What is CVV2 in credit card? Understanding this three-digit security code is crucial for safe online shopping. This vital number, located on the back of most credit cards, acts as an extra layer of protection against fraudulent transactions, verifying that you, the cardholder, are physically in possession of the card during online purchases. This guide will explore the intricacies of CVV2, its security features, and best practices for its use.

The CVV2 (Card Verification Value 2) number is a security feature designed to protect your credit card information during online and telephone transactions. Unlike your credit card number, which can be replicated through various means, the CVV2 is a unique, dynamic code that is difficult to counterfeit. This code is generated and linked to your specific card, adding an extra layer of security against unauthorized use.

It works in conjunction with other security measures, such as chip technology and encryption, to create a robust system for protecting your financial data.

What is a CVV2 Number?

A CVV2 (Card Verification Value 2) number is a three- or four-digit security code found on most credit and debit cards. Its primary purpose is to provide an additional layer of security for online and telephone transactions, helping to verify that the person making the purchase actually possesses the physical card. This extra step helps to protect cardholders from fraudulent activities.The CVV2 number is designed to be difficult for thieves to obtain, even if they manage to steal the card number and expiration date.

This is because the CVV2 is not encoded on the magnetic stripe or the card’s chip, making it unavailable to skimmers or other devices that copy card information.

CVV2 Number Location on Credit Cards

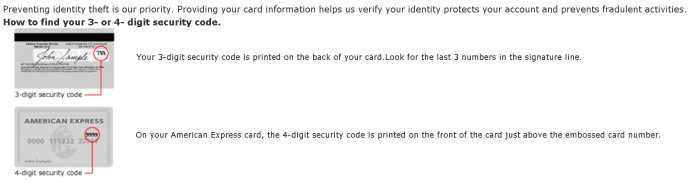

The CVV2 number is typically located on the back of the credit card, in the signature area. It’s usually a three-digit number, though some cards may have a four-digit CVV2. The exact location may vary slightly depending on the card issuer, but it is always clearly identified, often printed above or below the signature panel. For American Express cards, the CVV2 is a four-digit number printed on the front of the card, above the card number.

Difference Between CVV2 and CVC2

The terms CVV2 and CVC2 (Card Verification Code 2) are often used interchangeably, and for all practical purposes, they refer to the same security code. There is no significant difference between the two terms; they are simply variations used by different payment processors or card networks.

Examples of CVV2 Use in Card Authentication

When you make an online purchase, you will be asked to enter your credit card details, including the CVV2 number. The merchant then transmits this information to the card issuer’s payment processor. The processor verifies that the CVV2 number matches the number stored on file for that specific card. If the numbers match, it indicates a higher likelihood that the cardholder is legitimately making the purchase.

A mismatch suggests a potential fraudulent transaction, leading to the transaction being declined. For example, if you attempt to buy something online and enter an incorrect CVV2, the transaction will likely be rejected, even if the card number and expiry date are correct. Another example is a telephone purchase where a customer service representative will ask for the CVV2 number as part of the transaction verification process.

This provides an extra security check beyond just the card number and expiry date.

How CVV2 Protects Cardholders

The CVV2 number, a three- or four-digit security code located on the back of most credit and debit cards, plays a crucial role in enhancing the security of online and card-not-present transactions. Its primary function is to verify that the person making the purchase actually possesses the physical card, thereby significantly reducing the risk of fraudulent activity. This added layer of security complements other existing security measures to create a more robust system for protecting cardholders’ financial information.The security of CVV2 stems from its unique nature and its integration with payment processing systems.

Unlike the primary account number (PAN), which is printed on the card and can be easily copied, the CVV2 is not encoded on the magnetic stripe or embedded within the card’s chip. This makes it significantly more difficult for thieves to obtain the CVV2 through traditional methods like skimming or card cloning. Furthermore, the CVV2 is dynamically generated and is not stored by merchants, making it useless to those who manage to obtain it through illicit means.

Payment processors validate the CVV2 against the information provided by the card issuer during the transaction, adding an extra layer of authentication.

CVV2’s Role in Preventing Fraudulent Transactions

The CVV2 number acts as an additional authentication factor, making it much harder for fraudsters to make unauthorized purchases. Even if a thief obtains the card number and expiration date, they will still be unable to complete the transaction without the correct CVV2. This significantly reduces the success rate of online fraud schemes, particularly those involving stolen or compromised card information.

For instance, a fraudster attempting to make an online purchase with a stolen card number will be unable to complete the transaction if they do not possess the correct CVV2 code. The transaction will be declined, thus protecting the cardholder from financial loss.

Comparison of CVV2 with Other Card Security Features

CVV2 works in conjunction with other security features to provide comprehensive protection. While EMV chip cards and 3D Secure (like Verified by Visa or Mastercard SecureCode) offer robust protection at the point of sale and during online transactions respectively, CVV2 provides an additional layer of security, especially for online transactions where the physical card is not present. EMV chips encrypt transaction data, making it difficult to clone, while 3D Secure adds an extra authentication step, often requiring a password or one-time code.

CVV2 complements these technologies by verifying that the person making the purchase has physical possession of the card. The combination of these security measures creates a multi-layered approach to fraud prevention, offering a higher level of protection than any single feature alone.

CVV2’s Impact on Reducing Online Fraud

The implementation of CVV2 has demonstrably contributed to a reduction in online credit card fraud. While it is impossible to quantify the exact impact due to the many contributing factors involved in fraud prevention, studies and industry reports consistently indicate a correlation between the widespread adoption of CVV2 and lower rates of online card fraud. The added layer of security provided by CVV2 acts as a significant deterrent to fraudsters, forcing them to find other, more difficult, methods of committing fraud.

This has led to a decrease in the number of successful fraudulent transactions, ultimately benefiting both consumers and businesses.

CVV2 and Online Transactions

The CVV2 number plays a crucial role in securing online transactions, acting as an additional layer of protection beyond the credit card number and expiration date. Understanding how it works and how to protect it is essential for safe online shopping. This section will detail the process of using your CVV2 online, the security measures employed, and best practices to minimize risk.

During online purchases, the CVV2 number is entered as part of the payment information. This typically occurs on a secure payment gateway page, often identified by a padlock icon in the browser address bar and “https” at the beginning of the URL. The process is designed to ensure that only the legitimate cardholder can complete the transaction, even if someone obtains the credit card number and expiration date.

CVV2 Transmission Security Protocols

Online retailers utilize various security protocols to protect CVV2 numbers during transmission. These protocols encrypt the data, making it unreadable to unauthorized individuals. The most common protocol is Transport Layer Security (TLS), previously known as Secure Sockets Layer (SSL). TLS encrypts the communication between the customer’s browser and the retailer’s server, protecting the CVV2 number and other sensitive information from interception.

Payment gateways also employ robust security measures to protect data at rest and in transit. Data encryption and secure storage are critical components of this process, aiming to minimize the risk of data breaches and unauthorized access. Furthermore, many retailers use tokenization, replacing the actual CVV2 number with a unique token during the transaction process, adding another layer of security.

Best Practices for Protecting Your CVV2 Number

Protecting your CVV2 number requires vigilance and awareness. Avoid using public Wi-Fi networks for online transactions whenever possible, as these networks are more vulnerable to attacks. Always verify the website’s security before entering any sensitive information; look for the padlock icon and “https” in the URL. Never share your CVV2 number via email, text message, or other unsecured channels.

Regularly review your credit card statements for unauthorized transactions. Consider using virtual credit cards or payment services that offer additional security features. Finally, keep your computer’s operating system and antivirus software up to date to mitigate the risk of malware that could steal your information.

Safe CVV2 Entry During Online Checkout

Following these steps will help you safely enter your CVV2 number during online checkout:

| Step | Action | Security Measure | Potential Risk |

|---|---|---|---|

| 1 | Verify website security (look for padlock and “https”). | Ensures connection is encrypted. | Data interception if website is not secure. |

| 2 | Use a secure network (avoid public Wi-Fi). | Reduces risk of network-based attacks. | Data interception or malware infection on insecure networks. |

| 3 | Carefully enter your CVV2 number from your card. | Accurate entry prevents transaction rejection. | Transaction failure due to incorrect entry. |

| 4 | Do not save your CVV2 number on the website. | Reduces risk of data compromise if the website is breached. | Increased risk of fraudulent transactions if the website is compromised. |

| 5 | Review your transaction history regularly. | Allows for early detection of unauthorized activity. | Unnoticed fraudulent transactions leading to financial loss. |

CVV2 and Different Card Types

While the core function of the CVV2 remains consistent across different credit card brands, subtle variations exist in implementation, impacting the length, format, and associated security measures. Understanding these nuances is crucial for both merchants and cardholders to ensure secure online transactions. This section will explore these differences across major card networks.

The CVV2, or Card Verification Value 2, is a three- or four-digit security code printed on the back (or front for American Express cards) of most credit and debit cards. Its primary purpose is to verify that the person making the online purchase actually possesses the physical card, adding an extra layer of security beyond the card number, expiration date, and name.

CVV2 Length and Format Variations

The most significant difference between CVV2 implementations lies in the length and location of the code. Visa, Mastercard, and Discover cards typically feature a three-digit CVV2 printed on the back, usually near the signature strip. American Express cards, however, display a four-digit CVV2 on the front of the card, separate from the embossed card number. This difference in placement and length is a key distinguishing factor when processing transactions.

CVV2 Functionality Across Card Networks

Despite the variations in length and location, the fundamental function of the CVV2 remains consistent across all major card networks. It acts as an additional verification step, helping to prevent fraudulent transactions by confirming that the cardholder has physical possession of the card. The card issuer compares the CVV2 entered during an online transaction with the one stored on their system.

A mismatch indicates a potential security breach or unauthorized use. While the underlying principle is the same, the specific algorithms and security protocols employed by each network might differ, leading to slightly varying levels of protection.

Comparison of CVV2 Security Features

The security features associated with CVV2 are generally robust across all major brands, but subtle differences exist in their implementation and integration with other security protocols. A direct comparison is difficult due to the proprietary nature of these security systems. However, we can highlight some key aspects:

- Visa, Mastercard, and Discover: These networks typically utilize similar encryption and verification processes for CVV2, focusing on the secure transmission and comparison of the code. Their security measures are often integrated with other fraud detection systems, creating a layered approach to security.

- American Express: American Express’s four-digit CVV2, along with its other security protocols, is known for its robust security features. The company has a strong track record in fraud prevention and employs advanced techniques to detect and mitigate fraudulent activities. While specific details are not publicly available, their commitment to security is widely recognized.

What Happens if Your CVV2 is Compromised?: What Is Cvv2 In Credit Card

A compromised CVV2 number can lead to serious financial consequences. Because the CVV2 is used to verify cardholder identity for online and some in-person transactions, its theft can enable unauthorized purchases and withdrawals. The severity of the impact depends on the type of transaction and the swiftness of the cardholder’s response.

Consequences of a Compromised CVV2

The theft of your CVV2 can result in fraudulent charges appearing on your credit card statement. These charges could range from small, insignificant purchases to large, high-value transactions. The unauthorized use of your card can lead to significant financial losses and damage your credit score. Furthermore, the breach of your personal information can lead to identity theft, where criminals use your stolen data for other fraudulent activities.

The emotional stress and time spent rectifying the situation should also be considered a significant consequence.

Steps to Take if CVV2 is Suspected Stolen

If you suspect your CVV2 has been compromised, immediate action is crucial. First, review your credit card statement for any unauthorized transactions. If you find any suspicious activity, contact your bank’s fraud department immediately. Report the fraudulent charges and request that they be reversed. You should also change your online banking passwords and any other passwords that may be linked to your credit card information.

Consider placing a fraud alert or security freeze on your credit report to prevent further unauthorized access. Finally, keep detailed records of all communication with your bank and any police reports you file.

The Issuing Bank’s Role in Addressing CVV2-Related Fraud, What is cvv2 in credit card

Your issuing bank plays a vital role in mitigating the damage caused by CVV2-related fraud. Under the Fair Credit Billing Act, they are responsible for investigating and resolving any disputed charges. They should reverse any fraudulent transactions and, in many cases, will not hold you liable for the unauthorized charges, provided you reported them promptly. The bank also has internal security systems designed to detect unusual transaction patterns that might indicate fraudulent activity.

They may proactively contact you if they detect suspicious behavior linked to your card. However, it’s essential to remember that you are responsible for promptly reporting any suspected fraudulent activity.

Flowchart: Steps to Take if Your CVV2 is Compromised

The following flowchart illustrates the steps to take if you suspect your CVV2 has been compromised:[Imagine a flowchart here. The flowchart would begin with a box labeled “Suspect CVV2 Compromise?”. A “Yes” branch would lead to a sequence of boxes: “Review Credit Card Statement,” “Contact Bank’s Fraud Department,” “Report Fraudulent Charges,” “Change Passwords,” “Place Fraud Alert/Security Freeze,” “Keep Detailed Records.” A “No” branch would lead to a box labeled “End”.

Arrows would connect the boxes to indicate the flow of actions.]

CVV2 and EMV Chip Cards

CVV2 and EMV chip cards represent two crucial layers of security in modern payment systems, working together to significantly reduce the risk of fraudulent transactions. While both technologies aim to protect cardholders, they operate in distinct ways, offering complementary security measures. Understanding their individual roles and their combined effect is vital for comprehending the enhanced security landscape of today’s credit and debit cards.EMV chip cards, named after Europay, MasterCard, and Visa, utilize microchips embedded within the card to encrypt transaction data.

This encryption process makes it far more difficult for counterfeiters to clone cards and conduct fraudulent purchases. The chip creates a unique, one-time code for each transaction, rendering previously stolen data useless. However, the EMV chip primarily focuses on securing the in-person card-present transaction.

The Interplay of CVV2 and EMV Chip Technology

The CVV2 (Card Verification Value 2) code, a three- or four-digit number printed on the back of most credit and debit cards, serves as an additional layer of security, primarily for online and card-not-present transactions. While the EMV chip protects against card cloning in physical transactions, the CVV2 helps to verify that the person making the online purchase actually possesses the physical card.

This dual-layered approach significantly reduces the chances of fraud, even in scenarios where the card number itself might be compromised. The EMV chip secures the physical transaction, while the CVV2 adds a critical verification step for remote transactions.

Effectiveness Comparison: CVV2 and Other EMV Card Security Features

While the CVV2 is a vital component of card security, its effectiveness is not independent of other EMV card features. For instance, EMV chip cards often incorporate advanced encryption techniques and tokenization to further secure transactions. Tokenization replaces sensitive card details with unique, non-sensitive tokens during transactions, minimizing the risk of data breaches. The CVV2 complements these features by adding an extra layer of verification, particularly crucial in online transactions where the physical card is not present.

In essence, CVV2 acts as a final verification check, even when other EMV security measures are in place.

A Descriptive Illustration of CVV2 and EMV Chip Collaboration

Imagine a scenario where a customer attempts to make an online purchase. First, the customer enters their card details, including the CVV2 number. The merchant’s payment processor then sends the transaction details to the card issuer. The EMV chip, if the card has one, is not directly involved in this online transaction. However, the card issuer verifies the card number and the CVV2 against its database.

If both match, and the issuer confirms that the card is not reported as lost or stolen, the transaction is authorized. If the CVV2 is incorrect or missing, the transaction is declined, even if the card number is valid. This process illustrates how the CVV2 acts as a crucial independent check, complementing the security provided by the EMV chip in the card-present environment.

The combined use of the EMV chip and the CVV2 code provides a much stronger security measure than either technology could offer individually. The EMV chip protects against physical card cloning, while the CVV2 safeguards against unauthorized online purchases, even if the card number has been compromised through other means.

Last Word

In conclusion, understanding the role of the CVV2 number in credit card security is paramount in today’s digital landscape. By practicing safe online habits and being aware of the potential risks associated with compromised CVV2 numbers, you can significantly reduce your vulnerability to fraud. Remember, your CVV2 is a critical piece of information; treat it with the same level of care you would your credit card itself.

Staying informed and proactive is the best way to safeguard your financial security.