How to value an insurance book of business is a crucial skill for actuaries, underwriters, and anyone involved in mergers and acquisitions within the insurance industry. Accurately assessing the worth of a book of business requires a deep understanding of various factors, from analyzing historical claims data and projecting future revenue to considering market dynamics and competitive landscapes. This process involves a multifaceted approach, combining financial modeling with a thorough understanding of the insurance industry’s unique characteristics and risks.

This guide will walk you through a comprehensive process, outlining key steps and methods to effectively determine the value of an insurance portfolio. We’ll explore different valuation approaches, delve into the intricacies of risk assessment and loss reserving, and provide practical examples to illustrate the concepts. By the end, you’ll have a solid understanding of the tools and techniques needed to confidently assess the financial worth of an insurance book of business.

Defining the Book of Business

Understanding the composition of an insurance book of business is paramount for accurate valuation. A comprehensive assessment requires a detailed examination of its various components, going beyond simple premium figures to encompass a holistic view of its inherent risks and potential future profitability. This involves analyzing not only the current state but also projecting future performance based on historical trends and market conditions.A book of business represents the aggregate of all insurance policies underwritten by an insurer or a specific agency.

It’s a dynamic entity, constantly evolving with new policies written, existing policies renewed, and claims settled. Therefore, a snapshot in time only provides a partial picture; a longitudinal perspective, incorporating historical data, is essential for a robust valuation.

Components of an Insurance Book of Business

The components of an insurance book of business are multifaceted and interconnected. Accurate valuation depends on a thorough understanding of these elements and their interactions. These components provide the foundation for constructing a reliable valuation model.

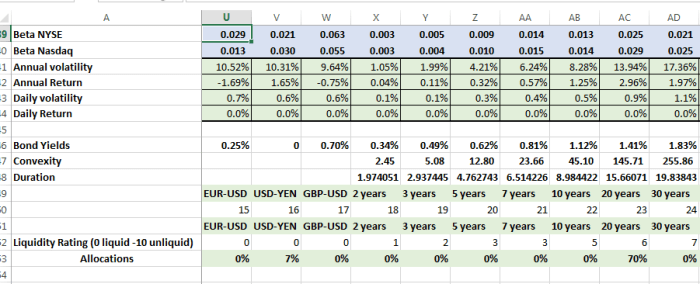

- Policy Types: This includes the breakdown of policies by type (e.g., auto, home, commercial, life, health). Each policy type carries different risk profiles, requiring distinct valuation methodologies. For instance, a book heavily weighted towards high-risk commercial lines necessitates a more cautious approach compared to one dominated by low-risk personal auto policies. The proportion of each policy type significantly influences the overall risk assessment.

- Customer Demographics: Detailed customer information, including age, location, occupation, and claims history, significantly impacts valuation. For example, a book with a high concentration of older drivers in an area prone to accidents will likely have a higher claims frequency than a book with predominantly younger drivers in a safer region. This demographic analysis allows for a more refined risk stratification.

- Historical Claims Data: This is arguably the most crucial component. Claims data provides insights into the frequency and severity of past claims, allowing for the estimation of future loss ratios. This includes information on the number of claims, the average cost per claim, and the distribution of claim sizes. The accuracy of this data is critical to the entire valuation process.

A comprehensive analysis may also involve examining loss development patterns over time to better predict future claim costs.

Data Points for Accurate Valuation

Numerous data points are needed to accurately value an insurance book of business. The quality and completeness of this data directly influence the reliability of the valuation. A lack of data or inaccurate data can lead to significant errors in the valuation.

- Premium Income: The total premium income generated by the book over a specific period, broken down by policy type and customer segment.

- Loss Ratio: The ratio of incurred losses to earned premiums, indicating the profitability of the book. A high loss ratio suggests higher risk and lower profitability.

- Expense Ratio: The ratio of underwriting expenses to earned premiums, representing the operational efficiency of the insurer.

- Retention Rate: The percentage of policies renewed at the end of their term, reflecting customer loyalty and the book’s stability.

- Lapse Rate: The percentage of policies that are cancelled before their term ends, indicating potential problems with the book’s composition or underwriting practices.

- Average Policy Size: The average premium value of policies within the book.

- Claim Frequency and Severity: The number of claims and the average cost of each claim, broken down by policy type and customer segment.

- Investment Income: Income generated from investing premiums before they are used to pay claims.

Importance of Data Quality

The accuracy of the valuation is directly proportional to the quality of the underlying data. Inaccurate or incomplete data can lead to significant errors in the valuation, potentially resulting in over- or undervaluation of the book. Data quality encompasses several aspects: completeness, accuracy, consistency, timeliness, and relevance. Inconsistencies or missing data points can introduce significant bias, leading to unreliable results.

For instance, underreporting of claims or inaccurate recording of policy details can dramatically affect the calculated loss ratio and ultimately the valuation. Robust data governance and quality control procedures are crucial to mitigate these risks. Regular audits and data validation processes are essential to maintain data integrity and ensure the accuracy of valuations.

Revenue and Profitability Analysis: How To Value An Insurance Book Of Business

Accurately assessing the revenue and profitability of an insurance book of business is crucial for determining its overall value. This involves projecting future income streams based on historical performance and market trends, and then calculating the net profit margin for each policy type. This analysis provides a clear picture of the book’s financial health and its potential for future growth.

Projecting Future Revenue Streams

Projecting future revenue requires a multi-faceted approach. It begins with a thorough analysis of historical data, including premium income, lapse rates, and renewal rates for each policy type within the book. This historical data forms the foundation for forecasting future performance. However, simply extrapolating past trends is insufficient. Market trends, such as changes in interest rates, inflation, and competitive pressures, must also be incorporated into the projections.

Sophisticated actuarial models often incorporate these factors to produce more accurate predictions. For example, a book of life insurance policies might see revenue growth influenced by demographic shifts and changes in life expectancy, requiring adjustments to the base projections. Similarly, a book of auto insurance policies might require adjustments based on anticipated changes in accident rates and average claim costs.

These adjustments are crucial for developing realistic and reliable revenue projections.

Calculating Net Profit Margin per Policy Type

Calculating the net profit margin for each policy type involves determining the total revenue generated by that policy type and subtracting all associated costs. These costs include claims payouts, operating expenses (such as commissions, salaries, and administrative costs), and taxes. The resulting net profit is then divided by the total revenue to arrive at the net profit margin.

The formula is:

Net Profit Margin = (Total Revenue – Total Costs) / Total Revenue

For example, if a particular type of homeowners insurance policy generates $1 million in revenue and incurs $700,000 in costs, the net profit margin would be 30% (($1,000,000 – $700,000) / $1,000,000). This calculation should be performed for each distinct policy type within the book of business to gain a comprehensive understanding of profitability across the portfolio.

Revenue and Profit Projections (Next 3 Years)

The following table presents a sample projection of revenue and profit for a hypothetical insurance book of business over the next three years. Note that these figures are illustrative and should be replaced with actual data and projections relevant to the specific book being valued. Furthermore, more detailed projections, spanning five years or more, would typically be included in a comprehensive valuation.

| Year | Total Revenue | Total Costs | Net Profit |

|---|---|---|---|

| Year 1 | $10,000,000 | $7,000,000 | $3,000,000 |

| Year 2 | $10,500,000 | $7,350,000 | $3,150,000 |

| Year 3 | $11,025,000 | $7,717,500 | $3,307,500 |

Assessing Risk and Loss Reserves

Accurately assessing risk and establishing appropriate loss reserves are critical steps in valuing an insurance book of business. Underestimating these factors can lead to significant financial underestimation of the book’s true value, while overestimation can result in unnecessarily conservative valuations. This section will detail the process of identifying and quantifying potential risks and explore various methods for calculating loss reserves.

Identifying and Quantifying Potential Risks

The process of identifying and quantifying risks begins with a thorough analysis of the book of business’s composition. This includes examining the types of policies included, the geographic distribution of the insured population, the historical claims data, and the underwriting practices employed. Specific risks may include catastrophic events (hurricanes, earthquakes), changes in regulatory environments, inflation impacting claim costs, and unforeseen increases in the frequency or severity of claims.

Quantifying these risks involves using statistical modeling techniques, incorporating historical data, and considering expert judgment to project future loss potential. For example, analyzing historical claims data for a specific region can help quantify the risk of future losses due to weather-related events in that region. Similarly, examining the types of policies (e.g., auto, home, commercial) helps to understand the potential exposure to different types of claims.

Loss Reserving Methods: Chain Ladder Method

The chain ladder method is a widely used actuarial technique for estimating loss reserves. It relies on the development pattern of historical claims data. The method uses the historical loss development triangles, which show the cumulative incurred losses over time for different accident years. The pattern of loss development is then extrapolated to estimate the ultimate incurred losses. For example, if the average incurred loss for a specific accident year has increased by 10% each year in the past, the chain ladder method would project a similar increase in the future.

The formula is based on the ratio of cumulative losses at different development periods. For example, the loss development factor (LDF) for year 2 to year 3 might be calculated as:

LDF2,3 = Cumulative Losses at Year 3 / Cumulative Losses at Year 2

This factor is then applied to the most recent cumulative losses to project the ultimate losses.

Loss Reserving Methods: Bornhuetter-Ferguson Method

The Bornhuetter-Ferguson method offers an alternative approach to loss reserving. Unlike the chain ladder method, which relies solely on historical loss development patterns, the Bornhuetter-Ferguson method incorporates an expected loss ratio. This expected loss ratio is typically derived from an underlying model or assumption about the expected loss ratio for the specific book of business. The method then combines this expected loss ratio with the observed loss development pattern to produce a more refined estimate of ultimate losses.

This is particularly useful when the historical data is limited or when significant changes in the underlying risk profile are anticipated. The formula is a weighted average of the expected losses and the chain ladder estimate. The weights are based on the level of confidence in the expected loss ratio and the historical loss development data.

Comparison of Loss Reserving Techniques

The chain ladder method is relatively simple to understand and implement, requiring only historical loss data. However, it can be sensitive to outliers in the data and may not accurately reflect changes in the underlying risk profile. The Bornhuetter-Ferguson method offers a more robust approach, incorporating prior expectations, but it requires more assumptions and may be more complex to implement.

The choice of method depends on the specific characteristics of the book of business, the availability of data, and the level of sophistication desired in the valuation. For example, in a stable insurance market with a long history of data, the chain ladder method might suffice. However, in a rapidly changing market with significant changes in underwriting practices or claims patterns, the Bornhuetter-Ferguson method would likely provide a more reliable estimate.

Determining the Value of Embedded Value

Embedded value represents the net present value of an insurer’s future profits from its in-force business. It’s a crucial metric in insurance valuation, providing a comprehensive assessment of the value beyond the insurer’s current assets and liabilities. Unlike traditional accounting measures, embedded value captures the long-term profitability potential locked within existing policy contracts. Understanding and accurately calculating embedded value is therefore essential for strategic decision-making, mergers and acquisitions, and overall business planning.

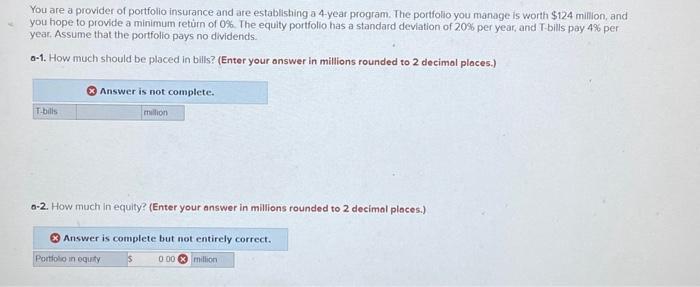

Calculating the Present Value of Future Profits

The core of embedded value calculation lies in determining the present value of expected future profits generated by the existing policy portfolio. This involves projecting future cash flows, considering factors such as premium income, claims payouts, expenses, and investment returns over the life of the policies. These projections are then discounted back to their present value using a suitable discount rate that reflects the risk associated with these future cash flows.

A higher discount rate reflects greater uncertainty and results in a lower present value. The accuracy of this process is paramount, as inaccuracies in projections or the discount rate can significantly impact the final embedded value figure.

A Step-by-Step Guide to Calculating Embedded Value

Calculating embedded value is a complex process, requiring detailed actuarial expertise and sophisticated modeling techniques. However, a simplified representation of the process can be Artikeld as follows:

- Project Future Cash Flows: This involves forecasting future premium income, claims costs, expenses, and investment returns for each policy in the portfolio. Sophisticated actuarial models are typically used to account for factors like mortality rates, lapse rates, and persistency. For example, a life insurance company might project future death claims based on mortality tables and the age distribution of its policyholders.

A property insurer would project future claims based on historical loss ratios and catastrophe modeling.

- Determine the Discount Rate: The discount rate reflects the risk associated with the projected future cash flows. This rate should consider the insurer’s financial risk profile, the overall economic environment, and the specific risks associated with the insurance portfolio. A higher discount rate reflects a higher perceived risk, leading to a lower present value of future profits. For example, a discount rate might be determined using a weighted average cost of capital (WACC) approach, considering the risk-free rate and market risk premiums.

- Calculate the Present Value of Future Profits: Once the future cash flows and discount rate are determined, the present value of future profits is calculated by discounting each year’s projected profit back to its present value. This is typically done using a discounted cash flow (DCF) model. The formula for present value is:

PV = FV / (1 + r)^n

where PV is the present value, FV is the future value, r is the discount rate, and n is the number of periods.

- Adjust for Embedded Value Components: Embedded value is often broken down into several components, such as the present value of future profits from existing policies and the value of new business expected from the existing policyholder base. These components are then summed to arrive at the total embedded value. This might include adjustments for the value of in-force renewal premiums, surrender values, and other policy benefits.

- Consider Assumptions and Sensitivities: It is crucial to carefully consider the assumptions underlying the projections, such as mortality rates, lapse rates, and investment returns. Sensitivity analysis should be performed to assess the impact of changes in these assumptions on the final embedded value. For instance, analyzing the impact of a change in interest rates on the present value of future profits allows for a more robust valuation.

Considering Market Factors and Competition

The valuation of an insurance book of business is significantly influenced by external market forces and the competitive landscape. Understanding these factors is crucial for arriving at a realistic and accurate valuation. Ignoring these elements can lead to substantial over- or undervaluation, impacting investment decisions and strategic planning.The valuation process must account for macroeconomic conditions and the specific competitive dynamics within the insurance sector.

These factors can impact profitability, future growth potential, and ultimately, the book’s overall worth. A comprehensive valuation will incorporate a detailed analysis of these elements to provide a robust assessment.

Market Factors Impacting Valuation

Interest rates and inflation are two key macroeconomic factors that significantly influence the value of an insurance book. Higher interest rates generally increase the present value of future cash flows, thereby increasing the book’s value. Conversely, higher inflation erodes the purchasing power of future cash flows, potentially reducing the book’s value. Additionally, changes in regulatory environments, such as new solvency requirements or tax laws, can directly affect profitability and therefore, the book’s valuation.

For example, increased capital requirements might necessitate a reduction in the valuation to reflect the increased capital needed to support the risk profile.

Competitive Analysis and its Influence

Competition within the insurance market significantly impacts the valuation of a book of business. A highly competitive market may result in lower premiums and reduced profitability, leading to a lower valuation. Conversely, a less competitive market may allow for higher premiums and greater profitability, resulting in a higher valuation. A comprehensive competitive analysis should consider the market share of competitors, their pricing strategies, product offerings, and distribution channels.

This analysis helps determine the book’s competitive positioning and its ability to generate future profits.

Market Share Comparison of Insurers

The following table illustrates a hypothetical comparison of market share among different insurers within a specific segment (e.g., auto insurance in a particular region). Note that these figures are for illustrative purposes only and do not represent actual market data. Real-world competitive analysis would require detailed market research and access to proprietary data.

| Insurer | Market Share (%) | Premium Growth (Last Year) | Loss Ratio (%) |

|---|---|---|---|

| Insurer A | 30 | 5% | 60% |

| Insurer B | 25 | 8% | 65% |

| Insurer C | 20 | 3% | 55% |

| Insurer D | 15 | 10% | 70% |

| Others | 10 | 2% | 62% |

Applying Valuation Methods

Valuing a book of insurance business requires a multifaceted approach, employing various valuation methods to arrive at a comprehensive assessment. The selection of appropriate methods depends heavily on the specific characteristics of the book, the available data, and the purpose of the valuation. Three primary approaches are commonly used: the market approach, the income approach, and the asset approach.

Each offers unique insights and presents its own set of limitations.

Market Approach

The market approach values the book of business by comparing it to similar books that have recently been sold. This involves identifying comparable transactions and adjusting the sale prices to reflect differences in size, profitability, risk profile, and market conditions. A key advantage of this method is its reliance on actual market transactions, providing a direct indication of market value.

However, finding truly comparable transactions can be challenging, especially for specialized or niche insurance lines. The accuracy of the valuation is also heavily dependent on the quality and availability of comparable data. Furthermore, market transactions may not always reflect the intrinsic value of the business, particularly if influenced by external factors like market fluctuations or economic downturns. For example, if a comparable book was sold during a period of low interest rates, the valuation may need to be adjusted upwards to reflect current market conditions.

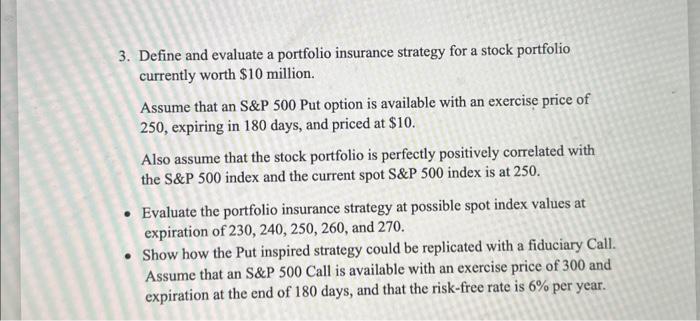

Income Approach

The income approach focuses on the future cash flows generated by the book of business. This method typically involves projecting future net income or cash flows, discounting them back to their present value using an appropriate discount rate that reflects the risk associated with the future cash flows. The present value of these projected cash flows represents the estimated value of the book.

A strength of the income approach is its direct consideration of the earning capacity of the book. However, accurate forecasting of future cash flows is crucial, and this is often subject to considerable uncertainty, particularly in the long term. The selection of the appropriate discount rate is also critical and can significantly impact the valuation. For instance, a higher discount rate reflecting higher perceived risk will lead to a lower valuation.

Consider a hypothetical scenario where a book is projected to generate $1 million in annual net income for the next five years. Using a discount rate of 10%, the present value of these cash flows would be approximately $3.79 million. A change in the discount rate to 15% would reduce the present value to approximately $2.85 million, highlighting the sensitivity of this method to the discount rate selection.

Asset Approach

The asset approach values the book of business by estimating the net asset value of its underlying assets. This method involves identifying and valuing all assets, including policy reserves, investments, and other tangible and intangible assets, and then deducting liabilities. The resulting net asset value provides an estimate of the book’s value. The asset approach is relatively straightforward and transparent.

However, it may not accurately reflect the market value of the business, particularly if the book’s intangible assets, such as customer relationships or brand reputation, are significant. Furthermore, the accuracy of the valuation depends on the accurate valuation of the assets and liabilities, which can be challenging, especially for complex insurance products. For example, the accurate valuation of loss reserves is crucial, but this is often subject to significant uncertainty and estimation.

Illustrative Example

This section presents a hypothetical insurance book of business to illustrate the valuation process discussed previously. We will walk through a simplified example, focusing on key aspects and making reasonable assumptions to arrive at a valuation. Remember, real-world valuations are far more complex and require detailed data analysis and expert judgment.

Hypothetical Book of Business Description

Our hypothetical book of business belongs to “Acme Insurance,” specializing in homeowner’s insurance in a specific region. The book comprises 10,000 policies, with an average annual premium of $1,200. The average policy has been in force for three years. The company maintains a loss ratio of 60% (meaning 60% of premiums are paid out in claims) and an expense ratio of 25%.

The book has consistently shown stable growth in the past five years, with a compound annual growth rate (CAGR) of 5%. Acme Insurance uses a reserving methodology consistent with industry best practices, taking into account historical claim data, inflation, and other relevant factors. This methodology is deemed appropriate by an independent actuary.

Revenue and Profitability Analysis

Total annual premium revenue is calculated as 10,000 policies$1,200/policy = $12,000,000. The incurred losses are 60% of premiums, or $7,200,000. Expenses are 25% of premiums, or $3,000,000. Therefore, the underwriting profit is $12,000,000 – $7,200,000 – $3,000,000 = $1,800,000. This represents the current year’s underwriting profit.

To understand profitability over time, we need to consider the history of the book. Considering the 5% CAGR, we can project future revenue and profit.

Assessing Risk and Loss Reserves

The loss reserve is crucial for valuing the book. Acme uses a discounted cash flow method to project future claim payments, considering factors like the age of policies, claim frequency and severity, and inflation. The estimated loss reserve for this book is $8,000,000, reflecting potential future claims on existing policies. This reserve is reviewed and updated regularly by an actuary.

Additional risks include changes in regulatory environment, catastrophic events, and competition. A sensitivity analysis would explore the impact of these variables on the valuation.

Determining the Value of Embedded Value, How to value an insurance book of business

Embedded value represents the present value of future profits from the existing book of business. We can estimate this using a discounted cash flow (DCF) model. Assuming a discount rate of 10% (reflecting the risk-free rate and risk premium), and projecting profits for the next five years, we can calculate the present value of these future profits. This calculation would involve projecting revenue, losses, and expenses for each year, discounting them back to the present value, and summing them up.

The resulting embedded value is a key component of the overall book valuation.

Considering Market Factors and Competition

The market value of the book is influenced by market conditions and competition. Factors such as interest rates, inflation, and the overall health of the insurance industry impact valuation. The competitive landscape, including the presence of other insurers offering similar products, also plays a significant role. A higher level of competition might reduce the book’s value, while a more favorable market environment could increase it.

A detailed market analysis would be necessary to assess these influences accurately.

Applying Valuation Methods

Several valuation methods can be applied, including the income approach (DCF), market approach (comparables), and asset approach (net asset value). The DCF approach, as Artikeld above, is commonly used. The market approach would involve comparing the book’s characteristics and performance to similar books that have been recently sold. The asset approach focuses on the net asset value of the book, considering assets such as premiums receivable and subtracting liabilities like loss reserves.

A combination of these methods often provides a more robust valuation.

Valuation Calculation Example (Simplified)

Let’s assume, for simplification, that the projected underwriting profit for the next five years remains constant at $1,800,000 annually. Using a 10% discount rate, the present value of these profits is approximately $6,865,000 (this is a simplified calculation and does not include the complexities of a full DCF model). Adding the present value of the loss reserve ($8,000,000) would give a total estimated value of approximately $14,865,000.

This is a simplified illustration and should not be considered a precise valuation.

Visual Representation of Value Drivers

A bar chart could visually represent the key value drivers. One bar would represent the present value of future underwriting profits (as calculated using the DCF model), another bar would show the value of the loss reserve, and a third bar would illustrate the impact of market factors and competition (a positive or negative adjustment to the initial valuation).

The total length of the bars would represent the final estimated value of the book. The relative lengths of the bars would clearly show the contribution of each factor to the overall valuation.

Final Thoughts

Valuing an insurance book of business is not a simple task, requiring a blend of financial expertise, actuarial knowledge, and a keen understanding of market dynamics. By carefully considering historical performance, projecting future profitability, accurately assessing risk, and applying appropriate valuation methods, a robust and reliable valuation can be achieved. This comprehensive approach, encompassing data analysis, risk assessment, and market considerations, is critical for informed decision-making in areas such as mergers, acquisitions, and strategic planning within the insurance sector.

Remember, accurate valuation is paramount for sound financial management and strategic success.