How to apply TMJ against insurance is a crucial question for many individuals facing temporomandibular joint (TMJ) disorders. Successfully navigating the insurance process for TMJ treatment requires understanding your policy, the pre-authorization procedures, and the claim filing process. This guide provides a comprehensive overview of these steps, empowering you to advocate effectively for your healthcare needs.

This guide will walk you through each stage, from understanding your insurance coverage and the pre-authorization process to filing a claim and appealing a denial. We’ll explore the various types of TMJ treatments and their likelihood of coverage, common exclusions, and strategies for successful claim submissions. Furthermore, we’ll discuss alternative payment options if your insurance coverage proves insufficient.

Understanding TMJ Insurance Coverage

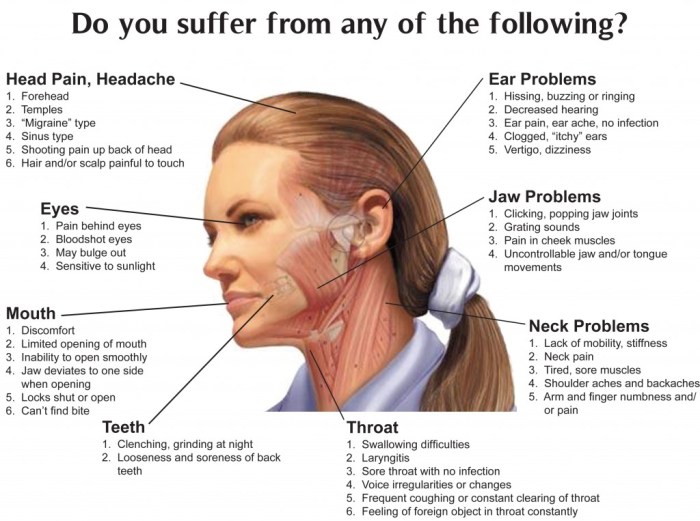

Navigating the complexities of insurance coverage for temporomandibular joint (TMJ) disorders can be challenging. Understanding your policy’s specifics and the typical limitations placed on TMJ treatment is crucial for effective cost management and treatment planning. This section will Artikel common aspects of TMJ insurance coverage to help you better understand what to expect.

TMJ insurance coverage varies significantly depending on the specific plan, provider, and the type of treatment required. While some plans offer comprehensive coverage, others may have substantial limitations, leading to significant out-of-pocket expenses for patients. Factors such as pre-existing conditions, the necessity of the treatment, and the chosen treatment method all play a role in determining coverage.

Typical Coverage Limitations for TMJ Treatment, How to apply tmj against insurance

Many insurance plans impose limitations on the types and extent of TMJ treatment they will cover. These limitations often involve restrictions on the number of visits, the types of diagnostic tests approved, and the specific procedures considered medically necessary. For instance, some plans might only cover a limited number of physical therapy sessions or may not cover more advanced treatments like surgery unless other, less invasive options have been exhausted and deemed unsuccessful.

Prior authorization for specific procedures is also common.

Types of TMJ Treatments and Coverage Likelihood

The likelihood of insurance coverage often depends heavily on the type of TMJ treatment. Conservative treatments, such as physical therapy, splints, and medication, tend to have a higher chance of coverage compared to more invasive procedures. Surgical interventions, such as arthroscopy or joint replacement, are often subject to stricter review and may require extensive documentation to demonstrate medical necessity.

Similarly, less common treatments such as Botox injections for TMJ pain may be viewed as experimental or elective and excluded from coverage.

Common Exclusions and Limitations in Insurance Policies

Insurance policies frequently include exclusions and limitations specifically addressing TMJ treatment. Common exclusions might include treatments deemed experimental or investigational, treatments not deemed medically necessary by the insurance provider, or treatments performed outside of the insurer’s network. Limitations often include pre-authorization requirements, specific limits on the number of visits or procedures, or restrictions on the types of specialists who can provide care.

For example, a policy might only cover treatment from a dentist specializing in TMJ disorders, not a general dentist or other medical professional.

Coverage Comparison Across Different Insurance Providers

Coverage for TMJ treatment can differ significantly between insurance providers. Some providers might offer more comprehensive coverage, while others may impose stricter limitations. Factors such as the type of plan (e.g., HMO, PPO), the level of coverage (e.g., bronze, silver, gold, platinum), and the specific benefits included in the policy all play a significant role. It’s crucial to review your individual policy documents carefully and contact your insurance provider directly to understand your specific coverage details for TMJ-related treatment.

Comparing plans before enrolling can help you choose one that best aligns with your potential needs and budget.

The Pre-Authorization Process

Securing pre-authorization for TMJ treatment is a crucial step in ensuring your insurance coverage. This process involves submitting detailed information to your insurance provider before undergoing any procedures, allowing them to assess the medical necessity and determine the extent of coverage. Failing to obtain pre-authorization may result in significantly higher out-of-pocket expenses.The pre-authorization process typically involves several key steps.

First, you or your dentist will need to submit a comprehensive treatment plan to your insurance company. This plan should clearly Artikel the proposed treatment, including diagnoses, procedures, and projected costs. Following submission, the insurance company will review the plan, often requiring several days or weeks for processing. During this period, the insurer may request additional information or clarification.

Once the review is complete, the insurance company will notify you of their decision, outlining the approved procedures and the associated coverage amounts.

Necessary Documentation for Pre-Authorization Requests

The success of a pre-authorization request hinges on the completeness and clarity of the supporting documentation. Incomplete or ambiguous documentation can lead to delays or denials. Essential documents usually include a completed pre-authorization form (provided by your insurer), a detailed treatment plan from your dentist outlining the proposed procedures and their medical necessity, relevant diagnostic testing results (such as x-rays, MRI scans, or other imaging), and any supporting medical records that pertain to the TMJ condition.

The dentist should thoroughly document the patient’s symptoms, examination findings, and the rationale for the proposed treatment, linking them directly to the diagnostic findings.

Examples of Successful Pre-Authorization Applications

A successful pre-authorization application clearly demonstrates the medical necessity of the proposed treatment. For instance, a patient experiencing severe TMJ pain, accompanied by limited jaw movement and confirmed through diagnostic imaging (e.g., MRI showing disc displacement), will have a stronger case for pre-authorization of procedures like splint therapy or surgery. Another example could be a patient with documented sleep apnea and associated TMJ issues, where the pre-authorization request would highlight the link between these conditions and justify the need for an oral appliance.

In both cases, the supporting documentation would include detailed medical records, imaging results, and a comprehensive treatment plan that clearly links the proposed treatment to the patient’s specific symptoms and diagnosis.

Sample Pre-Authorization Letter for a TMJ Treatment Plan

[Patient Name][Patient Address][Patient Phone Number][Patient Insurance Information][Date][Insurance Company Name][Insurance Company Address]Subject: Pre-Authorization Request for TMJ Treatment – [Patient Name] – [Patient ID Number]Dear [Insurance Company Contact Person],This letter is to request pre-authorization for a comprehensive TMJ treatment plan for [Patient Name], whose policy number is [Patient ID Number]. [Patient Name] is experiencing [briefly describe the patient’s symptoms, e.g., severe pain, limited jaw movement, clicking].

A thorough examination and diagnostic testing, including [list diagnostic tests, e.g., MRI, x-rays], have revealed [briefly describe diagnosis, e.g., disc displacement, osteoarthritis].The proposed treatment plan, developed by [Dentist Name], DDS, includes [list proposed treatments, e.g., occlusal splint therapy, physical therapy, medication]. A detailed treatment plan is attached for your review. This plan Artikels the medical necessity of each procedure and its expected outcome in alleviating [Patient Name]’s symptoms and improving their quality of life.We kindly request your prompt review and approval of this pre-authorization request.

Please contact [Dentist Phone Number] or [Dentist Email Address] if you require any additional information.Sincerely,[Dentist Name], DDS

Filing a Claim for TMJ Treatment

Successfully navigating the insurance claim process is crucial for managing the financial burden of TMJ treatment. Understanding your policy and following the correct procedures will ensure a smoother reimbursement experience. This section details the steps involved in filing a claim for your TMJ-related expenses.

The process of filing a claim for TMJ treatment generally involves submitting a completed claim form along with supporting documentation to your insurance provider. The specific requirements may vary depending on your insurance company, so it’s essential to review your policy documents or contact your provider for clarification.

Claim Form Completion

Accurately completing the claim form is paramount to avoid delays or denials. Most claim forms require detailed information about the patient, the provider, the services rendered, and the associated costs. Below are examples of correctly completed fields. Remember to always double-check for accuracy before submission.

Example 1: Patient Information

Name: Jane Doe; Date of Birth: 01/01/1980; Policy Number: 1234567890; Address: 123 Main Street, Anytown, CA 91234

Example 2: Provider Information

Provider Name: Dr. John Smith; NPI Number: 1234567890; Address: 456 Oak Avenue, Anytown, CA 91234; Phone Number: (555) 123-4567

Example 3: Services Rendered

Date of Service: 03/15/2024; Description of Service: TMJ examination and diagnosis; Procedure Code: 99214; Charge: $200.00

Claim Submission Methods

Insurance claims can be submitted electronically or via mail. Each method has its advantages and disadvantages, impacting the processing time. Choosing the right method depends on your comfort level with technology and your insurance provider’s preferences.

| Submission Method | Timelines (Estimated) | Advantages | Disadvantages |

|---|---|---|---|

| Electronic Submission (Online Portal) | 2-4 weeks | Fast processing, convenient, readily available tracking | Requires internet access and familiarity with online portals; potential technical issues |

| Electronic Submission (Email/Fax) | 3-6 weeks | Relatively fast, convenient for those without online portals | May require specific file formats; potential for delays due to email/fax issues |

| 4-8 weeks | Simple and accessible to everyone | Slowest method, lacks real-time tracking, risk of lost mail |

Step-by-Step Guide: Electronic Claim Submission

Submitting a claim electronically often involves using your insurance provider’s online portal. This typically involves creating an account, uploading the completed claim form and supporting documentation (such as receipts), and submitting the claim electronically. Confirmation of receipt is usually provided.

Step-by-Step Guide: Mail Claim Submission

Submitting a claim via mail involves printing the completed claim form, gathering all necessary supporting documentation, placing them in an envelope with the correct postage, and mailing it to the address specified by your insurance provider. You should retain a copy of everything submitted for your records.

Appealing a Denied Claim

Denial of a TMJ treatment claim can be frustrating, but understanding the appeals process and building a strong case significantly increases your chances of success. This section Artikels the steps involved in appealing a denied claim, provides examples of effective appeals letters, and offers strategies for addressing common reasons for denial.Appealing a denied TMJ claim typically involves several steps.

First, carefully review the denial letter to understand the specific reasons for the denial. This letter usually Artikels the grounds for the denial and the procedures for filing an appeal. Next, gather all relevant documentation, including the initial claim, medical records, diagnostic testing results (like MRI or CT scans), and any correspondence with your provider. Then, craft a well-written appeal letter, addressing each reason for denial with supporting evidence.

Finally, submit your appeal following the insurance company’s specified procedures, often within a specific timeframe. Failure to meet deadlines can result in the appeal being dismissed.

Understanding Common Reasons for Claim Denials

Insurance companies deny TMJ claims for various reasons, including lack of medical necessity, insufficient documentation, pre-authorization failures, or exceeding coverage limits. Lack of medical necessity often stems from insufficient evidence linking TMJ symptoms to the requested treatment. For example, a claim might be denied if the diagnosis is not clearly supported by objective findings such as diagnostic imaging or clinical examinations.

Insufficient documentation might include missing forms, incomplete medical records, or a lack of clear explanation of the treatment plan. Pre-authorization failures arise when required approvals weren’t obtained before the treatment began. Exceeding coverage limits means the total cost of treatment exceeds the plan’s maximum allowance for TMJ-related care.

Crafting an Effective Appeals Letter

A strong appeals letter clearly states the reason for the appeal, presents a compelling case for coverage, and provides all necessary supporting documentation. The letter should be professional, concise, and well-organized. It should directly address each reason for the initial denial, refuting the insurer’s points with evidence.

Example Appeals Letter

To Whom It May Concern,

I am writing to appeal the denial of my TMJ treatment claim (Claim Number: 1234567). The denial letter cited “lack of medical necessity” as the reason. However, I believe this assessment is incorrect. My enclosed medical records, including the MRI scan (Exhibit A) clearly demonstrate the presence of significant disc displacement and degenerative changes in my temporomandibular joint, directly correlating with my debilitating pain and limited jaw function.My physician, Dr. Smith (contact information provided), has recommended a course of treatment, including [specific treatments], which is medically necessary to alleviate my symptoms and improve my quality of life. I have also included a detailed treatment plan from Dr. Smith (Exhibit B) which Artikels the rationale for the proposed treatment and expected outcomes. I request a reconsideration of my claim based on the provided evidence.

Thank you for your time and consideration.

Sincerely,

[Your Name]

Effective Communication with Insurance Providers

Maintaining clear and professional communication with the insurance provider throughout the appeals process is crucial. Keep records of all communications, including dates, times, and summaries of conversations. If necessary, request clarification on any unclear aspects of the denial letter or the appeals process. Persistence and a polite but firm approach are key to achieving a favorable outcome.

Be prepared to provide additional information if requested and maintain a professional and respectful tone in all interactions. Remember, the goal is to work collaboratively to resolve the issue.

Understanding Your Policy and Benefits: How To Apply Tmj Against Insurance

Understanding your insurance policy’s specifics regarding TMJ coverage is crucial for navigating the treatment process smoothly. This section will guide you through locating relevant information, interpreting policy terms, and asking pertinent questions to your insurance provider. Failing to understand your coverage can lead to unexpected out-of-pocket expenses.Locating relevant information about TMJ coverage within your insurance policy requires careful review.

Your policy document, typically a lengthy booklet, will contain a section detailing covered services, exclusions, and benefit limits. Search for terms like “Temporomandibular Joint,” “TMJ,” “jaw disorders,” or “oral surgery” within the document’s index or using the search function (if available in a digital version). Pay close attention to sections describing dental benefits, as TMJ treatment often falls under this category, although it might sometimes be covered under medical insurance depending on the nature of the treatment.

If you are unable to locate this information, contact your insurance provider directly for clarification.

Policy Terms and Conditions Related to TMJ Treatment

A sample insurance policy might include clauses specifying that TMJ treatment is covered only when deemed medically necessary by a qualified specialist (e.g., an oral surgeon or orthodontist). It might stipulate pre-authorization requirements before initiating treatment, limiting coverage to specific procedures (e.g., only covering conservative treatments like physical therapy and excluding surgical interventions), or imposing annual or lifetime maximums on the total amount payable for TMJ-related services.

The policy may also define what constitutes “medically necessary” treatment, possibly requiring documentation supporting the need for specific procedures. For example, a policy might state that only treatment resulting from an accident or injury is covered, excluding cases of chronic TMJ disorder not related to an accident. Another example would be a limit on the number of physical therapy sessions covered annually.

Finally, the policy may Artikel specific provider networks, meaning that treatment is only covered if performed by in-network providers.

Key Questions to Ask Your Insurance Provider

Before beginning TMJ treatment, it’s essential to clarify several aspects of your coverage. This proactive approach helps avoid financial surprises later.

Understanding your policy’s specific parameters regarding TMJ treatment is paramount. Here’s a checklist of crucial questions to ask your insurance provider:

- Does my plan cover TMJ diagnosis and treatment?

- What specific TMJ-related procedures are covered under my plan?

- Are there any pre-authorization requirements for TMJ treatment?

- What is the process for obtaining pre-authorization?

- What is my plan’s deductible, copay, and out-of-pocket maximum for TMJ treatment?

- Does my plan cover treatment from out-of-network providers? If so, what is the reimbursement rate?

- What documentation is required to file a claim for TMJ treatment?

- What is the appeals process if a claim is denied?

- Are there any limitations on the duration or type of TMJ treatment covered?

- What is the procedure for submitting claims and how long does it usually take to process?

Understanding Deductibles, Copays, and Out-of-Pocket Maximums

Your policy’s deductible, copay, and out-of-pocket maximum significantly impact your financial responsibility for TMJ treatment. The deductible is the amount you must pay out-of-pocket before your insurance coverage begins. The copay is the fixed amount you pay for each medical visit or service. The out-of-pocket maximum is the most you will pay out-of-pocket for covered services in a plan year.

Once you reach your out-of-pocket maximum, your insurance company covers 100% of the remaining costs for covered services. For example, if your deductible is $1,000, your copay is $50 per visit, and your out-of-pocket maximum is $5,000, you would be responsible for the first $1,000 in expenses. After that, you would pay $50 per visit until your total out-of-pocket expenses reach $5,000.

Beyond that amount, your insurance would cover all further expenses for covered TMJ treatment. It is essential to understand these values to budget effectively for treatment.

Seeking Professional Guidance

Navigating the complexities of insurance coverage for TMJ treatment can be challenging. Fortunately, several resources and professionals can significantly assist in this process, improving your chances of successful claim processing and receiving necessary care. Seeking professional guidance is crucial to ensuring a smooth and efficient experience.Your healthcare provider plays a vital role in guiding you through the insurance process for TMJ treatment.

They possess in-depth knowledge of your condition, treatment options, and the associated costs. Furthermore, they are familiar with the specific requirements and procedures of various insurance providers. Their expertise can greatly simplify the process, reducing your administrative burden and stress.

The Role of Healthcare Providers in Insurance Navigation

Healthcare providers can assist in several key ways. They can pre-authorize necessary procedures with your insurance company, ensuring that the treatment is covered before it begins. They can also accurately code your medical claims, maximizing the likelihood of reimbursement. They can help you understand your Explanation of Benefits (EOB) and address any discrepancies or denials. Open communication with your provider is key to a successful insurance claim process.

They can also provide referrals to specialists or advocates, if needed.

Benefits of Consulting with a Healthcare Advocate or Insurance Specialist

A healthcare advocate or insurance specialist can act as a liaison between you, your provider, and your insurance company. These professionals possess extensive knowledge of insurance policies, procedures, and appeals processes. They can handle the complexities of insurance paperwork, submit claims, and negotiate with insurance companies on your behalf. This frees up your time and reduces the stress associated with navigating the insurance system, allowing you to focus on your recovery.

Their expertise can often result in increased reimbursement rates and fewer denials. For example, a specialist might identify loopholes in a denial letter or negotiate a payment plan that is more manageable.

Resources and Information on Patient Advocacy Groups

Several patient advocacy groups specialize in supporting individuals with TMJ disorders. These organizations can provide valuable information, resources, and support throughout your treatment journey. They often offer educational materials, connect you with other patients, and advocate for better insurance coverage for TMJ treatment. While specific names and contact information are best obtained through online searches to ensure currency, you can find these groups by searching for terms like “TMJ patient advocacy” or “craniofacial pain support groups” on reputable health websites and search engines.

Questions to Ask Your Healthcare Provider Regarding Insurance Coverage

Before starting any TMJ treatment, it is essential to clarify the insurance coverage aspects with your provider. This proactive approach helps avoid unexpected costs and delays.

- What is the estimated cost of my treatment?

- Does my insurance plan cover TMJ treatment, and what is the extent of coverage?

- What specific procedures are covered under my plan?

- What is the pre-authorization process for my treatment, and how long does it take?

- What forms or documentation will I need to submit to my insurance company?

- What is the appeals process if my claim is denied?

- Can you provide me with a detailed breakdown of the anticipated costs and insurance reimbursement?

- Are there any alternative treatment options covered by my insurance that I should consider?

Alternative Payment Options for TMJ Treatment

Securing TMJ treatment can be expensive, and insurance coverage may not always fully cover the costs. Fortunately, several alternative payment options exist to make treatment more accessible. Understanding these options can help you manage the financial burden associated with TMJ care.

Many healthcare providers offer flexible payment plans tailored to individual needs and financial situations. These plans typically involve breaking down the total cost into smaller, more manageable monthly installments. Interest rates and terms vary depending on the provider and the patient’s creditworthiness. In addition to payment plans directly offered by your healthcare provider, third-party financing companies specialize in providing medical financing options.

These companies often offer competitive interest rates and flexible repayment terms, allowing you to spread the cost of treatment over an extended period.

Payment Plans Offered by Healthcare Providers

Directly negotiating a payment plan with your healthcare provider is often the simplest option. This involves discussing your financial situation with the provider’s billing department or administrative staff. They can explain available payment plan options, including the total cost, monthly payment amounts, and the length of the repayment period. It’s crucial to thoroughly review the terms and conditions of any payment plan before agreeing to it.

Be sure to understand any late payment fees or penalties that may apply.

Third-Party Medical Financing Companies

Several companies specialize in providing financing for medical expenses. These companies typically conduct a credit check to assess your creditworthiness and determine the interest rate and repayment terms. They may offer different loan options with varying interest rates and repayment periods to accommodate diverse financial situations. Examples of such companies include CareCredit and LendingClub. It’s important to compare offers from multiple companies to secure the most favorable terms.

Thoroughly review the loan agreement before signing to fully understand the terms and conditions, including interest rates, fees, and repayment schedule.

Negotiating Payment Terms with Healthcare Providers

Open communication is key to successfully negotiating payment terms. Clearly explain your financial constraints to the provider’s billing department. Be prepared to provide documentation to support your financial situation, if requested. Explore all available options, such as payment plans, discounts for cash payments, or the possibility of reducing the scope of treatment to lower the overall cost.

Remember, a collaborative approach can often lead to a mutually agreeable solution. Document all agreements in writing to avoid misunderstandings.

Comparison of Payment Options

| Payment Option | Advantages | Disadvantages |

|---|---|---|

| Provider Payment Plan | Convenience, potentially lower interest rates than third-party financing. | May have limited flexibility in terms and repayment periods. |

| Third-Party Medical Financing | Greater flexibility in repayment terms and potentially higher loan amounts. | May involve higher interest rates and credit checks. |

| Charitable Organizations (see below) | Potential for significant cost reduction or elimination. | Strict eligibility criteria and a competitive application process. |

Financial Assistance Programs

Several charitable organizations and government programs offer financial assistance for medical expenses. These programs often have specific eligibility requirements, such as income level or type of illness. Thorough research is necessary to determine eligibility and the application process. Examples include The Patient Advocate Foundation and the National Patient Advocate Foundation, which offer assistance navigating healthcare costs and insurance issues.

Some hospitals and healthcare systems also have their own financial assistance programs. It is important to check with your healthcare provider to see if they offer any internal assistance programs.

Last Word

Successfully navigating the complexities of insurance coverage for TMJ treatment requires proactive engagement and a thorough understanding of your policy. By following the steps Artikeld in this guide, including understanding your coverage, completing the pre-authorization process correctly, and filing claims meticulously, you can significantly increase your chances of receiving the necessary financial assistance for your TMJ treatment. Remember, seeking professional guidance from healthcare providers and advocates can greatly simplify this process.

Don’t hesitate to advocate for your health and financial well-being.