How to start a real estate investment company is a question many aspiring entrepreneurs ponder. The allure of building wealth through property investment is undeniable, but the path requires careful planning, strategic execution, and a deep understanding of the market. This guide navigates the complexities, offering a practical roadmap to successfully launch and manage your own real estate investment company, from crafting a robust business plan to navigating the intricacies of property acquisition and financial management.

Successfully launching a real estate investment company involves more than just a passion for property. It demands a thorough understanding of business principles, legal compliance, investment strategies, and effective risk management. This comprehensive guide breaks down each crucial step, providing actionable advice and insights to help you navigate the challenges and capitalize on the opportunities within this dynamic industry.

We will explore various funding options, marketing strategies, and operational best practices to ensure your company’s success and long-term growth.

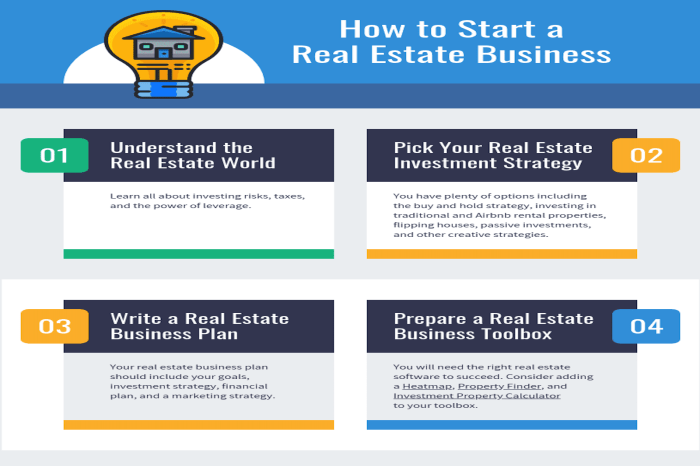

Business Plan Development

A robust business plan is the cornerstone of any successful real estate investment company. It serves as a roadmap, guiding your decisions and attracting potential investors. This plan should be a living document, regularly reviewed and updated to reflect market changes and company performance.A comprehensive business plan should clearly articulate your company’s mission, vision, and target market. It should also include detailed financial projections, a comprehensive marketing strategy, and a thorough risk management plan.

Securing initial funding is another critical component, requiring a well-defined strategy.

Company Mission, Vision, and Target Market Definition

The mission statement concisely defines your company’s purpose and how it will achieve its goals. For example, a mission statement might be: “To provide exceptional real estate investment opportunities, delivering strong returns for our investors while contributing to the revitalization of underserved communities.” The vision statement paints a picture of the company’s future aspirations. It could be: “To become a leading real estate investment firm known for its integrity, innovation, and commitment to sustainable development.” Defining your target market – whether it’s luxury residential properties, commercial real estate, or a specific geographic area – is crucial for focusing your efforts and resources.

Understanding the demographics, needs, and preferences of your target market will inform your marketing strategy and investment decisions.

Financial Projections for the First Three Years

Accurate financial projections are vital for securing funding and tracking progress. These projections should include detailed revenue forecasts, expense budgets, and cash flow statements for each of the first three years. They should be based on realistic assumptions about market conditions, occupancy rates, and operating expenses. For instance, you might project a 10% annual increase in revenue based on historical market data and your planned expansion strategy.

It’s also important to include sensitivity analyses to demonstrate how the projections might change under different scenarios (e.g., a decrease in market value, increased interest rates).

Marketing Strategy

A successful marketing strategy is essential for attracting investors and clients. This should include a mix of online and offline channels, such as a professional website, targeted advertising campaigns (both online and print), networking events, and public relations efforts. For example, you might utilize social media platforms like LinkedIn to connect with potential investors, while also attending industry conferences to build relationships and generate leads.

A well-defined branding strategy will also be crucial in establishing your company’s identity and building trust.

Risk Management Plan

The real estate market is inherently volatile. A comprehensive risk management plan is crucial for mitigating potential challenges. This plan should identify potential risks, such as market downturns, interest rate fluctuations, and tenant defaults. For each identified risk, the plan should Artikel specific mitigation strategies. For example, diversifying your investment portfolio across different property types and geographic locations can reduce the impact of a downturn in a specific market.

Similarly, securing adequate insurance coverage can protect against unforeseen events.

Securing Initial Funding

Securing initial funding requires a well-defined strategy. This could involve seeking funding from angel investors, venture capitalists, banks, or through crowdfunding platforms. A compelling business plan, strong management team, and realistic financial projections are crucial for attracting investors. You should also explore different funding options and choose the one that best suits your needs and circumstances. For example, a bank loan might be suitable for purchasing a specific property, while venture capital might be more appropriate for a company with significant growth potential.

Legal and Regulatory Compliance

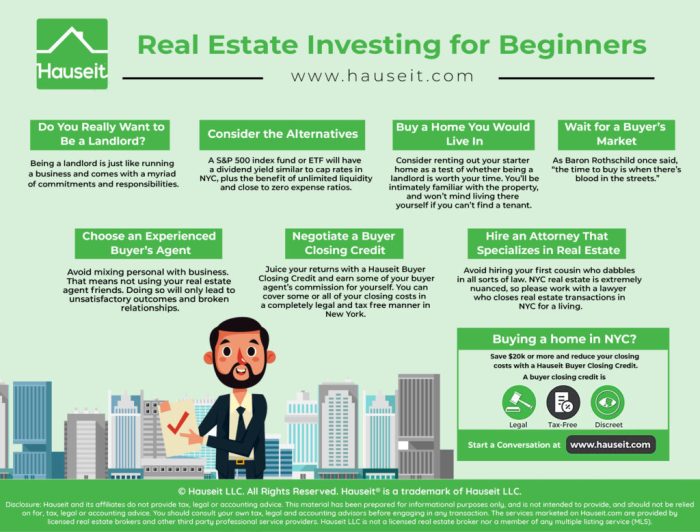

Navigating the legal landscape is crucial for the success and longevity of any real estate investment company. Understanding and adhering to all relevant regulations will protect your business and ensure smooth operations. This section will Artikel the key legal and regulatory considerations for establishing and running your real estate investment firm.

Necessary Licenses and Permits

The specific licenses and permits required to operate a real estate investment company vary significantly depending on your location, the type of real estate activities you undertake (e.g., buying, selling, renting, property management), and the legal structure of your business. For instance, you may need a general business license, a real estate broker’s license if you intend to list and sell properties, or a contractor’s license if you plan on significant property renovations.

It’s imperative to research your jurisdiction’s requirements through your state’s Secretary of State website, local government agencies, and consulting with a legal professional specializing in real estate law. Failure to obtain the necessary licenses can result in significant penalties and legal ramifications. You should also check for any zoning regulations or building codes that apply to the types of properties you intend to invest in.

Forming a Legal Entity

Choosing the right legal structure for your real estate investment company is a pivotal decision with significant tax and liability implications. Common structures include Limited Liability Companies (LLCs) and corporations (S-corps and C-corps). Forming an LLC typically involves filing articles of organization with your state’s Secretary of State, outlining the company’s name, registered agent, and operating agreement. Incorporating involves a similar process, but with more stringent requirements and ongoing compliance obligations.

The process usually includes drafting corporate bylaws, appointing directors and officers, and maintaining meticulous corporate records. Seeking guidance from a legal and tax professional is highly recommended during this stage to ensure you choose the structure best suited to your circumstances and long-term goals.

Comparison of Legal Structures and Tax Implications

The choice between an LLC, S-corp, or C-corp significantly impacts your tax liability and personal liability protection. LLCs offer pass-through taxation, meaning profits and losses are reported on the owners’ personal income tax returns, avoiding double taxation. S-corps also provide pass-through taxation, offering potential tax advantages through the separation of owner compensation and profits. C-corps, on the other hand, are subject to double taxation – the corporation pays taxes on its profits, and shareholders pay taxes on dividends received.

LLCs generally offer greater liability protection than sole proprietorships or partnerships, shielding personal assets from business debts and lawsuits. The optimal structure depends on factors such as the number of investors, the level of liability protection desired, and the anticipated profitability of the venture. Consulting with a tax advisor is crucial to understand the implications of each structure for your specific situation.

For example, a larger investment group might favor the structure of an LLC or a corporation for greater liability protection and the ability to raise capital more easily. A smaller, single-owner operation might find an LLC more straightforward to manage.

Maintaining Accurate Financial Records and Adhering to Regulatory Requirements

Maintaining meticulous financial records is paramount for tax compliance, attracting investors, and managing your business effectively. This includes keeping detailed records of all income and expenses, property valuations, loan agreements, and other relevant financial documents. Adhering to Generally Accepted Accounting Principles (GAAP) is crucial for transparency and accuracy. Regularly reconcile bank statements, and consider using accounting software to streamline the process.

Furthermore, staying informed about changes in tax laws and real estate regulations is essential. Regularly review your compliance procedures to ensure you are meeting all legal requirements, and consider engaging a qualified accountant and legal counsel to assist with financial reporting and regulatory compliance. Failure to maintain accurate records and comply with regulations can lead to significant penalties, audits, and legal challenges.

For instance, failing to properly report income can result in substantial back taxes and penalties.

Investment Strategies

Choosing the right real estate investment strategy is crucial for success. The optimal approach depends on your risk tolerance, capital, time commitment, and overall investment goals. This section will explore three common strategies, highlighting their advantages and disadvantages, and illustrating how to diversify your portfolio for optimal returns.

Wholesaling

Wholesaling involves finding undervalued properties, securing a contract to purchase them, and then quickly assigning (selling) that contract to another investor at a higher price. The wholesaler doesn’t actually purchase the property; they profit from the difference between the contract price and the assignment fee.

Advantages of wholesaling include low capital requirements and a relatively short time frame for transactions. It’s an excellent strategy for beginners with limited funds, allowing them to learn the market and build connections quickly. However, wholesaling relies heavily on market knowledge and strong negotiation skills to find profitable deals and secure assignments.

Disadvantages include the risk of the assigned contract falling through, leading to lost time and effort. Furthermore, success depends significantly on finding motivated sellers and experienced cash buyers. Profit margins can also be affected by fluctuating market conditions.

Flipping

Flipping involves purchasing a property, renovating it, and then selling it for a profit. This strategy requires more capital than wholesaling, as you need funds for the purchase, renovation, and holding costs. Success depends on accurate cost estimations for renovations and a keen understanding of the local market to determine appropriate sale prices.

Advantages of flipping include the potential for significant profits if the renovations are completed efficiently and the property is sold at the right price. It allows for creative input and can be very rewarding. However, it requires a significant upfront investment and a substantial time commitment to manage the renovation process.

Disadvantages include the risk of unforeseen renovation costs, delays, and difficulties in selling the property quickly, especially in a slow market. The success of flipping hinges on accurate market analysis, project management skills, and effective marketing.

Buy-and-Hold

Buy-and-hold involves purchasing a property with the intention of holding it long-term to generate passive income through rental payments and appreciate its value over time. This strategy typically requires a larger upfront investment and involves ongoing property management responsibilities.

Advantages of buy-and-hold include the potential for consistent cash flow through rental income, long-term appreciation of property value, and tax advantages such as depreciation deductions. It’s a more passive approach than wholesaling or flipping, allowing for a more hands-off management style once the property is rented.

Disadvantages include the higher initial investment required, the ongoing responsibility of property management, and the potential for vacancy periods which impact rental income. Market downturns can also affect property values, impacting overall ROI.

Sample Diversified Portfolio

A diversified portfolio might include a mix of property types to mitigate risk. For example:

- One single-family home for buy-and-hold, generating rental income and long-term appreciation.

- One multi-family property (duplex or triplex) for buy-and-hold, offering higher rental income potential.

- Two properties for flipping, targeting different price points and renovation scopes.

- One wholesale deal annually to generate quick cash flow.

Potential ROI Comparison, How to start a real estate investment company

The actual ROI for each strategy varies greatly depending on specific market conditions, property characteristics, and individual investor skill. The following table presentspotential* ROI scenarios, not guaranteed returns. These figures are illustrative and should not be taken as financial advice.

| Strategy | Potential ROI (Annualized) | Factors Influencing ROI | Example Scenario |

|---|---|---|---|

| Wholesaling | 10-20% | Assignment fee, market conditions, speed of transaction | A $100,000 property wholesaled for a $5,000 assignment fee represents a 5% ROI. Multiple deals can significantly increase the annualized return. |

| Flipping | 20-50% | Purchase price, renovation costs, sale price, market demand | A property purchased for $200,000, renovated for $50,000, and sold for $300,000 represents a 25% ROI. This excludes holding costs and taxes. |

| Buy-and-Hold | 5-15% | Rental income, property appreciation, vacancy rates, expenses | A $300,000 property with $2,000 monthly rental income, after expenses, and a 3% annual appreciation represents a roughly 8% ROI. |

Property Acquisition and Management: How To Start A Real Estate Investment Company

Successfully acquiring and managing properties is crucial for the profitability of your real estate investment company. This involves a systematic approach, from identifying promising properties to effectively managing tenants and maximizing property value. A well-defined process will minimize risks and maximize returns.Identifying and evaluating potential investment properties requires a thorough and multi-faceted approach. This includes market research, property analysis, and due diligence.

Property Identification and Evaluation

The process of identifying suitable investment properties begins with comprehensive market research. This involves analyzing local market trends, including rental rates, occupancy rates, and property values in target areas. Factors such as population growth, employment rates, and planned infrastructure developments should also be considered. Once potential areas are identified, properties are evaluated based on key metrics such as capitalization rate (Cap Rate), return on investment (ROI), and potential for appreciation.

A detailed analysis of the property’s condition, including any necessary repairs or renovations, is also essential. This might involve obtaining professional inspections from qualified engineers, plumbers, and electricians to uncover hidden issues and accurately estimate renovation costs. A thorough review of comparable properties (comps) helps to establish a fair market value and potential rental income. For example, analyzing recent sales data of similar properties in the same neighborhood will provide a benchmark for negotiating a purchase price.

Real Estate Transaction Negotiation and Closing

Negotiating and closing a real estate transaction involves several key steps. First, a strong offer is prepared based on the property’s evaluated value and market conditions. This offer includes the purchase price, contingencies (such as financing and inspection), and closing date. Negotiations with the seller often involve counteroffers and compromises. A skilled real estate attorney is crucial during this phase to ensure all legal aspects are handled correctly and the investor’s interests are protected.

Securing financing is a critical step; this may involve working with lenders to obtain a mortgage or other financing options. Once an agreement is reached, the due diligence process continues, including a final property inspection and review of title documents. The closing process involves signing all necessary paperwork, including the purchase agreement, mortgage documents, and transfer of ownership.

This often involves the services of a title company to ensure a smooth and legally sound transfer of ownership.

Rental Property Management Strategies

Effective rental property management is essential for maximizing returns and minimizing risks. This begins with a robust tenant screening process, which includes credit checks, background checks, and verification of income and employment. A well-drafted lease agreement clearly Artikels the terms of the tenancy, including rent amount, payment schedule, and responsibilities of both landlord and tenant. Regular property maintenance is crucial for preserving property value and preventing costly repairs.

This includes routine inspections, prompt responses to tenant requests, and proactive maintenance of systems such as HVAC and plumbing. For example, a preventative maintenance schedule might include annual HVAC inspections and bi-annual plumbing checks. Establishing a system for handling tenant complaints and resolving disputes efficiently is also essential. Utilizing professional property management services can significantly reduce the workload and enhance efficiency.

Maximizing Property Value Through Renovations and Upgrades

Renovations and upgrades can significantly enhance property value and rental income. Prior to undertaking any renovation, a thorough cost-benefit analysis is necessary. This involves evaluating the potential increase in property value and rental income against the cost of renovations. Strategic upgrades, such as kitchen and bathroom renovations, often yield the highest return on investment. Energy-efficient upgrades, such as new windows and insulation, can also increase property value and reduce operating costs.

For example, replacing outdated appliances with energy-star rated models can reduce utility bills and appeal to environmentally conscious tenants. Maintaining a consistent and high-quality standard of upkeep is paramount to maximizing property value over the long term. Careful planning and execution of renovations, alongside meticulous budgeting, are vital for success.

Team Building and Operations

Building a high-performing team is crucial for the success of any real estate investment company. A well-structured team, with clearly defined roles and responsibilities, ensures efficient operations and effective execution of investment strategies. This section Artikels the key components of team building and operational efficiency within a real estate investment company.A robust team structure is essential for managing the complexities of real estate investment.

Effective team building involves careful selection, thorough training, and consistent performance monitoring. This approach minimizes risks, optimizes resource allocation, and maximizes returns on investments.

Key Roles and Responsibilities

The specific roles within a real estate investment company will vary depending on its size and investment strategy. However, some key roles are common across most organizations. These roles often require a blend of expertise in finance, law, property management, and marketing. Clear delineation of responsibilities minimizes overlap and maximizes efficiency.

- Chief Executive Officer (CEO): Oversees all aspects of the company, sets strategic direction, and manages overall performance.

- Chief Financial Officer (CFO): Manages the company’s finances, including budgeting, forecasting, and financial reporting.

- Investment Manager/Analyst: Conducts market research, identifies investment opportunities, analyzes financial data, and makes investment recommendations.

- Property Manager: Oversees the day-to-day operations of acquired properties, including tenant management, maintenance, and repairs.

- Legal Counsel: Provides legal advice and ensures compliance with all relevant regulations.

- Marketing and Sales Team: Promotes investment opportunities and manages relationships with potential investors.

Recruiting and Hiring Qualified Personnel

The process of recruiting and hiring a qualified team should be thorough and systematic. A well-defined recruitment strategy attracts candidates with the necessary skills and experience. Effective screening processes help identify the best fit for each role. Background checks and reference checks are essential components of a robust hiring process.

- Define job requirements: Clearly Artikel the necessary skills, experience, and qualifications for each position.

- Source candidates: Utilize various channels such as online job boards, professional networking sites, and recruitment agencies.

- Screen applications: Review resumes and cover letters to shortlist suitable candidates.

- Conduct interviews: Conduct multiple rounds of interviews to assess candidates’ skills, experience, and cultural fit.

- Background checks and reference checks: Verify the information provided by candidates and obtain feedback from previous employers.

- Offer and onboarding: Extend job offers to selected candidates and provide a comprehensive onboarding program.

Employee Training Program

A comprehensive training program ensures that all employees understand their roles, responsibilities, and the company’s operational procedures. Consistent training promotes efficiency, reduces errors, and maintains a high standard of service. Regular updates and refresher courses are essential to keep employees abreast of changes in the industry and company policies.The training program should cover areas such as: property management software, legal and regulatory compliance, investment analysis techniques, financial reporting, and customer service best practices.

The program might include on-the-job training, workshops, online courses, and mentoring opportunities.

Key Performance Indicator (KPI) Tracking and Investment Success Measurement

Tracking key performance indicators (KPIs) is essential for monitoring the success of investments and the overall performance of the company. Regularly monitoring KPIs allows for timely identification of issues and opportunities for improvement. KPIs can be financial (e.g., return on investment, net operating income), operational (e.g., occupancy rates, tenant satisfaction), or strategic (e.g., market share, brand reputation).Examples of KPIs include: Return on Investment (ROI), Net Operating Income (NOI), Cash-on-Cash Return, Occupancy Rate, and Capitalization Rate.

A dashboard system could be implemented to visually represent the performance of each KPI, allowing for easy identification of trends and anomalies. Regular review and analysis of these metrics allow for informed decision-making and adjustments to investment strategies.

Funding and Financing

Securing sufficient funding is crucial for the success of any real estate investment company. The right financing strategy can significantly impact profitability and growth, while the wrong one can lead to significant financial strain. This section explores various funding options, compares their terms, and Artikels strategies for creating a compelling investor pitch deck.

Real estate investment companies typically rely on a combination of equity and debt financing to fund their projects. Equity financing involves selling ownership stakes in the company in exchange for capital, while debt financing involves borrowing money that must be repaid with interest. The optimal blend depends on factors like the company’s risk tolerance, project size, and market conditions.

Sources of Real Estate Investment Funding

Several avenues exist for securing funding for real estate investments. Each option carries distinct advantages and disadvantages regarding interest rates, repayment terms, and the level of control retained by the company.

Understanding the nuances of each funding source is critical for making informed decisions. The choice often depends on the specific project, the company’s financial standing, and the investor’s risk profile.

- Private Loans: These loans are typically obtained from private individuals or family offices. Interest rates and terms are often negotiated directly with the lender, offering flexibility but potentially higher interest rates than traditional loans. They can be advantageous for smaller projects or those with unique characteristics that may not fit conventional lending criteria.

- Hard Money Loans: These short-term loans are secured by real estate and are often used to quickly acquire properties or fund renovations. They typically carry higher interest rates than traditional loans but offer faster processing times. This makes them suitable for investors seeking rapid access to capital for time-sensitive opportunities. However, the short repayment periods can create significant financial pressure.

- Crowdfunding: This involves raising capital from a large number of individuals through online platforms. Crowdfunding platforms allow investors to contribute smaller amounts, diversifying the risk for both the company and the investors. This approach can be effective for building brand awareness and community support, but it may involve higher fees and regulatory compliance requirements.

- Traditional Bank Loans: Banks offer various loan products specifically designed for real estate investments. These loans typically have lower interest rates than private or hard money loans, but they often require extensive documentation and a strong credit history. The approval process can also be lengthier.

- Joint Ventures: Partnering with other investors or real estate companies can provide access to additional capital and expertise. This approach can reduce the financial burden on a single entity and leverage the strengths of different partners. However, it requires careful negotiation and agreement on shared responsibilities and profit distribution.

Comparison of Financing Options

The following table summarizes the key differences between the financing options described above. Interest rates and terms can vary significantly based on market conditions, the borrower’s creditworthiness, and the specifics of the loan agreement. The data provided represents general trends and should not be considered financial advice.

| Financing Option | Interest Rate | Loan Term | Advantages | Disadvantages |

|---|---|---|---|---|

| Private Loan | Variable, generally higher | Variable | Flexibility, personalized terms | Higher interest rates, potential difficulty securing funding |

| Hard Money Loan | High | Short-term | Fast processing, suitable for quick acquisitions | High interest rates, short repayment periods |

| Crowdfunding | Variable, potentially lower | Variable | Access to a wider pool of capital, increased brand awareness | Higher fees, regulatory compliance |

| Traditional Bank Loan | Lower | Longer-term | Lower interest rates, established lending process | Stricter requirements, longer approval process |

| Joint Venture | N/A (Equity Sharing) | N/A | Shared risk and resources, access to expertise | Requires negotiation and agreement on responsibilities |

Creating a Compelling Investor Pitch Deck

A well-structured investor pitch deck is essential for attracting capital. It should clearly articulate the company’s vision, investment strategy, and financial projections. A compelling narrative, supported by strong financial data, significantly increases the chances of securing funding.

The deck should include a concise executive summary, a detailed description of the company and its management team, the investment opportunity and its potential returns, a comprehensive financial model, and a clear exit strategy. Visual aids, such as charts and graphs, can enhance understanding and engagement.

Examples of Successful Fundraising Strategies

Many successful real estate investment companies have employed diverse strategies to secure funding. Some examples include:

- Focus on a Niche Market: Specializing in a specific type of property or geographic area can attract investors interested in that particular niche. This allows for targeted marketing and a deeper understanding of market dynamics.

- Strong Track Record: Demonstrating a history of successful investments builds credibility and trust with potential investors. This requires meticulous record-keeping and a proven ability to generate returns.

- Strategic Partnerships: Collaborating with established players in the real estate industry can enhance a company’s reputation and attract more investors.

- Value-Added Strategies: Focusing on value-add investments, such as property renovations or repositioning, can attract investors seeking higher returns.

Marketing and Sales

A robust marketing and sales strategy is crucial for attracting investors and securing profitable real estate deals. This involves crafting a compelling brand identity, implementing effective marketing channels, and cultivating strong relationships with clients. Success hinges on a clear understanding of your target audience and a well-defined plan to reach them.A multi-faceted approach, combining online and offline strategies, is often the most effective.

This ensures maximum reach and brand visibility within your chosen market segments.

Marketing Plan Design

Attracting both investors and clients requires a tailored approach. For investors, the focus should be on showcasing the company’s expertise, track record, and potential for high returns. Marketing materials should emphasize financial projections, risk management strategies, and the team’s experience. For clients seeking properties, the emphasis should shift to the quality of services offered, the breadth of property listings, and the ease and efficiency of the transaction process.

This might involve highlighting features like streamlined online portals and personalized client support. The overall marketing plan should clearly define target audiences, allocate budget across various channels, and establish measurable key performance indicators (KPIs) for success. For example, a KPI might be the number of qualified leads generated per month, or the conversion rate from lead to closed deal.

Sample Marketing Materials

A professional brochure for potential investors could include a company overview, highlighting key achievements and team expertise; a summary of investment opportunities, including projected returns and risk assessments; testimonials from satisfied investors; and contact information. Website content should mirror this information, adding interactive elements like property listings, investment calculators, and a blog with insightful market analysis and company updates.

For client-focused materials, brochures should showcase available properties with high-quality photography and detailed descriptions. The website should include a user-friendly search function, virtual tours, and client testimonials focusing on positive experiences with the company’s services.

Building a Strong Online Presence and Lead Generation

A strong online presence is essential for attracting both investors and clients in today’s digital landscape. This involves creating a professional website optimized for search engines (), utilizing social media platforms to engage with potential clients and investors, and employing targeted online advertising campaigns. Effective involves using relevant s in website content, optimizing page titles and meta descriptions, and building high-quality backlinks from reputable websites.

Social media marketing can involve sharing informative content, engaging with followers, and running targeted advertising campaigns to reach specific demographics. Paid online advertising, such as Google Ads or social media ads, allows for precise targeting based on location, demographics, and interests. Lead generation can be further enhanced by offering valuable resources, such as market reports or investment guides, in exchange for contact information.

Tracking website analytics and social media engagement provides valuable insights into campaign effectiveness and allows for data-driven optimization. For example, analyzing website traffic data can reveal which marketing channels are most effective in driving leads.

Closing Deals and Building Long-Term Relationships

Closing deals requires a combination of strong negotiation skills, excellent communication, and a deep understanding of client needs. This involves actively listening to client concerns, addressing objections effectively, and presenting compelling offers. Building long-term relationships requires consistent communication, providing excellent customer service, and going the extra mile to exceed client expectations. Regular follow-up after closing a deal, providing ongoing support, and proactively seeking feedback are crucial for fostering loyalty and repeat business.

For example, sending a personalized thank-you note after a successful transaction or offering assistance with property maintenance can significantly enhance client satisfaction. Building a strong referral network is also important for generating future business. This can be achieved by consistently exceeding client expectations and encouraging satisfied clients to refer new business.

Risk Mitigation and Crisis Management

Establishing a robust risk mitigation and crisis management framework is crucial for the long-term success of any real estate investment company. Proactive identification and management of potential risks are essential to protect the company’s assets, maintain profitability, and ensure the well-being of its stakeholders. This involves not only anticipating potential problems but also developing effective strategies to address them should they arise.Real estate investment inherently involves a variety of risks.

Understanding these risks and implementing proactive mitigation strategies is paramount for sustained success. Failure to adequately address these risks can lead to significant financial losses, reputational damage, and legal liabilities. A well-defined crisis management plan allows for a swift and organized response to unexpected events, minimizing potential damage and ensuring business continuity.

Market Downturns

Market fluctuations are an inherent risk in real estate. Economic downturns can lead to decreased property values, reduced rental income, and difficulty securing financing. Mitigation strategies include diversifying the investment portfolio across different property types and geographical locations, employing conservative leverage ratios, and maintaining sufficient cash reserves to weather periods of low market activity. For example, instead of concentrating investments solely in high-growth areas prone to bubbles, a diversified portfolio might include properties in more stable markets with consistent rental demand.

This reduces the overall impact of a downturn in any single market segment.

Tenant Issues

Tenant issues, ranging from late rent payments to property damage, are common occurrences in real estate investment. Effective tenant screening processes, including thorough background checks and credit reports, are essential for minimizing these risks. Clear lease agreements outlining tenant responsibilities and consequences for breaches are also crucial. Furthermore, establishing a proactive communication strategy with tenants and promptly addressing maintenance requests can prevent minor issues from escalating into major problems.

For instance, a robust online tenant portal for rent payments and communication can facilitate timely rent collection and address maintenance issues efficiently.

Legal Disputes

Legal disputes can arise from various sources, including contract breaches, zoning violations, and property boundary disagreements. Engaging experienced legal counsel to review all contracts and ensure compliance with all relevant regulations is crucial. Maintaining thorough documentation of all transactions and communications can provide valuable evidence in the event of a legal dispute. For example, meticulously documenting all repairs and maintenance activities can protect the company from liability in cases of tenant-related claims.

Proactive legal counsel can also help identify and resolve potential legal issues before they escalate into costly litigation.

Crisis Management Plan

A comprehensive crisis management plan should Artikel procedures for responding to various unexpected events, including natural disasters, economic crises, and major property damage. This plan should include designated personnel responsible for handling specific aspects of the crisis, communication protocols for stakeholders, and procedures for restoring normal operations. For example, the plan should include contact information for emergency services, insurance providers, and legal counsel.

Regular drills and simulations can help ensure that the plan is effective and that personnel are adequately prepared to respond to unexpected events. This proactive approach minimizes disruption and protects the company’s reputation.

Handling Difficult Situations

Effective crisis management requires a structured approach to handling difficult situations. For example, tenant evictions should be conducted legally and humanely, following all applicable laws and regulations. This involves providing proper notice, adhering to court procedures, and demonstrating compassion throughout the process. In cases of significant property damage, prompt action is crucial. This includes securing the property, contacting insurance providers, and initiating repairs as quickly as possible to minimize further damage and disruption.

Documentation of all actions taken, including communication with tenants, contractors, and insurance companies, is essential for protecting the company’s interests.

Last Point

Embarking on the journey of establishing a real estate investment company is an ambitious undertaking, demanding dedication, strategic thinking, and a commitment to continuous learning. By carefully considering the business plan, legal frameworks, investment strategies, and operational aspects Artikeld in this guide, you can significantly enhance your chances of success. Remember that consistent adaptation to market changes, proactive risk management, and a strong focus on building a skilled and reliable team are crucial for long-term profitability and sustainable growth in the competitive world of real estate investment.

This journey requires perseverance, but the potential rewards are significant for those who are prepared and well-informed.