How to cancel sport insurance is a question many athletes and active individuals face. Understanding the process, from navigating policy clauses to securing confirmation, ensures a smooth transition. This guide provides a comprehensive overview, covering everything from contacting your provider and understanding cancellation fees to exploring alternatives and protecting your rights as a policyholder. We’ll clarify the steps involved, offering practical advice and examples to help you navigate this process with confidence.

This guide will walk you through the various stages of cancelling your sport insurance policy, addressing common concerns and providing clear, actionable steps. We’ll examine different policy types, cancellation methods, and potential fees, empowering you to make informed decisions throughout the process. Whether you’re changing sports, reducing activity levels, or simply no longer require coverage, we’ll equip you with the knowledge to handle the cancellation efficiently and effectively.

Understanding Your Sport Insurance Policy: How To Cancel Sport Insurance

Understanding the specifics of your sport insurance policy is crucial, not only for enjoying the coverage but also for navigating the cancellation process smoothly. This section will clarify the different types of policies, their cancellation clauses, and the typical procedures involved. We’ll also explore common reasons for cancellation and provide a comparison of cancellation fees from various providers.

Types of Sport Insurance Policies and Cancellation Clauses

Sport insurance policies vary widely depending on the sport, the level of participation (amateur, professional), and the specific needs of the insured. Common types include single-event policies (covering a specific competition or event), annual policies (providing year-round coverage), and multi-year policies. Cancellation clauses, which Artikel the conditions and fees for terminating coverage, are typically detailed within the policy document itself.

These clauses often specify a notice period required before cancellation, as well as any applicable fees or penalties. For instance, a single-event policy might not allow cancellation once the event has begun, while an annual policy might allow cancellation with a 30-day notice, subject to a pro-rated refund. Always review your specific policy document for the exact details.

The Typical Cancellation Process

The cancellation process is usually straightforward and documented in your policy. It typically involves contacting your insurance provider via phone, email, or mail, and formally requesting cancellation. You will likely need to provide your policy number and personal information. The provider will then confirm the cancellation and inform you about any applicable refunds or fees. Keep records of all communication regarding the cancellation, including confirmation numbers and correspondence.

Some providers offer online cancellation portals for added convenience. Failing to follow the stipulated cancellation procedure may result in delayed processing or unexpected charges.

Common Reasons for Cancelling Sport Insurance

Several reasons might prompt an individual to cancel their sport insurance. These include the completion of the insured event (for single-event policies), changes in participation levels (e.g., retiring from a sport), changes in financial circumstances, or a decision to switch to a different insurance provider offering more suitable coverage or lower premiums. A change in the insured’s health status might also necessitate cancellation if the policy no longer adequately covers their needs.

Furthermore, dissatisfaction with the service provided by the insurance company could lead to a switch to an alternative provider.

Comparison of Cancellation Fees Across Various Providers

Cancellation fees vary significantly across different insurance providers. These fees are usually a percentage of the remaining premium or a fixed amount, depending on the policy and the provider’s terms. The table below provides a hypothetical comparison; actual fees should be confirmed directly with each provider.

| Provider | Annual Policy Cancellation Fee | Single-Event Policy Cancellation Fee | Notes |

|---|---|---|---|

| Provider A | 10% of remaining premium | Non-refundable | Requires 30-day notice |

| Provider B | $50 fixed fee | Full refund if cancelled before event start | Requires 7-day notice |

| Provider C | Pro-rated refund | Non-refundable after event registration | No notice period specified |

| Provider D | 20% of remaining premium + $25 admin fee | Non-refundable | Requires 60-day notice |

Contacting Your Insurance Provider

Cancelling your sports insurance policy requires contacting your provider. This process is usually straightforward, but understanding the available methods and necessary information will ensure a smooth and efficient cancellation. Familiarizing yourself with your provider’s preferred communication channels and the details they require will expedite the process.

There are several ways to contact your sports insurance provider to initiate a cancellation. Each method offers varying levels of convenience and response time. Choosing the most suitable method depends on your personal preference and the urgency of your request.

Contact Methods

Your insurance provider likely offers multiple avenues for communication. These typically include telephone, email, and an online customer portal. The specific options available may vary depending on your provider and the type of policy you hold.

- Phone: Calling your provider directly allows for immediate interaction and clarification of any questions. This is often the quickest way to initiate a cancellation, particularly if you require immediate confirmation. However, you may experience longer wait times depending on call volume.

- Email: Email provides a written record of your cancellation request. This method is convenient for those who prefer asynchronous communication. However, it may take longer to receive a confirmation compared to a phone call. Remember to retain a copy of your email for your records.

- Online Portal: Many insurance providers offer online customer portals where you can manage your policy details, including cancellation. This method is often the most efficient, allowing for self-service cancellation and immediate confirmation. However, access requires registration and familiarity with the portal’s interface.

Required Information

When contacting your provider to cancel your sports insurance, be prepared to provide specific information to verify your identity and policy details. Providing this information upfront will streamline the cancellation process and minimize delays.

- Policy Number: This is crucial for identifying your specific policy. It’s usually found on your policy documents or your online account.

- Full Name: As it appears on your policy documents.

- Date of Birth: Used for verification purposes.

- Contact Information: Your current phone number and email address.

- Reason for Cancellation: While not always mandatory, providing a brief reason can be helpful for the provider’s records.

Expected Response Time

The response time from your insurance provider will vary depending on the contact method used and the provider’s workload. While some providers may offer immediate confirmation via phone or online portal, email responses may take a few business days. It is advisable to allow a reasonable timeframe for confirmation before following up.

For example, a phone call might result in immediate confirmation, while an email cancellation request could take 2-3 business days for a response confirming receipt and processing of the cancellation.

Sample Cancellation Email

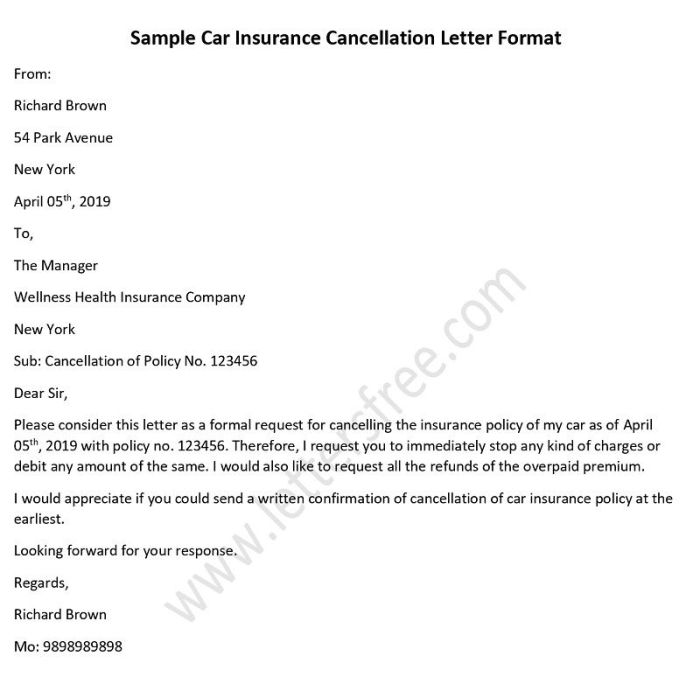

Here’s an example of an email you could use to request cancellation:

Subject: Cancellation Request – Policy Number [Your Policy Number]Dear [Insurance Provider Name],This email is to formally request the cancellation of my sports insurance policy, number [Your Policy Number]. My name is [Your Full Name], and my date of birth is [Your Date of Birth].Please confirm receipt of this request and let me know the effective date of cancellation and any outstanding refund due.Thank you for your time and assistance.Sincerely,[Your Name][Your Phone Number][Your Email Address]

Cancellation Fees and Refunds

Cancelling your sports insurance policy often involves fees, the amount of which depends on several factors. Understanding these factors and the cancellation processes of different providers is crucial to avoid unexpected costs. This section clarifies the intricacies of cancellation fees and refunds.Cancellation fees are primarily determined by the type of policy and the timing of cancellation. Policies with longer durations or more comprehensive coverage may have higher cancellation fees.

The closer to the policy’s start date you cancel, the higher the fee is likely to be. Conversely, cancelling a policy well in advance of its expiry date usually results in a smaller fee or potentially a full refund, depending on the provider’s terms.

Factors Influencing Cancellation Fees

Several key factors influence the amount of any cancellation fee. The type of policy, for instance, significantly impacts this cost. A comprehensive annual policy will generally have a higher cancellation fee than a shorter-term policy covering a single event. The timing of your cancellation is equally important; cancelling shortly before the policy’s start date often incurs the highest fees, whereas cancelling much earlier may result in a smaller fee or even a full refund.

Finally, the specific terms and conditions of your individual policy with your chosen provider will Artikel the exact cancellation fee structure.

Examples of Cancellation Scenarios

Let’s illustrate this with a few examples. Imagine three different scenarios with varying cancellation timings and policy types.Scenario 1: A customer cancels a one-year comprehensive sports insurance policy after only one month. Due to the early cancellation and the comprehensive nature of the policy, they may be charged a significant fee, perhaps 75% of the annual premium. The refund would be 25% of the total premium.Scenario 2: A customer cancels a single-event policy for a marathon a week before the event.

They might be charged a smaller fee, perhaps 20% of the premium, as the provider has incurred minimal administrative costs. The refund would be 80% of the premium.Scenario 3: A customer cancels a yearly policy three months before its renewal date. They might receive a partial refund, perhaps 50% of the remaining premium, reflecting the portion of the policy not utilized.

Comparison of Cancellation Policies Across Providers

Provider A: This provider typically charges a 50% cancellation fee for policies cancelled within the first six months, decreasing to 25% after six months. Refunds are processed within 14 business days.Provider B: Provider B has a more flexible policy, with cancellation fees ranging from 10% to 40% depending on the time of cancellation and policy type. They offer quicker refunds, typically within 7 business days.Provider C: Provider C’s policy states that cancellation fees are determined on a case-by-case basis, taking into account the circumstances of the cancellation.

Refunds are usually processed within 21 business days.

Questions Regarding Refunds

Understanding the specifics of your refund is crucial. The following points clarify common questions and concerns related to obtaining refunds:The exact amount of any refund will depend on the timing of the cancellation and the specific terms of the policy. The refund processing time varies by provider. The method of refund (e.g., original payment method) is a detail to confirm.

Whether there are any additional administrative fees associated with the refund should be clarified. Any required documentation needed to initiate a refund should be understood.

Alternatives to Cancellation

Before deciding to cancel your sports insurance policy, consider whether modifying it might be a more cost-effective and beneficial solution. Often, adjustments to your policy can better align with your current needs and circumstances, avoiding the potential penalties associated with cancellation. Exploring these alternatives can save you money and ensure you maintain the necessary coverage.Modifying your policy offers flexibility and allows you to tailor your insurance to your specific requirements.

Instead of completely severing the insurance contract, you can adjust various aspects to suit your changing circumstances, such as participation in fewer or different sports activities, or a change in your training schedule that impacts the risk level.

Adjusting Coverage Limits or Policy Duration, How to cancel sport insurance

Modifying your policy’s coverage limits or duration involves changing the scope or timeframe of your insurance protection. For instance, if your participation in high-risk sports has decreased, you might reduce your coverage limits to reflect the lower risk. Alternatively, if you’re taking a break from your sport for a defined period, shortening the policy duration can reduce your premium costs.

The process typically involves contacting your insurance provider, explaining the changes you require, and completing any necessary paperwork. They will then adjust your policy accordingly, and you’ll receive an updated policy document reflecting the modifications.

Suspending Your Policy Temporarily

Suspending your policy is a valuable option if you anticipate a temporary break from your sport, such as during an injury recovery period or a planned vacation. This allows you to maintain your policy without paying premiums during the inactive period. Upon resuming your sport, you can easily reactivate your policy, often with no additional fees or processing delays.

The reactivation process is generally straightforward and may only require a notification to your insurer. This avoids the need to reapply for coverage and maintain continuous insurance history. However, the availability of a suspension option depends on your specific insurance provider and policy terms.

Cancellation Versus Policy Modification

The following table compares the pros and cons of cancelling your policy versus modifying it:

| Feature | Cancellation | Policy Modification |

|---|---|---|

| Cost | May incur cancellation fees; loss of any prepaid premiums. | Potentially lower premiums due to reduced coverage or shorter duration. |

| Coverage | Complete loss of coverage. | Adjusted coverage to meet your current needs. |

| Convenience | Simple process, but may require re-applying for coverage later. | Requires contacting your provider but maintains continuous coverage. |

| Future Premiums | May face higher premiums upon re-application due to a break in coverage. | May result in lower premiums in the future due to adjusted risk profile. |

Documentation and Confirmation

Obtaining written confirmation of your sports insurance cancellation is crucial for protecting your rights and ensuring a smooth process. This documentation serves as irrefutable proof of your cancellation request and the terms agreed upon with your provider. Without it, disputes regarding cancellation dates, fees, or refunds can arise.Maintaining a record of all communication is essential for managing any potential complications.

This includes not only the cancellation confirmation but also any preceding correspondence, such as initial cancellation requests or inquiries. This comprehensive record can be invaluable if you need to resolve any discrepancies or disputes later.

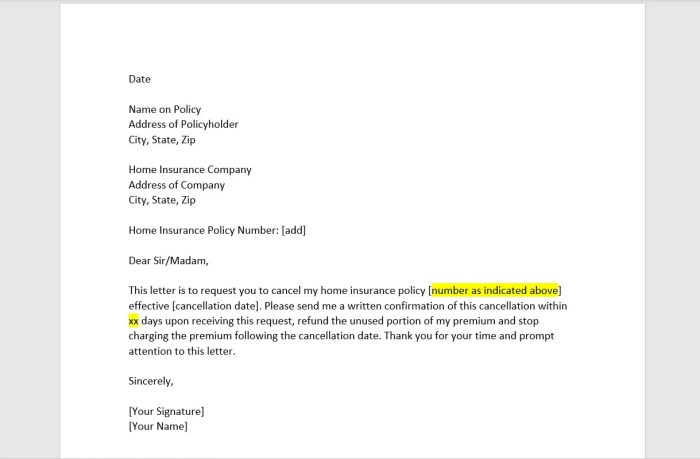

Cancellation Confirmation Letter Content

A cancellation confirmation letter should clearly state the cancellation date, policy number, insured’s name, and the effective date of cancellation. It should also specify any applicable cancellation fees or the amount of any refund, along with the method and timeframe for its disbursement. For example, a confirmation might state: “This letter confirms the cancellation of your sports insurance policy, number 1234567, effective October 26, 2024.

A refund of $50 will be processed within 10 business days and credited to your account.” The letter might also include a reference number for tracking purposes and contact information for further inquiries.

Handling Lack of Confirmation

If you don’t receive confirmation within a reasonable timeframe (e.g., 1-2 weeks after submitting your cancellation request), you should immediately contact your insurance provider. Follow up via your preferred method of contact (phone, email, or mail), referencing your initial cancellation request. Keep a detailed record of this follow-up communication, including the date, time, method of contact, and the name of the person you spoke with.

If the issue remains unresolved, consider sending a formal letter via certified mail, requesting confirmation of cancellation and outlining the steps you’ve already taken. This documented follow-up provides further evidence of your attempts to cancel the policy.

Record Keeping for Cancellation

Maintaining meticulous records is paramount. This can involve creating a dedicated file, either physical or digital, to store all correspondence related to your cancellation. This file should include copies of your initial cancellation request, any emails or letters exchanged with the provider, and the final cancellation confirmation. For phone calls, maintain a detailed log including date, time, the name of the representative, and a summary of the conversation.

This comprehensive record will be invaluable if you need to refer back to the cancellation process at a later date. Consider using a system that allows you to easily organize and search your documents, such as a labeled folder or a dedicated email folder.

Understanding Your Rights as a Policyholder

Cancelling your sports insurance policy should be a straightforward process, but understanding your rights as a policyholder is crucial to ensure a fair and transparent experience. Knowing your legal protections and dispute resolution options empowers you to navigate any potential challenges effectively. This section will Artikel relevant consumer protection laws, dispute resolution mechanisms, and examples of potential rights violations.Consumer protection laws vary by jurisdiction, but generally aim to protect consumers from unfair or deceptive business practices.

These laws often dictate the insurer’s obligations regarding policy cancellation, including providing clear and timely communication about cancellation procedures, fees, and refunds. Specific regulations may cover areas such as the right to a full refund if the policy is cancelled within a specified timeframe, or limitations on cancellation fees. It’s advisable to consult your local consumer protection agency or a legal professional for precise details applicable to your region.

Relevant Consumer Protection Laws

Many jurisdictions have specific laws governing insurance contracts and consumer rights. These laws often grant policyholders the right to cancel their policies under certain circumstances and Artikel the procedures for doing so. For example, some regions may have “cooling-off” periods, allowing consumers to cancel a contract within a short timeframe after signing without penalty. Other laws might regulate the maximum amount an insurer can charge as a cancellation fee.

These regulations vary significantly depending on the specific legislation in your area and the type of insurance policy. Always review your policy documents and consult relevant legal resources to fully understand your rights.

Dispute Resolution Mechanisms

If you encounter difficulties cancelling your sports insurance or believe your rights have been violated, several dispute resolution mechanisms are available. These may include contacting your insurance provider’s customer service department to attempt to resolve the issue informally. If this fails, you could consider filing a formal complaint with your state’s insurance commissioner or a consumer protection agency. Mediation or arbitration services may also be options, providing a neutral third party to facilitate a resolution.

As a last resort, legal action may be necessary.

Examples of Rights Violations

Several scenarios could constitute a violation of a policyholder’s rights during cancellation. For instance, an insurer refusing to provide a promised refund after timely cancellation, or charging excessive cancellation fees exceeding those Artikeld in the policy documents, would be considered a violation. Similarly, an insurer failing to provide clear and accurate information about the cancellation process or withholding crucial documentation could be grounds for complaint.

A delay in processing the cancellation request beyond a reasonable timeframe, causing undue financial hardship, could also be a violation.

Key Points to Remember When Cancelling Your Policy

Before cancelling your sports insurance policy, it’s essential to understand your rights and obligations. The following points highlight key aspects to keep in mind:

- Review your policy documents carefully to understand the cancellation process, fees, and refund policies.

- Keep records of all communication with your insurer, including emails, letters, and phone call notes.

- Follow the insurer’s cancellation procedure precisely to avoid potential complications.

- Obtain written confirmation of your cancellation request and the effective cancellation date.

- If you encounter any issues, promptly contact your insurer’s customer service department and escalate the matter if necessary to the appropriate regulatory bodies.

End of Discussion

Cancelling sport insurance doesn’t have to be daunting. By understanding your policy, contacting your provider effectively, and carefully documenting the process, you can ensure a straightforward cancellation. Remember to explore alternatives like modifying your policy before cancelling outright, and always retain confirmation of your request. This guide has provided a framework for a successful cancellation, equipping you with the knowledge and confidence to navigate this process smoothly.

Should any unforeseen issues arise, remember to assert your rights as a policyholder and seek appropriate dispute resolution if necessary.