How long does an insurance claim on a house process take? This question is understandably top-of-mind for homeowners facing unexpected damage. The timeline for settling a home insurance claim varies significantly depending on several interacting factors. From the nature of the damage and the complexity of the claim to the efficiency of the insurance company and the availability of supporting documentation, numerous variables influence the overall process.

Understanding these factors empowers homeowners to navigate the claim process more effectively and achieve a timely resolution.

This guide will delve into the intricacies of the home insurance claim process, providing a comprehensive overview of the factors affecting processing time, the steps involved, the role of the insurance adjuster, relevant legal considerations, and practical tips for a smoother experience. We aim to equip you with the knowledge and understanding needed to confidently handle your claim and obtain a fair settlement.

Factors Influencing Claim Processing Time: How Long Does An Insurance Claim On A House Process

The speed at which a home insurance claim is processed can vary significantly depending on several interacting factors. Understanding these factors can help homeowners manage expectations and facilitate a smoother claims experience. This section details the key influences on processing time, offering examples and suggesting mitigation strategies.

Type of Damage

The nature of the damage significantly impacts processing time. Catastrophic events like fires or major storms often involve numerous claims simultaneously, leading to longer processing times due to increased workload for insurance adjusters. Conversely, smaller, less complex events like minor water damage might be resolved more quickly. For example, a simple roof leak might be assessed and repaired within a week, while a house fire could take several months due to the extensive damage assessment, debris removal, and reconstruction involved.

Claim Complexity

The intricacy of a claim directly correlates with processing time. Simple claims with clear liability and easily quantifiable damage are processed faster. Complex claims, however, involving multiple parties, significant structural damage requiring extensive engineering assessments, or disputes over coverage, can significantly prolong the process. For instance, a claim involving a dispute over the cause of water damage, requiring expert investigation, will naturally take longer than a straightforward claim for a broken window.

Insurance Company Procedures

Each insurance company has its own internal procedures for handling claims. Companies with streamlined, efficient processes and readily available resources generally process claims faster than those with more cumbersome systems or limited staff. Factors such as the company’s technological infrastructure (e.g., use of digital claim platforms) and the training and experience of its adjusters play a significant role.

Some insurers prioritize fast processing, while others might prioritize thorough investigation, resulting in varying processing times.

Documentation Availability

The availability and quality of supporting documentation are crucial. Providing comprehensive documentation, such as detailed photographs of the damage, receipts for repairs already undertaken, and any relevant contracts or warranties, significantly accelerates the process. Conversely, a lack of documentation or incomplete information can lead to delays as the insurer requests additional details, potentially causing significant delays. For example, clear photographic evidence of wind damage can expedite the assessment process compared to a claim relying solely on a verbal description.

Policy Type

Processing times can also vary depending on the type of insurance policy. Homeowners insurance claims, which typically involve more extensive coverage and potentially higher value losses, might take longer to process than renters insurance claims, which usually involve smaller losses and simpler assessments. The complexity of the insured property and the extent of coverage under the policy also contribute to this variation.

Factors Influencing Claim Processing Time

| Factor | Impact on Time | Examples | Mitigation Strategies |

|---|---|---|---|

| Type of Damage | Significant impact; catastrophic events cause longer delays | Fire vs. minor water leak | Prepare for potential delays after major events |

| Claim Complexity | Direct correlation; complex claims take longer | Dispute over liability vs. straightforward damage | Gather thorough documentation and cooperate fully with the adjuster |

| Insurance Company Procedures | Influenced by efficiency of internal processes | Streamlined digital platform vs. manual paper-based system | Choose an insurer known for efficient claim handling |

| Documentation Availability | Crucial; complete documentation accelerates the process | Detailed photos and receipts vs. limited information | Document damage thoroughly; keep all relevant records |

| Policy Type | Homeowners claims often take longer than renters claims | Homeowners insurance vs. renters insurance | Understand your policy coverage and limitations |

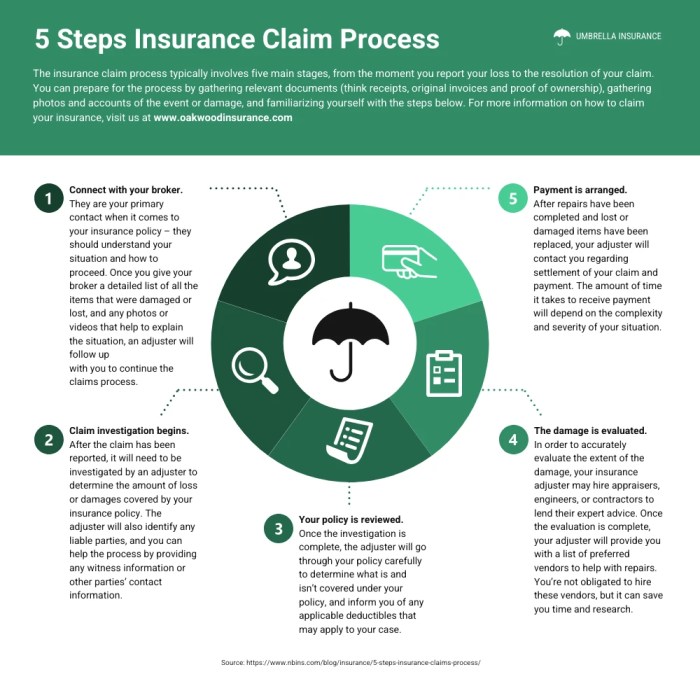

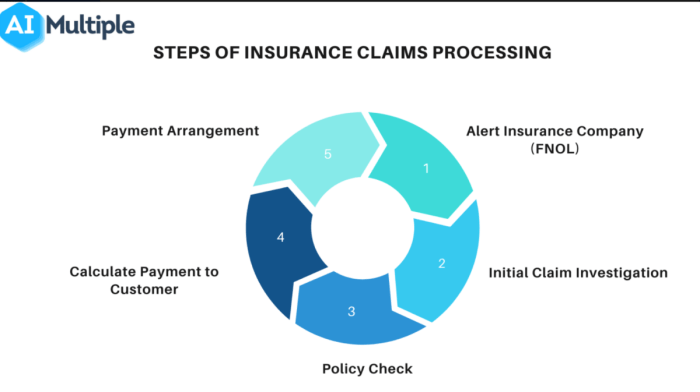

Steps in the Home Insurance Claim Process

Navigating the home insurance claim process can feel overwhelming, but understanding the typical steps involved can significantly reduce stress and improve outcomes. This guide provides a clear overview of the process, from initial reporting to final settlement, highlighting potential delays and offering strategies for effective communication with your insurer.

The home insurance claim process is a structured sequence of events designed to assess damages and provide appropriate compensation. Successful navigation requires prompt action, accurate documentation, and clear communication with your insurance company. The time it takes to complete the process can vary significantly depending on the complexity of the claim and the responsiveness of all parties involved.

Initial Claim Reporting

The first step involves promptly notifying your insurance company of the damage to your property. This usually involves contacting them by phone or through their online portal. Accurate and detailed reporting is crucial at this stage. Include the date and time of the incident, a brief description of the damage, and any immediate safety concerns. Potential delays can arise from failure to provide sufficient information or contacting the wrong department.

Required documentation at this stage might include your policy number and contact information.

Damage Assessment and Investigation, How long does an insurance claim on a house process

Following your initial report, the insurance company will typically assign an adjuster to assess the extent of the damage. The adjuster will inspect your property, take photographs, and document the damage. They may also request additional documentation, such as receipts for repairs or contractor estimates. Delays can occur if the adjuster is unavailable or if access to the property is difficult.

Cooperation with the adjuster is crucial during this phase.

Claim Review and Negotiation

Once the adjuster has completed their investigation, they will prepare a claim report outlining the estimated cost of repairs or replacement. This report will be reviewed by the insurance company, and you may be involved in negotiations to agree on the final settlement amount. This stage might involve submitting supporting documentation such as repair estimates, and it can be delayed if there are disagreements over the assessment of damages or the coverage provided by your policy.

Settlement and Payment

After the claim is approved and the settlement amount is agreed upon, the insurance company will process the payment. This could involve direct payment to you or to contractors carrying out the repairs. The payment method and timeline will depend on your insurance policy and the company’s procedures. Delays may arise due to processing errors or discrepancies in the paperwork.

Effective Communication with the Insurance Adjuster

Maintaining open and clear communication with your insurance adjuster is vital throughout the entire claim process. Respond promptly to their requests for information, and don’t hesitate to ask questions if anything is unclear. Document all communication, including emails, phone calls, and meetings. Keeping a detailed record will be beneficial in case of any disputes. Proactive communication can prevent misunderstandings and delays.

Potential Roadblocks and Solutions

Several factors can cause delays in the claim process. These include inaccurate or incomplete documentation, disputes over the cause of damage, difficulty accessing the property, and disagreements over the scope of repairs. Proactive steps such as maintaining thorough records, promptly providing requested documentation, and clearly communicating with the adjuster can help mitigate these potential roadblocks. Engaging a public adjuster can also be helpful in complex or contentious claims.

Homeowner Actions at Each Stage

Taking the right actions at each stage is key to a smooth claims process. Here’s a summary:

- Initial Claim Reporting: Immediately report the damage, providing detailed information and photos.

- Damage Assessment: Cooperate fully with the adjuster, provide access to the property, and gather supporting documentation.

- Claim Review: Review the adjuster’s report carefully, negotiate the settlement amount if necessary, and provide any additional documentation required.

- Settlement and Payment: Ensure you understand the payment method and timeline, and follow up if the payment is delayed.

The Role of the Insurance Adjuster

Insurance adjusters play a crucial role in the home insurance claims process, acting as the bridge between the insurance company and the policyholder. They are responsible for investigating the damage, determining the extent of the loss, and ultimately deciding the amount of compensation to be paid. Their work is essential for ensuring fair and efficient claim settlements.

Adjuster Responsibilities in Handling Home Insurance Claims

The insurance adjuster’s primary responsibility is to thoroughly investigate the circumstances surrounding the claim. This involves visiting the damaged property, documenting the extent of the damage through photographs and detailed reports, and interviewing the homeowner to gather information about the incident. They must verify the validity of the claim against the terms of the insurance policy, considering factors such as the cause of the damage, the policy coverage, and any exclusions that might apply.

Following the investigation, the adjuster prepares a detailed report summarizing their findings and recommending a settlement amount. This report is then reviewed by the insurance company before a final decision is made.

Methods for Assessing Damage and Determining Claim Payouts

Adjusters employ several methods to assess damage and determine appropriate payouts. They use various tools and techniques, including detailed visual inspections, measurements, and the use of specialized software to estimate repair costs. They may consult with contractors or other experts to obtain additional opinions and ensure accuracy in their assessments. In cases of significant damage, the adjuster might utilize advanced technology such as drone photography or 3D modeling to create a comprehensive record of the damage.

The final payout is calculated based on the assessed damage, considering factors such as the cost of repairs or replacement, the homeowner’s deductible, and the applicable policy limits.

Communication Strategies of Effective Insurance Adjusters

Effective communication is paramount to the adjuster’s role. They must maintain clear and consistent communication with the homeowner throughout the claims process, providing regular updates on the progress of the investigation and explaining the steps involved. This involves actively listening to the homeowner’s concerns, responding promptly to inquiries, and providing clear and concise explanations of complex insurance terminology.

Building trust and rapport with the homeowner is crucial for a smooth and efficient claims process. Transparency in the assessment process and a willingness to address any questions or concerns are key elements of effective communication.

Common Homeowner Questions and Concerns Regarding the Adjuster’s Role

Homeowners frequently question the adjuster’s objectivity and the fairness of the claim assessment. Concerns about the speed of the process and the adequacy of the proposed settlement are also common. Homeowners often want to understand the rationale behind the adjuster’s assessment and the factors considered in determining the payout amount. They may also be unsure about the appeals process if they disagree with the adjuster’s decision.

Comparison of Independent and Company Adjusters

Independent adjusters are hired by insurance companies on a contract basis to handle claims, while company adjusters are employees of the insurance company. Independent adjusters often handle a higher volume of claims and may have broader experience across different types of insurance, potentially providing a more impartial perspective. Company adjusters, on the other hand, are more integrated into the company’s processes and may have a deeper understanding of internal policies and procedures.

Both types of adjusters have the responsibility to fairly and accurately assess damages and handle claims according to the policy and the law.

Qualities of a Good Insurance Adjuster from the Homeowner’s Perspective

A good insurance adjuster, from the homeowner’s perspective, possesses several key qualities. It’s important to note that these are subjective, and what constitutes a “good” adjuster may vary based on individual experiences and expectations.

- Professionalism and courtesy in all interactions.

- Thoroughness and attention to detail in assessing the damage.

- Prompt and clear communication throughout the claims process.

- Empathy and understanding towards the homeowner’s situation.

- Fairness and objectivity in determining the claim settlement.

- Responsiveness to questions and concerns.

- Knowledge of insurance policies and procedures.

Legal and Regulatory Aspects

Navigating the complexities of a home insurance claim often involves understanding your legal rights and the regulatory framework governing the process. This section clarifies the legal landscape, empowering homeowners to protect their interests throughout the claim process.

Homeowner Rights and Responsibilities

Homeowners possess several crucial rights during the claims process. These include the right to a prompt and fair investigation of their claim, access to all relevant documentation, and clear communication from the insurance company. They also have the right to negotiate the settlement amount and to seek legal counsel if necessary. Conversely, homeowners have responsibilities, such as providing accurate information to the insurance company, cooperating fully with the investigation, and complying with the terms and conditions of their insurance policy.

Failure to fulfill these responsibilities could jeopardize their claim. For instance, intentionally withholding information about a pre-existing condition could lead to a claim denial.

Regulations Governing Insurance Claim Handling

State insurance departments play a critical role in regulating insurance claim handling practices. These regulations often mandate specific timelines for claim processing, investigation procedures, and communication protocols. Furthermore, regulations aim to protect consumers from unfair or deceptive practices by insurance companies. Specific regulations vary by state, but common themes include requirements for prompt acknowledgment of claims, timely investigations, and good-faith efforts to settle claims fairly.

Violations of these regulations can result in penalties for the insurance company. Examples include fines, mandated restitution, and even license revocation.

Appealing Denied or Undervalued Claims

If a homeowner’s claim is denied or undervalued, they typically have the right to appeal the decision. The appeal process usually involves submitting additional documentation or evidence to support their claim. This might include photos, repair estimates, or expert opinions. Many states also provide a formal process for appealing claims, often involving mediation or arbitration. Successfully appealing a denied claim requires meticulous documentation and a clear understanding of the policy terms and applicable state regulations.

For example, a homeowner might appeal a denied claim by presenting a second opinion from a qualified contractor demonstrating the damage exceeds the insurer’s assessment.

Common Legal Disputes and Resolutions

Disputes frequently arise from disagreements over the extent of damages, the value of repairs, or the interpretation of policy terms. These disputes may involve issues such as whether the damage was caused by a covered peril, the appropriate method for calculating the settlement, or whether the insurance company acted in good faith. Resolutions can range from informal negotiations and mediation to formal litigation.

Mediation, a less adversarial approach, can often help parties reach a mutually agreeable settlement. If mediation fails, litigation may become necessary, potentially involving expert witnesses and extensive legal proceedings. A common example is a dispute over whether water damage resulted from a covered plumbing leak or from neglect, which may require expert testimony.

Resources for Homeowners

Homeowners facing difficulties with their insurance claims can access several resources. State insurance departments often provide consumer assistance programs, offering guidance and mediation services. Legal aid organizations may offer free or low-cost legal representation to those who qualify. Consumer advocacy groups can also provide information and support. Additionally, independent adjusters can provide an unbiased assessment of the damage and assist in negotiating with the insurance company.

These resources are essential for ensuring homeowners receive fair treatment and compensation.

Comparison of Homeowner Legal Rights: California vs. Florida

| Legal Right | California | Florida |

|---|---|---|

| Timely Claim Acknowledgement | Requires acknowledgement within a reasonable time, often specified by regulation. | Similar requirement for prompt acknowledgement, with specific timeframes Artikeld in state statutes. |

| Right to an Independent Appraisal | Homeowners have the right to request an independent appraisal to determine the value of damages if they disagree with the insurer’s assessment. | Florida also grants homeowners the right to an independent appraisal under specific circumstances Artikeld in the insurance policy and state statutes. |

| Appeal Process | A formal appeal process exists, often involving mediation or arbitration before litigation. | Similar formal appeal process available, with specific procedures detailed in state regulations. |

| Bad Faith Claims | Homeowners can sue insurers for bad faith if they believe the insurer acted unfairly or unreasonably in handling the claim. | Florida also allows lawsuits for bad faith claims, with specific legal precedents defining what constitutes bad faith. |

| Access to Policy Documents | Homeowners have the right to access and review all relevant policy documents. | Homeowners have the right to access and review all relevant policy documents. |

Tips for a Smooth Claim Process

Navigating the home insurance claim process can be stressful, but proactive preparation and effective communication can significantly ease the burden. By taking certain steps before, during, and after a covered event, homeowners can increase their chances of a fair and timely settlement. This section Artikels practical strategies to help you manage the process efficiently and effectively.

Proactive Steps for Claim Preparation

Preparing for a potential claim begins long before any damage occurs. Taking preventative measures and maintaining thorough records will significantly streamline the claims process should an incident happen. This proactive approach demonstrates responsibility and can help avoid delays or disputes.

| Tip | Description | Example |

|---|---|---|

| Inventory Your Belongings | Create a detailed inventory of your home’s contents, including descriptions, purchase dates, and receipts or appraisals. This is crucial for documenting losses accurately. | Use a spreadsheet or app to list each item, its value, and supporting documentation like photos or receipts. For high-value items, consider professional appraisals. |

| Photograph and Video Record Your Home | Regularly document your home’s interior and exterior, capturing details of its condition. This visual record serves as baseline evidence of your property’s state before any damage. | Take high-resolution photos and videos, focusing on all rooms, appliances, and structural elements. Include date and time stamps on all media. |

| Maintain Accurate Records of Home Improvements | Keep detailed records of all home improvements, repairs, and renovations, including receipts, contracts, and permits. This documentation supports claims related to damaged improvements. | Maintain a dedicated file or digital folder with all relevant documents for each improvement project. |

Effective Damage Documentation

Thorough documentation of damage is essential for a successful claim. High-quality photos and videos provide irrefutable evidence to support your claim and prevent disputes. Remember to capture the extent of the damage from multiple angles.

| Tip | Description | Example |

|---|---|---|

| Take Multiple Photographs | Capture images from various angles and distances to fully illustrate the extent of the damage. Include close-ups of specific details. | Take photos of the damaged area from wide shots showing the overall context to close-ups showing the specific damage. Include photos of the surrounding area to show the extent of the damage in relation to the whole structure. |

| Use Video Recording | Video recording allows you to capture a broader perspective and provide a more comprehensive record of the damage. | Use a video camera or smartphone to record a walk-through of the damaged area, highlighting specific damage points. |

| Note Damage Details | Maintain a written record alongside your photos and videos. Include dates, times, and specific descriptions of the damage. | Create a document listing each damaged item, its condition, and an estimate of its repair or replacement cost. Include specific details, such as the make and model of appliances or the type of material used in construction. |

Communicating with Your Insurance Company

Open and proactive communication with your insurance company is crucial for a smooth claims process. Clear and timely communication minimizes misunderstandings and delays.

| Tip | Description | Example |

|---|---|---|

| Report the Claim Promptly | Report the damage to your insurance company as soon as possible after the incident. | Contact your insurance company within 24-48 hours of the incident to begin the claims process. |

| Provide All Necessary Documentation | Gather and provide all relevant documentation promptly, including photos, videos, receipts, and repair estimates. | Organize all documentation into a clear and easily accessible format for the adjuster. |

| Maintain Regular Contact | Follow up regularly to check on the progress of your claim and address any questions or concerns. | Contact your adjuster weekly to inquire about the status of your claim and address any outstanding issues. |

Negotiating a Fair Settlement

Negotiating a fair settlement requires a clear understanding of your policy coverage and the value of your losses. Be prepared to provide supporting documentation and justification for your claims.

| Tip | Description | Example |

|---|---|---|

| Understand Your Policy | Thoroughly review your insurance policy to understand your coverage limits and deductibles. | Review your policy documents carefully and make note of key provisions related to your claim. |

| Support Your Claims | Provide comprehensive documentation to support your claims, including receipts, appraisals, and estimates. | Gather all relevant documentation and organize it into a clear and concise format. |

| Be Prepared to Negotiate | Be prepared to negotiate with your insurance company to reach a fair settlement. | If you disagree with the initial settlement offer, present your supporting documentation and calmly explain your reasoning. |

Ultimate Conclusion

Successfully navigating a home insurance claim requires preparation, patience, and proactive communication. By understanding the factors influencing processing times, meticulously documenting damages, and maintaining open communication with your insurance adjuster, you can significantly increase your chances of a swift and equitable resolution. Remember, your insurance policy is a contract, and knowing your rights and responsibilities empowers you throughout the process.

While the timeline can vary, a well-prepared claim significantly streamlines the process, minimizing stress and ensuring a fair outcome.