How to invest in Perplexity AI is a question attracting significant interest, given the company’s rapid rise in the artificial intelligence landscape. This guide explores the various avenues for potential investment, from understanding Perplexity AI’s business model and market position to evaluating its financial performance and navigating the inherent risks. We’ll delve into different investment vehicles and strategies, emphasizing the importance of thorough research and a well-defined risk tolerance before committing capital.

Successfully investing in any emerging technology company requires careful consideration of several key factors. For Perplexity AI, this includes analyzing its competitive advantage, assessing its long-term growth potential within the broader AI market, and understanding the potential impact of macroeconomic conditions. This guide aims to provide a framework for navigating these complexities and making informed investment decisions.

Understanding Perplexity AI Investment Opportunities

Investing in Perplexity AI, a rapidly growing company in the generative AI space, presents a unique opportunity with significant potential but also considerable risk. Its current stage of development means investment avenues are limited compared to established tech giants, but the potential rewards could be substantial for early investors. This section will explore the various aspects of investing in Perplexity AI, outlining potential strategies, inherent risks, and comparisons with more established companies.

Investment Avenues in Perplexity AI

Currently, direct investment in Perplexity AI is likely restricted to venture capital firms and private equity investors due to its private status. Public offerings (IPOs) or other public investment opportunities may become available in the future if Perplexity AI decides to go public. However, even then, access might be limited to high-net-worth individuals and institutional investors. Indirect investment might be possible through investment vehicles that hold shares in companies involved in the development or application of large language models, though this approach offers less direct exposure to Perplexity AI’s success.

Risks Associated with Investing in Perplexity AI

Investing in a relatively young, private company like Perplexity AI carries significant risk. The company may not achieve its projected growth, its technology could become obsolete due to rapid advancements in the AI field, or it may face intense competition from established players. The lack of readily available information about the company’s financials and operational details further amplifies the uncertainty associated with this investment.

Furthermore, the regulatory landscape surrounding AI is still evolving, posing potential legal and compliance risks. A hypothetical example would be a significant regulatory shift that negatively impacts the use of large language models, directly affecting Perplexity AI’s revenue streams.

Comparison with Established Tech Companies

Investing in Perplexity AI differs significantly from investing in established tech companies like Google or Microsoft. Established companies offer greater stability, transparency, and liquidity. Their financial performance is readily available, and their stock is easily traded on public exchanges. Conversely, Perplexity AI offers potentially higher returns but with considerably higher risk due to its early-stage development and private status.

The risk-reward profile is vastly different; established companies offer a more conservative investment, while Perplexity AI represents a high-growth, high-risk venture. Consider the difference between investing in a well-established automobile manufacturer versus a promising but unproven electric vehicle startup.

Potential Return on Investment (ROI) Scenarios, How to invest in perplexity ai

The potential ROI for Perplexity AI investments is highly speculative and dependent on numerous factors, including the company’s future growth, market conditions, and the overall success of its technology. A successful IPO could generate significant returns for early investors, mirroring the substantial returns seen by early investors in other successful tech companies. However, if the company fails to meet expectations or faces significant setbacks, the investment could result in a complete loss.

For instance, if Perplexity AI were to secure a large funding round at a high valuation and subsequently achieve a successful IPO at a significantly higher valuation, the ROI could be exceptionally high. Conversely, if the company struggles to gain traction or faces fierce competition, the investment could be worthless. There is no guaranteed ROI in this type of investment.

Researching Perplexity AI’s Business Model and Market Position

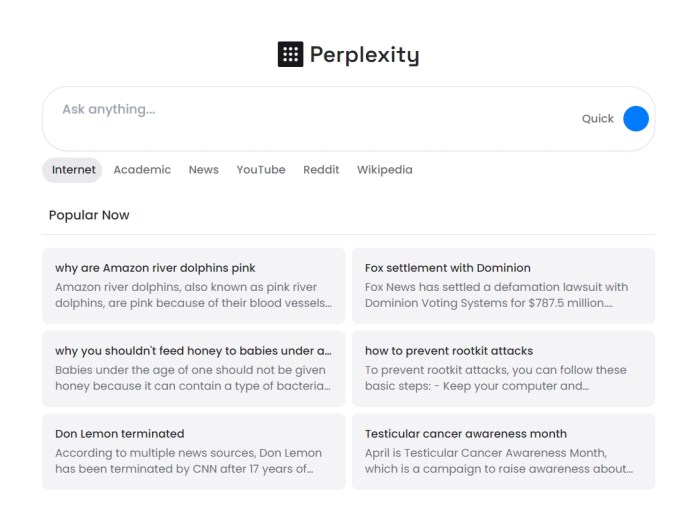

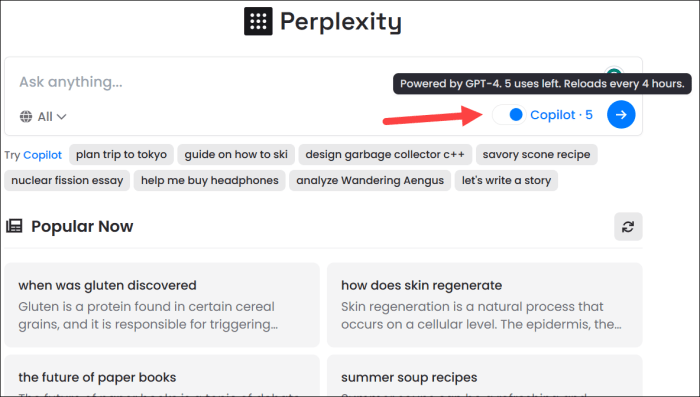

Perplexity AI operates in the rapidly evolving landscape of artificial intelligence, specifically focusing on providing a more intuitive and conversational search experience. Understanding its business model, competitive landscape, and market potential is crucial for assessing its investment viability. This section delves into these key aspects to provide a comprehensive overview.

Perplexity AI’s Business Model and Revenue Streams

Perplexity AI’s core business model centers around providing a powerful and user-friendly AI-powered search engine. Currently, the primary revenue stream is likely derived from advertising revenue, similar to traditional search engines. As the platform grows and expands its capabilities, additional revenue streams could emerge, such as premium subscriptions for enhanced features, API access for developers to integrate Perplexity AI into their applications, or partnerships with businesses for customized solutions.

The exact breakdown of current revenue streams is not publicly available, but these are logical projections based on the company’s offerings and the general trends in the AI search market.

Perplexity AI’s Competitors and Competitive Analysis

Perplexity AI faces stiff competition in the AI search market. Key competitors include established players like Google Search, Bing, and DuckDuckGo, each possessing significant resources and user bases. Google, for example, holds a dominant market share and benefits from its vast data infrastructure and integration with other Google services. Bing, powered by Microsoft, leverages its own considerable resources and partnerships.

DuckDuckGo, while smaller, focuses on privacy, a significant differentiator in the market. Perplexity AI’s competitive advantage lies in its conversational interface and focus on providing more comprehensive and contextually relevant answers, potentially appealing to users seeking a more natural and insightful search experience. However, scaling to compete with the established players’ vast resources and infrastructure presents a significant challenge.

Market Potential and Long-Term Growth Prospects

The market for AI-powered search engines is experiencing rapid growth, driven by increasing user demand for more intelligent and efficient information retrieval. The potential for Perplexity AI is significant, given its focus on improving the user experience through a conversational interface. However, realizing this potential hinges on several factors, including continued technological innovation, successful user acquisition, and the ability to effectively monetize its services.

Long-term growth prospects depend on maintaining a competitive edge in terms of accuracy, speed, and user experience, while simultaneously managing operational costs and securing sufficient funding. Success stories of similar innovative companies in the tech sector, such as early Google, demonstrate the potential for exponential growth given the right circumstances and execution.

SWOT Analysis of Perplexity AI

A SWOT analysis provides a structured overview of Perplexity AI’s internal and external factors.

| Strengths | Weaknesses |

|---|---|

| Innovative conversational interface | Limited brand recognition compared to established players |

| Focus on providing comprehensive answers | Dependence on external data sources and potential biases |

| Potential for rapid growth in a burgeoning market | Resource constraints compared to larger competitors |

| Opportunities | Threats |

| Expansion into new markets and applications | Intense competition from established players |

| Strategic partnerships and collaborations | Rapid technological advancements and evolving user expectations |

| Development of new features and functionalities | Potential for regulatory scrutiny and ethical concerns surrounding AI |

Evaluating Perplexity AI’s Financial Performance and Future Projections

Assessing the financial health and future potential of Perplexity AI requires a multifaceted approach, considering both its current performance and projected growth within the rapidly evolving AI landscape. While precise financial data for a privately held company like Perplexity AI is limited, we can still analyze available information and build a hypothetical model to understand its potential trajectory.

Key Financial Metrics and Performance Indicators

Analyzing Perplexity AI’s financial performance requires focusing on indirect metrics due to the lack of publicly available financial statements. Key indicators could include user growth rates (number of users, queries processed), engagement metrics (average session duration, query complexity), and revenue generation models (pricing tiers, subscription rates, potential partnerships). Rapid user growth coupled with high engagement suggests strong market traction and potential for future profitability.

Analyzing the cost structure, particularly concerning server infrastructure and research and development, will also be crucial in determining profitability. For example, a high growth rate in users but simultaneously high operational costs would suggest a need for improved operational efficiency.

Hypothetical Financial Model for Perplexity AI

Building a hypothetical financial model requires making several assumptions. Let’s assume Perplexity AI adopts a freemium model, offering basic services for free while charging for advanced features and increased query limits. We can project revenue growth based on projected user acquisition, conversion rates from free to paid users, and average revenue per user (ARPU). For example, if we assume a user base growth of 50% annually, a 10% conversion rate to paid users, and an ARPU of $50, the revenue projections can be modeled for the next 5 years.

This would involve forecasting the cost of goods sold (COGS), primarily related to cloud computing and infrastructure, and operating expenses, such as salaries and marketing. Profitability would then be determined by subtracting these costs from the projected revenue. This model needs to incorporate potential changes in pricing, user acquisition costs, and competition. A sensitivity analysis should be conducted to account for various scenarios.

For instance, a scenario analysis could examine the impact of a slower-than-expected user growth rate or increased competition.

Impact of Macroeconomic Factors

Macroeconomic factors can significantly influence Perplexity AI’s financial performance. A recession, for instance, could lead to reduced spending on AI-powered solutions by businesses, impacting Perplexity AI’s revenue growth. Conversely, increased government investment in AI research and development could positively impact Perplexity AI through grants, contracts, or increased overall market demand. Interest rate hikes could affect the cost of capital for Perplexity AI, impacting its ability to invest in growth and expansion.

Inflation could impact operating expenses, particularly related to cloud infrastructure and salaries. These macroeconomic factors should be incorporated into the financial model through sensitivity analysis and scenario planning to understand the potential range of outcomes.

Valuation of Perplexity AI

Valuing Perplexity AI requires using methods appropriate for a privately held company. Comparable company analysis, which compares Perplexity AI to publicly traded companies with similar business models and growth trajectories, can provide a benchmark valuation. This would involve identifying comparable companies, analyzing their key financial metrics and market multiples (e.g., Price-to-Sales ratio, Price-to-Earnings ratio), and applying these multiples to Perplexity AI’s projected financial performance.

Another method is discounted cash flow (DCF) analysis, which estimates the present value of Perplexity AI’s future cash flows based on a projected discount rate reflecting the risk associated with the investment. The chosen valuation method should be justified based on the available information and the specific characteristics of Perplexity AI. It’s important to note that these valuations are inherently uncertain and subject to various assumptions.

Exploring Investment Vehicles and Strategies

Investing in Perplexity AI, a rapidly growing company in the competitive AI landscape, requires careful consideration of various investment vehicles and strategies. The lack of a public market listing for Perplexity AI necessitates exploring alternative avenues for potential investors. This section Artikels the key options and their associated advantages and disadvantages.

Investment Vehicles for Perplexity AI

Several investment vehicles could offer exposure to Perplexity AI, depending on the investor’s profile and risk tolerance. These include private equity, venture capital, and potentially, public markets in the future if Perplexity AI decides to pursue an IPO.Private equity firms typically invest in established, privately held companies, often providing capital for expansion or acquisitions. Venture capital firms, on the other hand, focus on early-stage companies with high growth potential, providing funding in exchange for equity.

Public markets, once a company goes public, offer a more liquid and accessible route to investment through the purchase of shares. Given Perplexity AI’s current stage, venture capital or private equity represent the most likely avenues for direct investment.

Advantages and Disadvantages of Investment Vehicles

| Investment Vehicle | Advantages | Disadvantages |

|---|---|---|

| Venture Capital | High potential returns, early-stage involvement, access to exclusive deals. | High risk, illiquidity, limited control, potential for significant loss. |

| Private Equity | Lower risk compared to venture capital, potential for higher returns than public markets in some cases, greater control than public markets. | Illiquidity, higher investment thresholds, longer investment horizons. |

| Public Markets (Future Possibility) | Liquidity, ease of investment, transparency, regulatory oversight. | Lower potential returns compared to venture capital or private equity, subject to market volatility. |

Successful Investments in Similar AI Companies

Several successful investments in similar AI companies illustrate effective investment strategies. For example, the early investment in DeepMind by Google demonstrated the significant returns possible from investing in cutting-edge AI research and development. Similarly, early investors in OpenAI benefited immensely from its advancements in large language models. These successful investments often involved a long-term perspective and a thorough understanding of the underlying technology and market potential.

They also highlight the importance of due diligence and assessing the management team’s capabilities.

Comparison of Investment Strategies

The choice of investment strategy hinges on an investor’s risk tolerance and financial goals. A more conservative approach might favor a later-stage private equity investment, while a higher-risk, higher-reward strategy might focus on early-stage venture capital.

| Investment Strategy | Risk Profile | Potential Return | Time Horizon |

|---|---|---|---|

| Early-Stage Venture Capital | High | Very High (Potential for 10x or more) | Long-term (5-10+ years) |

| Late-Stage Private Equity | Medium | High (Potential for 2-5x) | Medium-term (3-7 years) |

| Public Market Investment (Post-IPO) | Low to Medium | Medium | Short-term to Medium-term (Variable) |

Managing Investment Risks and Diversification: How To Invest In Perplexity Ai

Investing in a promising technology company like Perplexity AI presents significant opportunities but also carries inherent risks. A well-informed investment strategy requires a thorough understanding of these risks and the implementation of appropriate diversification strategies to mitigate potential losses. This section Artikels key risks and explores methods to manage them effectively.

Key Risks Associated with Investing in Perplexity AI

Investing in Perplexity AI, or any early-stage technology company, involves considerable risk. These risks are multifaceted and require careful consideration before committing capital. Failure to adequately assess and manage these risks could lead to significant financial losses.

- Technological Disruption: The rapid pace of technological advancement means that Perplexity AI’s current competitive advantage could be eroded by newer, more efficient, or more appealing technologies. A disruptive innovation could render Perplexity AI’s offerings obsolete, impacting its market share and profitability.

- Competition: The AI market is intensely competitive, with established players and numerous startups vying for market share. Intense competition can lead to price wars, reduced profit margins, and ultimately, a decline in Perplexity AI’s financial performance. The emergence of a dominant competitor with superior technology or a stronger market position poses a significant threat.

- Regulatory Changes: The regulatory landscape surrounding AI is constantly evolving. New regulations or changes in existing laws could significantly impact Perplexity AI’s operations, potentially leading to increased compliance costs, limitations on data usage, or even legal challenges.

- Financial Performance: As a relatively new company, Perplexity AI’s financial history is limited. Future financial performance is uncertain and depends on various factors, including market adoption, successful product development, and effective cost management. Unforeseen economic downturns could also negatively impact investor sentiment and the company’s valuation.

Strategies for Mitigating Investment Risks

Several strategies can help mitigate the risks associated with investing in Perplexity AI. A well-defined risk management plan is crucial for protecting capital and achieving investment goals.

- Diversification: Diversification is a fundamental risk management technique. By spreading investments across different asset classes (e.g., stocks, bonds, real estate), sectors, and geographies, investors can reduce their overall portfolio volatility and minimize the impact of any single investment’s underperformance. Investing only a portion of one’s portfolio in Perplexity AI, rather than concentrating all funds, is a prudent approach.

- Risk Tolerance Assessment: Before investing in Perplexity AI, investors should carefully assess their risk tolerance. This involves evaluating their comfort level with potential losses and their long-term investment goals. High-risk investments like Perplexity AI are generally suitable for investors with a higher risk tolerance and a longer time horizon.

- Due Diligence: Thorough due diligence is essential. This involves researching Perplexity AI’s business model, competitive landscape, financial performance, and management team. Understanding the company’s strengths and weaknesses is crucial for making an informed investment decision.

Hypothetical Diversified Portfolio

A hypothetical portfolio illustrating diversification could include:

| Asset Class | Allocation | Rationale |

|---|---|---|

| Perplexity AI (Stock) | 10% | High-growth potential, but also high risk. Limited allocation reflects risk mitigation. |

| Large-Cap US Equities (Index Fund) | 40% | Provides diversification across a broad range of established companies, reducing overall portfolio volatility. |

| International Equities (Index Fund) | 20% | Further diversification across global markets, reducing dependence on US economic performance. |

| Bonds (Investment-Grade Corporate Bonds) | 20% | Provides stability and income, acting as a counterbalance to the volatility of equity investments. |

| Real Estate (REITs) | 10% | Provides exposure to a different asset class with potentially lower correlation to the stock market. |

Assessing Investor Risk Tolerance

Assessing risk tolerance involves considering several factors:

- Investment Time Horizon: Longer time horizons allow investors to ride out market fluctuations and recover from potential losses.

- Financial Goals: Understanding the investor’s financial goals (e.g., retirement, education) helps determine the appropriate level of risk.

- Financial Situation: Investors with substantial assets and lower debt burdens can generally tolerate higher levels of risk.

- Risk Aversion: Individual investors have varying levels of comfort with risk. A risk questionnaire can help quantify an investor’s risk tolerance.

Illustrating Investment Scenarios

Understanding the potential risks and rewards associated with investing in Perplexity AI requires considering various scenarios. The outcome of an investment will depend on several interacting factors, including the company’s performance, market conditions, and the investor’s risk tolerance. Let’s examine both high-risk/high-reward and conservative investment scenarios.

High-Risk, High-Reward Investment Scenario

Investing in Perplexity AI could be a high-risk, high-reward proposition if the company experiences rapid growth and market dominance in the AI-powered search and knowledge access sector. This scenario hinges on several key factors. First, Perplexity AI must successfully maintain its technological advantage, continuously innovating and adapting to the rapidly evolving AI landscape. Competition from established tech giants and emerging startups is fierce, requiring significant ongoing investment in research and development.

Second, the company needs to effectively scale its operations to meet increasing user demand while maintaining profitability. Third, favorable market conditions, such as strong investor confidence in the AI sector and a growing acceptance of AI-driven search tools, are essential. If these factors align positively, Perplexity AI could see exponential growth, leading to significant returns for early investors.

Conversely, failure in any of these areas could result in substantial losses. For example, if a competitor develops superior technology or if the market for AI-powered search tools shrinks unexpectedly, the value of Perplexity AI shares could plummet.

Visual Representation of Potential Outcomes

Imagine a horizontal line representing the range of possible investment outcomes. On the far left, we have the worst-case scenario: a complete failure of the company, resulting in a total loss of investment. Moving to the right, we see a range of scenarios where the investment yields only modest returns, perhaps matching or slightly exceeding inflation. This represents a scenario where Perplexity AI survives but fails to achieve significant market share or profitability.

The most likely scenario falls somewhere in the middle, representing moderate growth and reasonable returns, aligning with the company’s projected growth and market penetration. Finally, on the far right, we have the best-case scenario: Perplexity AI becomes a dominant player in the AI-powered search market, leading to substantial returns for investors, potentially exceeding 100% or even more depending on the investment timeframe and initial investment amount.

This is a highly optimistic scenario, contingent on significant success and market dominance. This visual representation is a simplification; the actual distribution of outcomes might not be symmetrical.

Conservative, Lower-Risk Investment Approach

A more conservative approach to investing in Perplexity AI might involve a diversified portfolio strategy, allocating only a small percentage of the overall investment to Perplexity AI shares. This reduces the impact of potential losses if the company underperforms. Furthermore, waiting for a period of market stabilization and more established financial performance before investing would mitigate risk. This approach would involve a thorough analysis of Perplexity AI’s financial statements, including revenue growth, profitability, and debt levels, alongside a careful assessment of its competitive landscape and market positioning.

Investing in Perplexity AI only after the company demonstrates consistent profitability and a clear path to sustainable growth would significantly reduce the risk, though it might also limit potential upside compared to a high-risk approach. A conservative approach also might include investing in a broader AI-focused ETF or mutual fund, allowing for diversification across multiple companies within the AI sector, thereby mitigating the risk associated with a single company’s performance.

Conclusive Thoughts

Investing in Perplexity AI, or any emerging AI company, presents both significant opportunities and considerable risks. This guide has provided a structured approach to evaluating this investment opportunity, encompassing research into the company’s fundamentals, analysis of its market position, and a thorough assessment of various investment vehicles and strategies. Remember that diversification and a clear understanding of your own risk tolerance are crucial for successful investing in this dynamic sector.

Thorough due diligence and a long-term perspective are paramount to navigating the complexities of this exciting yet volatile market.