calculation would consider these cash flows over the five-year period to determine the average annual return. A higher IRR would suggest a more attractive investment compared to other opportunities.

Manual IRR Calculation for a Small Real Estate Project

Calculating IRR manually can be iterative and requires some trial and error. However, for a small project, it’s manageable. Here’s a step-by-step approach:

- Estimate Cash Flows: Project all cash inflows (rental income, sale proceeds) and outflows (purchase price, expenses, taxes) for the investment’s lifespan.

- Choose an Initial Discount Rate: Start with a reasonable guess, perhaps the current interest rate on similar investments.

- Calculate the Present Value (PV) of each Cash Flow: Use the formula: PV = FV / (1 + r)^n, where FV is the future value, r is the discount rate, and n is the number of periods.

- Sum the PVs: Add up the present values of all cash inflows and subtract the present values of all cash outflows. This gives you the Net Present Value (NPV).

- Iterate: If the NPV is positive, increase the discount rate; if it’s negative, decrease the discount rate. Repeat steps 3 and 4 until the NPV is close to zero. The discount rate that results in an NPV of approximately zero is the IRR.

Note: This process is often done using financial calculators or software as it can be time-consuming to perform manually, especially with complex projects.

Comparison of IRR with Other Real Estate Investment Metrics

| Metric | Description | Calculation | Example |

| IRR | The discount rate making the NPV of cash flows zero. | Iterative process; requires financial calculator or software. | 12% (from the rental property example) |

| ROI (Return on Investment) | The percentage gain or loss on an investment relative to its cost. | (Gain from Investment – Cost of Investment) / Cost of Investment | [(250,000 + (24,000*5)

|

| NPV (Net Present Value) | The difference between the present value of cash inflows and the present value of cash outflows. | Sum of PVs of all cash flows, discounted at a specific rate. | Positive NPV indicates a profitable investment. |

IRR and Investment Decisions

Investors utilize the Internal Rate of Return (IRR) to assess the profitability of real estate ventures by comparing the projected cash inflows from a project against its initial investment and subsequent costs. A higher IRR indicates a more attractive investment, signifying a faster return on the initial capital outlay. Essentially, it represents the discount rate that makes the Net Present Value (NPV) of the project equal to zero.

This allows for a direct comparison of the potential returns of different real estate projects, regardless of their size or duration.Investors use IRR to evaluate the profitability of real estate projects by calculating the discount rate that equates the present value of future cash flows to the initial investment. A higher IRR suggests a more profitable project, offering a quicker return on investment.

This metric facilitates comparison between projects with varying sizes and investment horizons, providing a standardized measure of profitability.

Limitations of IRR as a Sole Investment Criterion

While IRR is a valuable tool, relying solely on it for investment decisions can be misleading. IRR does not consider the scale of the investment; a project with a higher IRR but a smaller overall profit might be less desirable than a project with a lower IRR but significantly larger profits. Furthermore, IRR assumes that cash flows are reinvested at the same rate as the project’s IRR, an assumption that may not always hold true in the volatile real estate market.

Finally, multiple IRRs can exist for projects with unconventional cash flow patterns, leading to ambiguity in the interpretation. A comprehensive investment analysis should incorporate other metrics and qualitative factors alongside IRR.

Comparison of IRR with Other Investment Appraisal Techniques

Several other techniques complement IRR in evaluating real estate investments. Net Present Value (NPV) considers the time value of money and directly measures the project’s profitability in present-day dollars. A positive NPV suggests a profitable investment. Payback Period measures the time required to recoup the initial investment. While simpler to calculate than IRR, it doesn’t account for the time value of money or cash flows beyond the payback period.

Profitability Index (PI) measures the ratio of the present value of future cash flows to the initial investment. A PI greater than 1 indicates a profitable project. Each technique offers unique insights, and a combined analysis usually provides a more robust assessment. For example, a project might have a high IRR but a low NPV if the initial investment is extremely large.

Conversely, a project with a high NPV might have a relatively lower IRR due to a longer investment period.

Situations Where IRR Might Be Misleading

IRR can be misleading in situations with unconventional cash flows, such as those with multiple sign changes (alternating positive and negative cash flows). This can result in multiple IRRs, making it difficult to determine the true profitability. Furthermore, IRR doesn’t account for the scale of the investment. A small project with a high IRR might be less profitable than a larger project with a lower IRR.

In situations with significant reinvestment risk, the assumption of reinvestment at the IRR rate may be unrealistic, leading to an overestimation of the project’s true return. For instance, a project with a high IRR early on might underperform later due to unforeseen market changes, rendering the initial IRR projection inaccurate. Finally, IRR does not inherently incorporate risk; a high IRR might mask significant underlying risks associated with the project.

Factors Affecting IRR in Real Estate

Calculating the Internal Rate of Return (IRR) for a real estate investment is crucial for determining its profitability. However, numerous factors influence the final IRR figure, making a thorough understanding of these elements essential for informed decision-making. This section explores the key factors that can significantly impact the IRR of a real estate project.

Financing Options and Their Impact on IRR

The method of financing a real estate investment significantly affects its IRR. Different financing options, such as mortgages and loans, carry varying interest rates and repayment schedules, directly influencing the cash flows used in the IRR calculation. For example, a lower interest rate on a mortgage will result in lower debt service payments, increasing the net cash flow and consequently boosting the IRR.

Conversely, a higher interest rate will reduce the net cash flow and lower the IRR. The length of the loan also plays a role; a shorter-term loan might lead to higher initial payments, potentially reducing the IRR in the early years, but a faster payoff can improve the long-term IRR. Similarly, the use of leverage (borrowing money to invest) can magnify both profits and losses, leading to a higher or lower IRR compared to an all-cash purchase, depending on market conditions and the investment’s performance.

Property Value and Rental Income Fluctuations

Changes in property values and rental income directly affect the cash flows and ultimately the IRR of a real estate investment. Appreciation in property value increases the overall return, particularly at the time of sale, thus enhancing the IRR. Conversely, depreciation reduces the overall return. Similarly, increases in rental income boost the cash flows, thereby increasing the IRR.

Conversely, decreases in rental income due to factors like market saturation or economic downturns will lower the IRR. For instance, a property purchased for $500,000 and sold five years later for $750,000 will have a significantly higher IRR than one sold for $400,000, all other factors being equal. Similarly, consistent rental income increases year over year contribute to a higher IRR compared to a scenario with stagnant or decreasing rental income.

Tax Implications on Real Estate IRR

Tax implications play a substantial role in determining the true profitability of a real estate investment. Tax deductions for mortgage interest, property taxes, and depreciation can significantly reduce the taxable income, effectively increasing the after-tax cash flow and consequently the IRR. Conversely, capital gains taxes payable upon the sale of the property reduce the net proceeds, impacting the overall IRR.

The specific tax laws and regulations in the relevant jurisdiction significantly influence these effects. For example, accelerated depreciation methods can significantly boost the IRR in the earlier years of an investment by lowering the taxable income. However, this benefit is often offset by higher tax liabilities later on, during the sale of the asset.

Factors Increasing or Decreasing Real Estate IRR

The IRR of a real estate project is influenced by a multitude of factors. Understanding these factors is crucial for effective investment strategy.

- Factors that increase IRR: High occupancy rates, strong rental growth, low interest rates on financing, tax benefits (depreciation, deductions), strategic property location, efficient property management, property appreciation, value-add renovations.

- Factors that decrease IRR: High vacancy rates, stagnant or declining rental income, high interest rates on financing, unexpected repair costs, property devaluation, increased property taxes, unfavorable market conditions, prolonged vacancy periods.

IRR and Different Real Estate Asset Classes: What Is Irr In Real Estate

Internal Rate of Return (IRR) varies significantly across different real estate asset classes due to factors like risk profiles, capital requirements, and market dynamics. Understanding these variations is crucial for informed investment decisions. This section will explore the typical IRR ranges for various asset classes, providing examples and highlighting challenges in accurate IRR calculation.

Typical IRR Ranges for Different Real Estate Asset Classes

The IRR achievable in real estate is highly dependent on the specific asset class. Generally, higher-risk asset classes tend to offer the potential for higher IRRs, but also carry a greater chance of lower or even negative returns. Conversely, lower-risk asset classes typically offer more modest IRR potential but with greater stability.Residential properties, particularly those in strong rental markets, often exhibit IRRs ranging from 8% to 15%, depending on factors like location, property condition, and management efficiency.

Commercial real estate, encompassing office buildings, retail spaces, and shopping centers, can yield IRRs between 10% and 20%, although this is heavily influenced by lease terms, occupancy rates, and market demand. Industrial properties, such as warehouses and distribution centers, might offer IRRs in the range of 12% to 25%, driven by factors such as lease length, tenant creditworthiness, and location near transportation hubs.

Land development projects, due to their inherent risk and long-term nature, can potentially offer very high IRRs (20% or more) if successful, but also carry a substantial risk of substantial losses.

Examples of Real Estate Projects with High and Low IRR Values, What is irr in real estate

A high-IRR example could be a newly constructed luxury apartment building in a rapidly growing urban area with strong rental demand and low vacancy rates. The high rents, combined with efficient construction and management, could easily push the IRR above 15%. Conversely, a low-IRR example might be a distressed property in a declining neighborhood requiring significant renovations and facing high vacancy rates.

The costs of rehabilitation and ongoing maintenance, coupled with low rental income, could result in an IRR below 8%, or even a negative IRR. Another example of a low IRR scenario might be a retail property in a mall experiencing declining foot traffic and high competition. High vacancy rates and reduced rental income could significantly depress the IRR.

Challenges in Accurately Calculating IRR for Different Real Estate Investments

Accurately calculating IRR for diverse real estate investments presents unique challenges. For example, REITs (Real Estate Investment Trusts) present complexities due to their structure as publicly traded entities, requiring consideration of dividend payouts, share price fluctuations, and management fees. Land development projects often involve uncertain timelines and fluctuating land values, making accurate cash flow projections difficult. Estimating future rental income and operating expenses for various asset classes also requires careful market analysis and consideration of potential economic shifts.

Furthermore, the inherent illiquidity of real estate can make it difficult to precisely determine the terminal value of the investment, which significantly impacts IRR calculations.

Typical IRR Distribution Across Different Real Estate Asset Classes

Imagine a bar chart. The horizontal axis represents different real estate asset classes: Residential, Commercial, Industrial, and Land Development. The vertical axis represents the IRR percentage. The bars representing Residential and Commercial would be relatively close in height, with Residential slightly shorter, reflecting their moderate IRR ranges. The Industrial bar would be taller, indicating a higher potential IRR.

The Land Development bar would be the tallest, reflecting the highest potential IRR but also acknowledging the significantly higher risk involved. The bars are not uniformly distributed but show some overlap, demonstrating that actual IRR can vary significantly even within a single asset class. It is crucial to remember that this is a general representation, and actual IRR values will vary widely based on many factors specific to each investment.

Using IRR in Real Estate Modeling

Internal Rate of Return (IRR) is a crucial metric integrated into various financial models used for evaluating real estate investment opportunities. These models project future cash flows associated with a property, allowing investors to compare the profitability of different investment scenarios and make informed decisions. The accuracy and usefulness of the IRR calculation are directly tied to the quality and comprehensiveness of the underlying financial model.IRR is calculated by finding the discount rate that makes the Net Present Value (NPV) of all cash flows from a project equal to zero.

This involves a complex iterative process, often best handled by specialized software or spreadsheet functions. The higher the IRR, the more attractive the investment is considered to be, as it represents a higher return relative to the initial investment and the time value of money. Sophisticated models incorporate various factors, including purchase price, projected rental income, operating expenses, capital expenditures, and the eventual sale price.

IRR Sensitivity Analysis

Sensitivity analysis is a critical step in using IRR for real estate investment analysis. It involves systematically changing one or more input variables in the model (such as rental growth rates, vacancy rates, or operating expenses) to observe the resulting changes in the calculated IRR. This helps investors understand the potential impact of uncertainty and risk on their investment. For example, an investor might assess the impact of a 10% increase or decrease in rental income on the overall IRR.

By systematically varying key inputs and observing the resulting change in IRR, the investor can better understand the range of possible outcomes and assess the robustness of the investment. A significant change in IRR due to a small variation in an input variable indicates a high degree of sensitivity and potentially higher risk.

Best Practices for Interpreting IRR Results

While IRR is a valuable tool, it’s crucial to interpret its results within a broader financial modeling context. Simply comparing the IRR of different investments isn’t always sufficient. Other metrics, such as Net Present Value (NPV), payback period, and the overall risk profile of the investment, should be considered alongside the IRR. The investor should also analyze the assumptions underpinning the financial model and ensure they are realistic and well-justified.

Furthermore, comparing IRRs across investments with different time horizons or risk profiles requires careful consideration. A higher IRR investment with a longer time horizon might not be superior to a lower IRR investment with a shorter time horizon and less risk.

Hypothetical Real Estate Investment Scenario and IRR Application

Consider a hypothetical apartment building purchase for $1,000,000. The projected annual net operating income (NOI) is $100,000 for the next five years, after which the building is sold for $1,200,000. Using a spreadsheet program or financial calculator, we can input these cash flows (including the initial investment as a negative cash flow and the sale proceeds as a positive cash flow at the end of year 5) to calculate the IRR.

Let’s assume the calculated IRR is 12%. This suggests that the investment is expected to yield a 12% annual return, taking into account the time value of money. If a similar investment opportunity presents itself with a projected IRR of 15%, and other factors are comparable, the 15% IRR investment would be considered more attractive. However, a thorough sensitivity analysis should be conducted to assess the impact of potential variations in rental income, vacancy rates, and operating expenses on the IRR before making a final investment decision.

This helps to quantify the risks associated with the investment and to understand the range of possible returns.

Last Point

In conclusion, understanding Internal Rate of Return (IRR) is paramount for successful real estate investment. While IRR offers a valuable tool for evaluating profitability and comparing projects, it’s essential to remember its limitations and use it in conjunction with other investment appraisal techniques. By considering factors like financing, market conditions, and tax implications, and by performing sensitivity analyses, investors can leverage IRR to make well-informed decisions that maximize returns and minimize risk.

Mastering IRR allows for a more nuanced and strategic approach to real estate investment, ultimately leading to greater success in this dynamic market.