How much to buy whole life insurance doctor? This crucial question confronts many physicians, balancing the need for comprehensive coverage with the realities of premium costs. Understanding the factors that influence whole life insurance premiums for doctors—age, specialty, health history, and chosen provider—is paramount to making an informed decision. This guide explores these factors, offering insights into policy types, financial planning strategies, and the process of selecting a suitable provider to help you find the right coverage for your unique circumstances.

Navigating the world of whole life insurance can feel complex, especially for medical professionals with demanding careers and unique financial considerations. This guide aims to demystify the process, providing clear explanations and practical advice to empower you to make a confident choice. We will examine the various policy options available, including their advantages and disadvantages, and offer strategies for determining the appropriate death benefit amount and managing long-term costs.

By understanding the interplay between your individual needs and the available insurance products, you can secure a policy that aligns perfectly with your financial goals and provides the security you deserve.

Whole Life Insurance Costs for Doctors

Securing whole life insurance is a significant financial decision for doctors, offering lifelong coverage and potential cash value accumulation. However, the cost of this type of policy can vary considerably based on several key factors. Understanding these factors is crucial for physicians to make informed choices about their insurance needs and budget accordingly.

Age’s Impact on Whole Life Insurance Premiums for Doctors

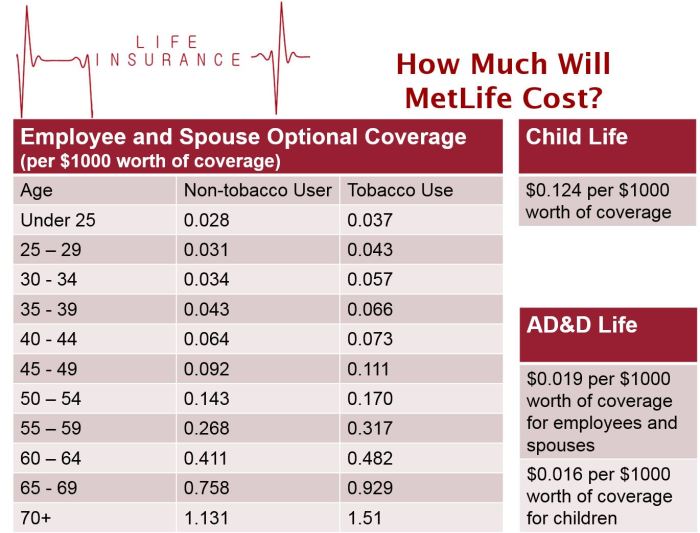

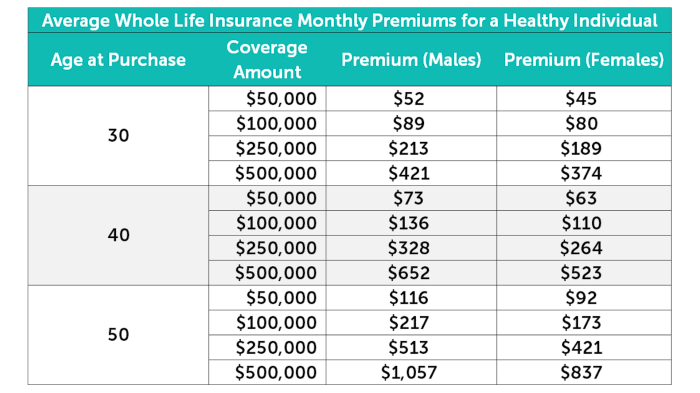

Age is a primary determinant of whole life insurance premiums. Younger applicants generally qualify for lower premiums because they statistically have a longer life expectancy. As age increases, the risk of mortality rises, leading to higher premiums to reflect the increased risk for the insurance company. For example, a 30-year-old doctor will typically pay significantly less than a 50-year-old doctor for the same coverage amount, even with identical health profiles and other factors held constant.

This is a fundamental principle of actuarial science underpinning life insurance pricing.

Medical Specialty’s Influence on Whole Life Insurance Costs

A doctor’s medical specialty can also affect insurance premiums. Specialties perceived as higher-risk, such as neurosurgery or cardiovascular surgery, may result in higher premiums compared to lower-risk specialties like dermatology or ophthalmology. This is because certain specialties involve higher levels of stress, potentially leading to health complications and impacting longevity. The insurance company assesses the inherent risk associated with each specialty when calculating premiums.

Premium Cost Comparison Across Different Insurance Providers for Doctors

Premium costs for whole life insurance can differ significantly between insurance providers. Various factors contribute to this, including the company’s risk assessment models, financial strength, and overall business strategies. It’s advisable for doctors to obtain quotes from multiple reputable insurers to compare policy features and costs before making a decision. Direct comparisons are difficult without specific quotes, but a significant range in premiums is common, often exceeding 20% between the highest and lowest offers for comparable policies.

Health History’s Impact on Whole Life Insurance Premiums for Physicians

A doctor’s health history plays a crucial role in determining insurance premiums. Pre-existing conditions, such as diabetes, heart disease, or cancer, can lead to higher premiums or even policy denials in some cases. Similarly, a history of smoking or substance abuse can significantly increase the cost of insurance. Comprehensive medical underwriting is performed to assess the applicant’s overall health risk.

For instance, a doctor with a history of high blood pressure might see a 15-20% increase in premiums compared to a doctor with an impeccable health record.

Premium Cost Comparison Table

| Age | Health Status | Medical Specialty | Estimated Annual Premium (USD) |

|---|---|---|---|

| 35 | Excellent | Dermatology | $2,500 |

| 45 | Good | Cardiology | $4,000 |

| 55 | Fair (Controlled Hypertension) | General Surgery | $6,500 |

| 35 | Excellent | Neurosurgery | $3,500 |

Note: These are illustrative examples only and actual premiums will vary significantly depending on the specific policy, insurer, and individual circumstances. These figures are for illustrative purposes and do not reflect actual quotes from any specific insurance provider.

Types of Whole Life Insurance Policies for Doctors

Choosing the right whole life insurance policy is a crucial financial decision for doctors, given their high earning potential and long-term career prospects. Several types of whole life policies cater to varying needs and risk tolerances. Understanding the nuances of each type is essential for making an informed choice. This section will explore the different types of whole life insurance policies available, highlighting their features, benefits, and drawbacks for medical professionals.

Whole life insurance policies offer lifelong coverage, accumulating cash value that grows tax-deferred. The two primary categories are participating and non-participating policies, each with distinct characteristics affecting cost and benefits.

Participating Whole Life Insurance

Participating whole life insurance policies offer policyholders a share of the insurance company’s profits in the form of dividends. These dividends can be used to reduce premiums, purchase additional coverage, or accumulate within the cash value of the policy. The dividend amounts are not guaranteed and vary annually based on the insurer’s performance. This element of uncertainty is balanced by the potential for higher returns and greater flexibility in managing the policy.

- Policyholders receive dividends based on the insurer’s performance.

- Dividends can be used to reduce premiums, purchase paid-up additions, or accumulate within the cash value.

- Higher potential returns compared to non-participating policies.

- Less predictable premium costs due to dividend variations.

Non-Participating Whole Life Insurance

Non-participating whole life insurance policies do not pay dividends. Premiums remain fixed throughout the policy’s life, providing predictable and consistent costs. While lacking the dividend feature, these policies often offer lower initial premiums compared to participating policies with similar death benefits. The simplicity and predictability make them attractive to those prioritizing consistent budgeting.

- Fixed premiums throughout the policy’s life.

- No dividends are paid to policyholders.

- Generally lower initial premiums compared to participating policies.

- Less flexibility in managing the policy compared to participating policies.

Comparison of Whole Life Insurance Policy Options for Doctors

The choice between participating and non-participating whole life insurance depends on individual financial goals and risk tolerance. Doctors with a higher risk tolerance and a longer-term perspective might favor participating policies for the potential higher returns. Those prioritizing predictable costs and simpler policy management might prefer non-participating policies.

| Feature | Participating Whole Life | Non-Participating Whole Life |

|---|---|---|

| Premiums | Variable, may decrease with dividends | Fixed |

| Dividends | Yes, based on insurer’s performance | No |

| Cash Value Growth | Potentially higher due to dividends | Predictable, based on fixed interest rates |

| Cost | Potentially higher initial premiums | Generally lower initial premiums |

Financial Planning and Whole Life Insurance for Doctors

Whole life insurance plays a significant role in comprehensive financial planning for doctors, offering unique advantages beyond traditional term life insurance. Its ability to build cash value over time makes it a versatile tool for addressing various financial goals, from protecting against unexpected expenses to supplementing retirement income. This section explores the strategic integration of whole life insurance into a doctor’s financial plan.

Whole Life Insurance as a Component of a Doctor’s Financial Plan

Whole life insurance provides a stable foundation within a doctor’s broader financial strategy. It offers a guaranteed death benefit, protecting the family from financial hardship in the event of the doctor’s untimely death. Simultaneously, the cash value component can serve as a long-term savings vehicle, accumulating tax-deferred growth that can be accessed for various needs throughout the policyholder’s life.

This dual function allows for both protection and wealth accumulation within a single financial instrument. A well-structured financial plan should consider the interplay between whole life insurance, investments, retirement accounts, and other assets to create a robust and diversified portfolio.

Whole Life Insurance and Protection Against Unexpected Medical Expenses

The medical profession, ironically, carries significant personal financial risk. Unexpected illnesses or injuries can lead to substantial medical expenses, even for doctors with robust health insurance. Whole life insurance’s cash value component can serve as a readily accessible emergency fund to cover such costs, reducing the need to deplete other savings or incur high-interest debt. For example, a doctor facing a prolonged illness might utilize the policy’s cash value to pay for treatment, rehabilitation, or ongoing care without jeopardizing their family’s financial security.

The availability of funds ensures continuity of care and minimizes financial stress during a challenging period.

Whole Life Insurance as a Retirement Income Supplement

Whole life insurance can act as a valuable supplement to retirement income. The accumulated cash value can be accessed through various methods, including loans or withdrawals, providing a steady stream of funds during retirement. This can be particularly beneficial for doctors who may face reduced income during their retirement years. For instance, a doctor retiring at age 65 with a substantial cash value in their whole life policy could use it to supplement their pension or Social Security benefits, maintaining their desired lifestyle without depleting other retirement assets.

Careful planning is crucial to determine the optimal withdrawal strategy to maximize tax efficiency and ensure the longevity of the funds.

Determining the Appropriate Death Benefit Amount for a Doctor

Determining the appropriate death benefit requires a comprehensive assessment of the doctor’s financial obligations and desired legacy. Factors to consider include outstanding debts (mortgages, loans), future educational expenses for children, ongoing spousal support, and desired bequests to family or charity. Financial professionals can assist in calculating the appropriate death benefit by considering the doctor’s current income, projected future earnings, and the present value of future expenses.

A common approach is to estimate the present value of all future income the family would have received and cover outstanding debts and expenses. For example, a high-earning surgeon with a young family might require a significantly larger death benefit than a general practitioner nearing retirement.

Calculating the Potential Long-Term Cost of Whole Life Insurance

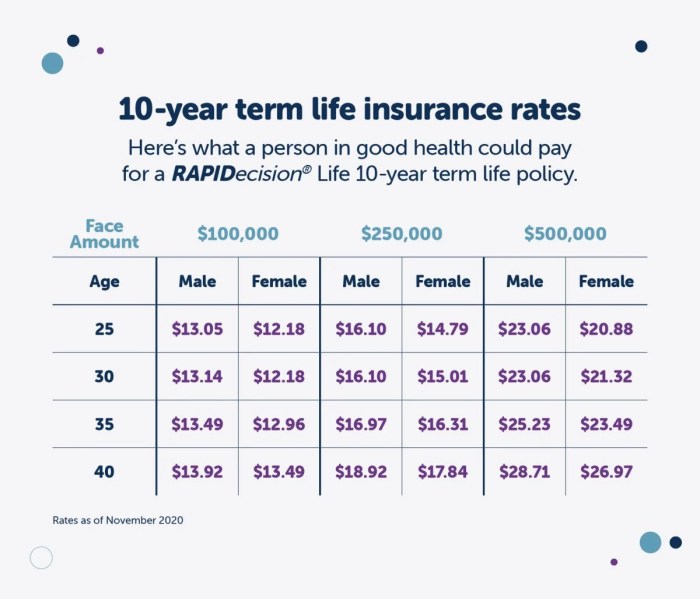

The long-term cost of whole life insurance is influenced by factors such as the age of the policyholder at inception, the chosen death benefit, and the type of policy. Premium payments are typically level, meaning they remain constant throughout the policy’s duration. However, the actual cost can vary based on the insurer and policy features. While initial premiums may seem high, it’s important to consider the long-term growth potential of the cash value and the guaranteed death benefit.

Financial modeling tools can be used to project the total premiums paid over time, factoring in the cash value accumulation and potential tax implications. It’s advisable to compare quotes from multiple insurers to ensure a competitive premium and favorable policy terms. For instance, a comparison of premiums for a 35-year-old doctor purchasing a $1 million whole life policy from different insurers could reveal significant variations in total cost over the policy’s lifetime.

Finding and Selecting a Whole Life Insurance Provider for Doctors

Choosing the right whole life insurance provider is crucial for securing your financial future and protecting your loved ones. The decision involves careful consideration of several key factors, going beyond simply finding the lowest premium. A thorough evaluation process ensures you select a provider that aligns with your specific needs and long-term financial goals.

Key Factors to Consider When Choosing a Provider

Selecting a whole life insurance provider requires a multifaceted approach. Several critical factors should guide your decision-making process, ensuring the chosen provider offers stability, reliability, and a product that meets your specific requirements. These factors range from the financial strength and reputation of the company to the specific features and benefits offered within their policies. Ignoring these elements could lead to an unsuitable policy or even financial instability in the long run.

Comparing Services and Reputation of Insurance Companies

Different insurance companies cater to specific demographics and needs. Some specialize in providing whole life insurance policies tailored to the unique financial circumstances of doctors, considering factors such as high incomes, student loan debt, and specialized practice needs. A comprehensive comparison should involve researching the financial stability ratings of potential providers, such as those provided by A.M. Best, Moody’s, and Standard & Poor’s.

Online reviews and independent ratings can also provide valuable insights into customer satisfaction and the overall experience of working with a particular company. For example, a provider with consistently high ratings for claims processing efficiency might be preferred over one with a history of slow or difficult claims settlements.

Obtaining Quotes from Multiple Insurance Providers

Obtaining quotes from multiple insurance providers is essential to compare pricing and policy features. This process involves contacting several companies directly or using online comparison tools. However, it is crucial to ensure that you provide consistent information across all quotes to ensure a fair comparison. For instance, providing accurate details regarding your age, health status, desired death benefit, and preferred policy features will ensure you receive accurate and comparable quotes.

Discrepancies in provided information could lead to significant differences in the quotes received, making it difficult to identify the best value.

Reviewing Policy Terms and Conditions

Thoroughly reviewing the policy terms and conditions is paramount before signing any contract. This involves carefully examining the fine print, paying close attention to details like the policy’s cash value growth rate, fees, surrender charges, and any limitations on benefits. Understanding these aspects is crucial to making an informed decision, ensuring the policy aligns with your financial goals and risk tolerance.

For instance, a policy with high surrender charges might not be suitable if you anticipate needing access to the cash value in the near future. Misunderstanding these terms could lead to unforeseen financial consequences down the line.

Checklist of Questions to Ask Potential Insurance Providers

Before committing to a whole life insurance policy, it’s vital to ask potential providers specific questions. This proactive approach ensures you receive all the necessary information to make an informed decision. These questions should cover areas such as the provider’s financial strength, policy features, fees, and the claims process. For example, inquiring about the provider’s history of paying claims on time and without issue will provide valuable insight into their reliability.

A detailed understanding of all aspects of the policy is critical to avoid potential problems in the future. A sample checklist could include questions about the company’s financial ratings, the policy’s cash value growth projections, and the specifics of the death benefit payout.

Understanding Policy Riders and Add-ons

Whole life insurance policies offer a foundation of lifelong coverage, but their value can be significantly enhanced through the addition of riders and add-ons. These optional features provide customized protection tailored to the specific needs and circumstances of the policyholder, in this case, a doctor. Understanding the available riders and their associated costs is crucial for making informed decisions about maximizing the benefits of a whole life insurance policy.

Types of Whole Life Insurance Policy Riders

Several riders can augment a whole life insurance policy, providing additional coverage or benefits beyond the basic death benefit. The choice of riders will depend on individual financial goals and risk tolerance. Carefully evaluating the benefits and costs of each rider is essential before making a purchase decision.

Common Whole Life Insurance Riders and Their Benefits

The following are some common riders available for whole life insurance policies. Each offers distinct advantages, and their suitability varies depending on the doctor’s specific circumstances and priorities.

| Rider Name | Description | Benefits | Costs |

|---|---|---|---|

| Waiver of Premium Rider | Waives future premiums if the insured becomes totally disabled. | Protects policy from lapsing due to disability, ensuring continued coverage. | Increased premium on the base policy. The cost depends on the insurer and the insured’s health. |

| Accidental Death Benefit Rider | Pays an additional death benefit if the insured dies due to an accident. | Provides a larger death benefit to beneficiaries in case of accidental death, offering financial security in unforeseen circumstances. | Adds to the overall premium cost. The amount added depends on the level of additional coverage chosen. |

| Guaranteed Insurability Rider | Allows the insured to purchase additional coverage at predetermined times without a medical exam, regardless of health status. | Protects against future increases in premiums or potential uninsurability due to health changes. Useful for doctors who anticipate increasing income or family size. | Adds a small amount to the regular premium, usually a fixed amount per $1000 of additional coverage. |

| Long-Term Care Rider | Provides funds for long-term care expenses, such as nursing home or assisted living costs. | Offers financial protection against potentially high long-term care costs, easing the burden on both the insured and their family. | Significantly increases the overall premium. The cost is determined by factors like age and health. |

| Return of Premium Rider | Returns all or a portion of the premiums paid if the insured is still alive at a certain age or upon policy surrender. | Offers a form of living benefit, providing a financial return even if the death benefit is not claimed. | Substantially increases the premium compared to a standard whole life policy. |

Examples of Riders Enhancing Policy Coverage

A surgeon facing high malpractice insurance costs might benefit from a Waiver of Premium rider, ensuring coverage continues even if a disability prevents them from working. A family physician with young children might find an Accidental Death Benefit rider valuable, providing extra financial support for their family in the event of an unexpected accident. An established doctor planning for retirement might appreciate a Long-Term Care rider to cover potential future healthcare expenses.

The selection of riders is highly individualized and should be carefully considered with the advice of a financial professional.

Illustrative Example: Dr. Anya Sharma’s Whole Life Insurance Needs: How Much To Buy Whole Life Insurance Doctor

Dr. Anya Sharma, a 35-year-old cardiologist with a thriving practice, is considering purchasing a whole life insurance policy. She is single, debt-free, and has a high income. This case study will explore her insurance needs, the factors influencing her cost, policy selection, long-term financial implications, and a summary of the benefits and drawbacks of a suitable plan.

Dr. Sharma’s Insurance Needs and Cost Factors

Several factors influence the cost of Dr. Sharma’s whole life insurance. Her age (35) places her in a lower risk category compared to older applicants, resulting in lower premiums. Her excellent health, as evidenced by regular check-ups and a healthy lifestyle, further reduces her risk profile. However, her high income means she can afford a higher premium for a larger death benefit, providing greater financial security for her family in the event of her untimely death.

The type of policy she chooses (e.g., participating or non-participating) will also significantly impact her premiums. Finally, the policy’s cash value accumulation feature will influence the overall cost, as premiums will partially contribute to this growing investment component.

Policy Selection Process for Dr. Sharma

Given Dr. Sharma’s financial stability and desire for long-term financial security, a whole life insurance policy with a substantial death benefit and a cash value component appears appropriate. The selection process would involve comparing quotes from multiple reputable insurance providers, considering factors like the policy’s features, surrender charges, and the provider’s financial strength rating. Dr. Sharma might opt for a participating whole life policy due to the potential for dividends, which can further enhance the cash value growth.

A financial advisor could assist in determining the optimal death benefit amount based on her current assets, potential future earnings, and desired legacy.

Long-Term Financial Implications of the Chosen Policy

A whole life insurance policy provides long-term financial security and offers several benefits beyond the death benefit. The cash value component grows tax-deferred, potentially providing a source of funds for retirement, education expenses, or other significant life events. However, the policy’s cash value growth is not guaranteed and depends on the policy’s performance and the insurer’s investment strategy. Dr.

Sharma should carefully consider the potential long-term costs and compare the policy’s return on investment with other investment vehicles. For instance, she could model the projected cash value growth against potential returns from alternative investments to evaluate the opportunity cost. This analysis will provide a clear picture of the long-term financial implications of her decision.

Benefits and Drawbacks of the Chosen Plan for Dr. Sharma, How much to buy whole life insurance doctor

A whole life policy offers several benefits to Dr. Sharma, including a guaranteed death benefit, tax-deferred cash value growth, and the potential for dividends. The guaranteed death benefit provides peace of mind, ensuring her family is financially protected even in the event of her premature death. The cash value component acts as a forced savings plan, encouraging consistent savings and offering potential long-term growth.

However, whole life insurance policies typically have higher premiums compared to term life insurance. The cash value growth may not outperform other investment options, and accessing the cash value may incur surrender charges. The complexity of the policy and its long-term commitment require careful consideration and professional advice.

Final Conclusion

Securing adequate whole life insurance as a doctor requires careful consideration of numerous factors. From understanding the impact of your age, specialty, and health history on premiums to selecting the right policy type and provider, the decision-making process demands a comprehensive approach. This guide has provided a framework for evaluating these critical elements, empowering you to navigate the complexities of whole life insurance and make an informed choice that safeguards your financial future and provides peace of mind for your loved ones.

Remember to seek professional financial advice tailored to your specific situation to ensure your insurance strategy complements your overall financial plan.