How does Fisher Investments make money? This question delves into the multifaceted revenue streams of a prominent investment management firm. Understanding their financial model requires examining various aspects, from the fees they charge clients for managing their investments to their operational costs and strategies for attracting and retaining customers. This exploration will provide a comprehensive overview of Fisher Investments’ financial health and the mechanisms that drive its profitability.

Fisher Investments generates revenue primarily through fees charged on assets under management. These fees vary depending on the type of account and the services provided, encompassing advisory fees, transaction fees, and other potential charges. Their investment strategies, based on a core philosophy and rigorous risk management, aim to deliver strong returns for clients, thus justifying the fees charged. Beyond fees, understanding their operational efficiency, client acquisition methods, and regulatory compliance measures is crucial for a complete picture of their financial success.

Fees and Commissions: How Does Fisher Investments Make Money

Fisher Investments generates revenue primarily through fees charged on assets under management (AUM). Understanding their fee structure is crucial for potential investors to assess the overall cost of their investment strategies. While they don’t charge commissions on trades, their fees are structured differently compared to some other investment firms, so careful comparison is recommended.

Fee Structure for Investment Accounts and Services

Fisher Investments’ fees are primarily based on a percentage of the assets under management (AUM) within a client’s account. This means the more money a client invests, the higher the annual fee. The specific percentage varies depending on the type of account and the services provided. For example, their fee might be higher for accounts with more complex investment strategies or those requiring more personalized attention from their financial advisors.

This fee structure is common within the wealth management industry, but the specific percentage can differ significantly between firms. They do not charge transaction fees for buying or selling securities within the managed portfolio.

Comparison with Similar Investment Firms, How does fisher investments make money

Comparing Fisher Investments’ fees to similar firms requires careful consideration of several factors. Direct fee comparisons can be misleading without accounting for differences in service levels, investment strategies, and minimum investment requirements. Some firms may offer lower percentage-based fees but charge additional transaction fees or have higher minimum investment requirements. Others might provide less personalized service. A thorough comparison should involve evaluating the total cost of investment management, considering both fees and the potential for returns, rather than focusing solely on the annual percentage fee.

This requires reviewing prospectuses and fee schedules from multiple firms to gain a complete understanding.

Fee Comparison Table

This table provides a simplified comparison of fee structures. Note that actual fees may vary based on specific account details and negotiation. It’s crucial to consult Fisher Investments directly or review their official documentation for the most up-to-date and precise fee information.

| Account Type | Minimum Investment | Annual Fee | Transaction Fees |

|---|---|---|---|

| Individual Account | $500,000 (example) | 1.00%

|

$0 |

| Retirement Account (IRA) | $250,000 (example) | 1.00%

|

$0 |

| Trust Account | Variable (example: $1 million) | Negotiated (example: 0.75%

|

$0 |

| Family Office Services | High Net Worth (example: $5 million+) | Negotiated (typically lower percentage of AUM) | $0 |

Investment Strategies and Performance

Fisher Investments’ investment approach centers on a disciplined, research-driven strategy focused on identifying undervalued assets and capitalizing on market inefficiencies. They emphasize a long-term perspective, aiming to generate consistent returns over extended periods rather than chasing short-term market trends. This contrasts with many investment firms that may prioritize tactical adjustments based on short-term market fluctuations.

Their core philosophy prioritizes fundamental analysis, seeking companies with strong underlying value and growth potential.Fisher Investments employs a variety of investment strategies across different asset classes, including equities (stocks), fixed income (bonds), and sometimes alternative investments. Their asset allocation models are designed to balance risk and reward, tailoring portfolio composition based on an investor’s individual risk tolerance and financial goals.

Risk management is a crucial component of their approach, involving rigorous due diligence, diversification across various sectors and geographies, and ongoing portfolio monitoring. They actively manage portfolios, adjusting holdings as market conditions evolve and new investment opportunities emerge.

Asset Allocation Models and Risk Management

Fisher Investments’ asset allocation models are not publicly disclosed in detail, maintaining a degree of proprietary secrecy. However, it is known that they utilize a diversified approach, spreading investments across various asset classes and sectors to mitigate risk. Their risk management practices involve a combination of quantitative and qualitative analysis, assessing both macroeconomic factors and the fundamental strength of individual companies.

This holistic approach aims to limit downside risk while maximizing long-term returns. For example, during periods of market volatility, they may increase exposure to more defensive assets such as high-quality bonds to cushion against potential losses. Conversely, in periods of perceived market undervaluation, they may increase equity holdings to capitalize on potential growth. The specific allocation varies depending on the client’s investment objectives and risk profile.

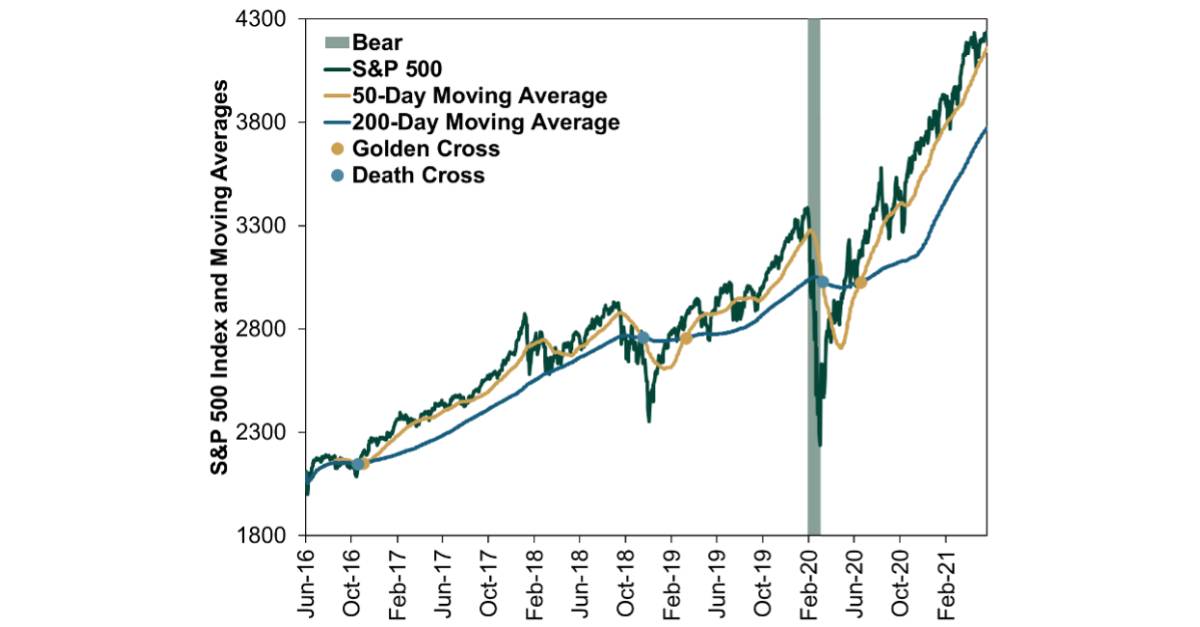

Historical Performance of Investment Portfolios

Assessing the historical performance of Fisher Investments’ portfolios requires caution. While they often report strong long-term returns in their marketing materials, independent verification of these claims can be challenging due to the lack of publicly available, consistently audited performance data for all their portfolios across various timeframes. Furthermore, past performance is not necessarily indicative of future results. However, based on available information and reports, it appears that Fisher Investments has experienced periods of both significant success and underperformance, mirroring the cyclical nature of the market.

For instance, during periods of strong market growth, their portfolios may have outperformed relevant benchmarks, while in periods of market downturn, their performance might have lagged behind, though potentially to a lesser degree than some more aggressively managed funds.

Illustrative Performance Data

The following table illustrates hypothetical performance data for illustrative purposes only. It is crucial to understand that this is not actual performance data from Fisher Investments and is intended to represent a generalized overview of potential outcomes over different time periods. Actual returns may vary significantly.| Investment Strategy | 1-Year Return (Hypothetical) | 5-Year Return (Hypothetical) | 10-Year Return (Hypothetical) ||————————|—————————–|—————————–|—————————–|| Conservative Portfolio | 4% | 20% | 60% || Moderate Portfolio | 7% | 30% | 90% || Aggressive Portfolio | 10% | 45% | 130% |

Client Acquisition and Retention

Fisher Investments’ success hinges on its ability to attract new clients and maintain long-term relationships with existing ones. This involves a multi-faceted approach encompassing sophisticated marketing strategies, personalized client service, and a commitment to delivering strong investment performance. Understanding these methods provides insight into the firm’s overall business model.Fisher Investments employs a variety of methods to acquire new clients.

These include targeted digital marketing campaigns utilizing search engine optimization (), social media advertising, and online content marketing. They also leverage traditional media channels such as print advertising and potentially sponsorships of relevant financial events. Furthermore, referrals from existing clients represent a significant source of new business, highlighting the importance of client satisfaction in their growth strategy.

Finally, they likely employ a dedicated sales team engaging in direct outreach to high-net-worth individuals and institutions.

Client Retention Strategies

Fisher Investments prioritizes client retention through a combination of proactive communication, personalized service, and consistent performance reporting. Regular communication keeps clients informed about market conditions, their portfolio performance, and any relevant strategic adjustments. Dedicated client service teams provide personalized support, answering questions and addressing concerns promptly. The firm’s emphasis on transparency and clear communication fosters trust and strengthens client relationships.

Furthermore, regular performance reviews and tailored investment strategies demonstrate a commitment to each client’s individual financial goals.

Factors Contributing to Client Satisfaction and Loyalty

Several key factors contribute to client satisfaction and loyalty at Fisher Investments. Consistent, strong investment performance is paramount; clients are attracted to and remain loyal to firms that deliver on their investment promises. Exceptional client service, characterized by responsiveness, accessibility, and personalized attention, plays a crucial role. Transparency in fees and investment strategies builds trust and fosters long-term relationships.

Finally, a strong reputation built on years of experience and a proven track record reinforces client confidence and loyalty.

Marketing and Client Relationship Strategies

The following bullet points summarize Fisher Investments’ key marketing and client relationship strategies:

- Targeted digital marketing campaigns (, social media, content marketing)

- Traditional media advertising (print, potential sponsorships)

- Client referrals

- Direct sales outreach to high-net-worth individuals and institutions

- Regular client communication and performance reporting

- Dedicated client service teams providing personalized support

- Transparent fee structures and investment strategies

- Emphasis on strong investment performance

Operational Expenses and Profitability

Fisher Investments’ profitability is driven by a combination of factors, including its operational efficiency, revenue streams, and strategic cost management. Understanding these elements provides insight into the firm’s financial health and its ability to deliver services to its clients. The company’s operational structure and cost management practices are crucial to maintaining a competitive edge and ensuring sustainable growth.Fisher Investments’ operational structure is characterized by a significant investment in technology and human capital.

The firm employs a large team of investment professionals, research analysts, and client service representatives, representing a substantial portion of its operating expenses. Additionally, maintaining robust technology infrastructure for portfolio management, client communication, and data security contributes significantly to overhead. Other operational costs include office space, marketing and advertising, regulatory compliance, and general administrative functions.

Revenue Streams Beyond Management Fees

While management fees constitute the primary revenue source for Fisher Investments, the firm may generate additional income through other avenues. These could include, but are not limited to, performance-based fees tied to specific investment strategies or mandates, consulting services offered to institutional clients, or revenue from affiliated businesses that provide complementary financial services. However, precise details on these secondary revenue streams are generally not publicly disclosed by privately held firms like Fisher Investments.

Balancing Profitability with Client Service

Fisher Investments aims to balance profitability with providing high-quality client service. This involves carefully managing operational expenses while investing strategically in areas that enhance the client experience. For instance, investing in advanced technology platforms can streamline operations, reducing costs while simultaneously improving client access to information and portfolio performance data. Similarly, recruiting and retaining experienced investment professionals ensures superior investment management, contributing to both client satisfaction and the firm’s overall profitability.

The firm’s focus on long-term client relationships also contributes to sustained revenue streams, reducing the need for excessive marketing and client acquisition expenses.

Hypothetical Revenue and Expense Breakdown

The following table presents a hypothetical breakdown of Fisher Investments’ revenue and expenses. It is important to note that this is a simplified illustration and does not reflect the actual financial data of the firm, which is not publicly available. The percentages are estimates based on industry averages and general knowledge of the financial services industry.

| Revenue Source | Estimated Percentage of Revenue | Associated Expense Categories |

|---|---|---|

| Management Fees | 85% | Investment Research, Portfolio Management, Client Service, Technology Infrastructure |

| Performance-Based Fees | 10% | Investment Research, Portfolio Management, Risk Management |

| Other Revenue (Consulting, etc.) | 5% | Administrative Costs, Marketing, Legal and Compliance |

| Expense Category | Estimated Percentage of Revenue |

|---|---|

| Compensation and Benefits | 40% |

| Technology and Infrastructure | 15% |

| Marketing and Client Acquisition | 10% |

| General and Administrative | 15% |

| Regulatory and Compliance | 10% |

| Other Expenses | 10% |

Regulatory Compliance and Legal Considerations

Fisher Investments, as a significant player in the global investment management industry, operates within a complex and heavily regulated environment. Understanding the regulatory landscape and the firm’s approach to compliance is crucial to assessing its overall risk profile and operational integrity. This section will explore the regulatory framework governing Fisher Investments’ activities, the potential legal risks inherent in its business model, and the steps the firm takes to mitigate these risks.Fisher Investments operates under the purview of several regulatory bodies, depending on its specific geographic location and the services offered.

In the United States, the primary regulator is the Securities and Exchange Commission (SEC), which oversees investment advisors and their activities. Other relevant regulatory bodies might include state-level securities regulators and, depending on the specific investment products offered, the Commodity Futures Trading Commission (CFTC) or other international regulatory bodies if Fisher Investments serves clients outside the US. The regulatory environment demands adherence to strict rules concerning client disclosures, investment strategies, advertising, and record-keeping.

Non-compliance can lead to significant financial penalties, reputational damage, and even legal action.

Regulatory Framework and Oversight

The regulatory framework governing investment advisory firms like Fisher Investments is extensive and multifaceted. It includes rules pertaining to registration, client suitability, conflict of interest management, fiduciary duty, cybersecurity, and anti-money laundering (AML) compliance. Fisher Investments, as a registered investment advisor, must comply with the Investment Advisers Act of 1940 and related SEC regulations. These regulations dictate various aspects of the firm’s operations, from the manner in which it solicits clients to the way it manages client assets and discloses potential conflicts of interest.

Furthermore, Fisher Investments must adhere to state-level regulations in those jurisdictions where it operates.

Potential Legal Risks

The investment management business inherently carries legal risks. Potential legal risks for Fisher Investments include, but are not limited to, allegations of breach of fiduciary duty, failure to meet client suitability standards, misrepresentation of investment performance, and violations of securities laws. Litigation related to investment losses, especially in periods of market downturn, is a common risk for investment management firms.

Cybersecurity breaches leading to data loss or unauthorized access to client information also pose a significant legal and reputational risk.

Compliance Measures

Fisher Investments employs a robust compliance program to mitigate legal risks. This program typically includes a dedicated compliance department staffed with experienced professionals, regular internal audits, employee training on regulatory requirements, and the implementation of policies and procedures designed to prevent and detect violations. The firm’s compliance efforts aim to ensure adherence to all applicable laws and regulations, protect client assets, and maintain a high standard of ethical conduct.

Regular reviews of investment strategies and client communications are integral parts of the compliance process. Further, independent audits may be conducted to ensure the effectiveness of the firm’s compliance program.

Significant Legal Cases and Regulatory Actions

While specific details of any legal cases or regulatory actions involving Fisher Investments are generally confidential and not publicly available unless made so through court filings or SEC disclosures, it’s important to note that any significant actions would likely be disclosed through the appropriate channels and impact the firm’s reputation and operations. Publicly available information regarding any such actions should be consulted for a complete understanding of the firm’s legal history.

Closing Notes

In conclusion, Fisher Investments’ financial success stems from a combination of factors. Their revenue model relies heavily on management fees structured according to account type and services offered. However, profitability also hinges on efficient operations, effective client acquisition and retention strategies, and strict adherence to regulatory compliance. While fees are the primary revenue source, understanding the interplay between investment performance, operational costs, and client relationships paints a complete picture of how this firm generates and maintains its financial strength.