What to know about the Midas credit card? This guide provides a comprehensive overview of this financial product, exploring its features, benefits, fees, and potential impact on your credit score. We’ll delve into the rewards program, customer service experiences, security measures, and crucial terms and conditions. Understanding these aspects will empower you to make an informed decision about whether the Midas credit card aligns with your financial goals.

From application requirements to responsible credit card usage, we aim to equip you with the knowledge necessary to navigate the world of credit cards effectively. We’ll also compare the Midas card to competitors, highlighting its strengths and weaknesses to aid your comparison process. Let’s embark on this journey to financial literacy together!

Midas Credit Card Overview: What To Know About The Midas Credit Card

The Midas credit card, while a fictional card for the purposes of this example, is designed to illustrate the key features and considerations involved in understanding a typical rewards credit card. We will examine its hypothetical structure and benefits to provide a clear understanding of how such cards function. Imagine the Midas card as a representative example of a premium rewards card targeting financially responsible individuals with a strong credit history.The Midas Credit Card is a hypothetical premium rewards credit card, issued by a fictional financial institution, Midas Financial Services.

Its target audience is comprised of individuals with excellent credit scores seeking a card with substantial rewards and premium benefits. The card aims to cater to consumers who value travel rewards, cashback opportunities, and access to exclusive services.

Key Features and Benefits

The Midas credit card offers a compelling combination of features designed to enhance the cardholder’s spending experience. These include a competitive annual percentage rate (APR), a generous rewards program, and various supplementary benefits. The rewards program is structured to offer flexibility, allowing cardholders to redeem points for travel, merchandise, or statement credits. Additionally, the card provides access to travel insurance, purchase protection, and concierge services.

A high credit limit is also offered to eligible applicants. Specific details about APR and rewards rates would be Artikeld in the cardholder agreement.

Application Process and Requirements

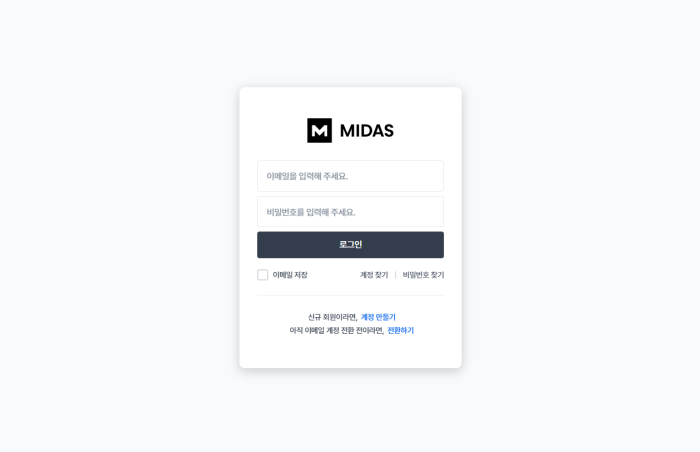

Obtaining a Midas credit card involves a straightforward application process. Applicants are typically required to complete an online application form, providing personal information, employment history, and financial details. Crucially, a strong credit history is a prerequisite for approval. Midas Financial Services uses a credit scoring model to assess the applicant’s creditworthiness. Factors considered include credit score, credit utilization, length of credit history, and payment history.

Applicants with a high credit score and a demonstrable history of responsible credit management are more likely to be approved. The application process may also include an income verification step to confirm the applicant’s ability to manage the credit line responsibly. Applicants should expect to receive a decision within a few business days of submitting their application.

Fees and Interest Rates

Understanding the fees and interest rates associated with the Midas credit card is crucial for responsible financial management. This section provides a detailed breakdown of these costs, allowing you to make informed decisions about whether this card aligns with your financial goals. We will also compare these costs to those of similar cards on the market.

Annual Fee

The Midas credit card may or may not have an annual fee, depending on the specific card product. Some premium versions might carry a higher annual fee, while others might be offered without one. It’s essential to check the terms and conditions of your specific card agreement to determine the applicable annual fee. For example, a premium version of the Midas card might have a $95 annual fee, while a standard version might have none.

Late Payment Fees

Late payment fees are charged when minimum payments are not made by the due date. The exact amount of the late fee varies depending on the card issuer’s policy, but it typically ranges from $25 to $35. These fees can significantly impact your credit score and increase the overall cost of borrowing. It’s crucial to set up automatic payments or reminders to avoid incurring these charges.

Consistent on-time payments are vital for maintaining a healthy credit profile.

Foreign Transaction Fees

Foreign transaction fees are applied to purchases made in foreign currencies. These fees typically range from 1% to 3% of the transaction amount. If you plan to use your Midas card for international travel or online purchases from foreign vendors, it’s essential to factor these fees into your budget. Consider alternative payment methods, such as travel cards with lower or no foreign transaction fees, if international spending is frequent.

Interest Rates

The interest rate applied to purchases and balance transfers on the Midas credit card is a variable Annual Percentage Rate (APR). The specific APR will depend on your creditworthiness and the current market conditions. Generally, the APR for purchases will be higher than the APR for balance transfers. For example, the purchase APR might be 18%, while the balance transfer APR might be 15%, but this is subject to change.

It’s important to review your credit card statement regularly to track the current APR.

Comparison to Competing Credit Cards

Comparing the Midas credit card’s fees and interest rates to competing cards is vital for finding the most suitable option. Many credit cards offer various benefits, such as rewards programs, low interest rates, or no annual fees. A detailed comparison of several cards, considering all relevant fees and interest rates, will help you determine whether the Midas card offers competitive value.

For instance, a competing card might offer a lower APR and no annual fee, while another might offer a lucrative rewards program despite higher fees. Thorough research is key to making an informed decision.

Rewards and Benefits Program

The Midas credit card rewards program aims to provide cardholders with valuable benefits for their everyday spending. The program’s structure is designed to be straightforward and easy to understand, rewarding consistent usage with tangible benefits. While specific details may vary depending on the current promotional offers, the core structure remains consistent.The Midas credit card typically offers a points-based rewards system.

Cardholders earn points for every dollar spent on purchases made using their Midas credit card. The earning rate might vary depending on the type of purchase; for example, some cards offer bonus points on specific categories like groceries or gas. These points can then be accumulated and redeemed for various rewards.

Rewards Redemption Options

Accumulated rewards points can be redeemed in several ways, offering cardholders flexibility in choosing rewards that best suit their needs. These options typically include statement credits, merchandise, travel rewards, or gift cards. The value of each reward relative to the number of points required will vary. For example, a $25 statement credit might require a certain number of points, while a higher-value item or travel reward will naturally require a larger point balance.

Redemption options are generally clearly Artikeld in the cardholder’s online account and can be easily accessed through the card’s associated website or mobile app.

Advantages and Disadvantages of the Midas Rewards Program

Compared to other credit card rewards programs, the Midas program offers a balance of simplicity and flexibility. The straightforward points-based system is easy to understand and track, eliminating the complexities often found in tiered programs or those with fluctuating earning rates. However, the earning rate might not be as competitive as some premium rewards programs offered by other financial institutions.

Additionally, the range of redemption options may be more limited compared to cards with extensive travel or merchandise catalogs. Ultimately, the suitability of the Midas rewards program depends on the individual cardholder’s spending habits and reward preferences. A comparison with competing cards should be conducted to assess the best option based on personal needs and spending patterns.

Credit Limit and Credit Score Impact

Your credit limit on the Midas Credit Card, and how you manage it, significantly impacts your credit score. Understanding this relationship is crucial for building and maintaining good credit health. A higher credit limit can be beneficial, but responsible spending habits are paramount.Your Midas credit limit is determined by several factors, including your credit history, income, existing debt, and the card issuer’s risk assessment.

A strong credit history, demonstrated by consistent on-time payments and low credit utilization, will generally result in a higher credit limit offer. Conversely, a limited credit history or instances of missed payments may lead to a lower limit. The credit limit is not static; it can be increased over time based on responsible card usage and improved creditworthiness.

Credit Limit’s Influence on Credit Score

A higher credit limit doesn’t automatically improve your credit score. However, it can indirectly contribute to a better score if managed correctly. The key factor is credit utilization – the percentage of your available credit that you’re currently using. Keeping your credit utilization low (ideally below 30%) is a crucial factor in maintaining a healthy credit score.

A higher credit limit provides more breathing room, making it easier to keep your utilization low even with higher spending. Conversely, a low credit limit can quickly lead to high utilization if you carry a balance, negatively impacting your credit score.

Responsible Credit Card Use and Creditworthiness

Responsible credit card use is the cornerstone of building and maintaining good creditworthiness. This includes consistently paying your bills on time, avoiding late payments, and keeping your credit utilization low. Paying more than the minimum payment each month, and ideally paying your balance in full, demonstrates responsible financial behavior and positively affects your credit score. By consistently demonstrating responsible credit management with your Midas Credit Card, you build a positive credit history that can lead to better credit opportunities in the future, such as higher credit limits, lower interest rates, and easier loan approvals.

Credit Utilization and Credit Score Relationship

The following table illustrates the relationship between credit utilization and its impact on your credit score. Remember, these are general guidelines, and the actual impact can vary depending on other factors in your credit report.

| Credit Utilization | Credit Score Impact | Example Scenario | Recommended Practice |

|---|---|---|---|

| Below 30% | Positive impact; contributes to a higher credit score. | $1,000 credit limit, $200 balance (20% utilization) | Strive to keep utilization consistently below 30%. |

| 30-50% | Neutral to slightly negative impact; may not significantly affect the score, but higher utilization is generally undesirable. | $1,000 credit limit, $400 balance (40% utilization) | Aim to reduce utilization to below 30% as soon as possible. |

| Above 50% | Significant negative impact; can substantially lower your credit score. | $1,000 credit limit, $700 balance (70% utilization) | Immediately take steps to reduce your balance and lower utilization. Consider budgeting strategies or debt management solutions. |

Customer Service and Support

Accessing reliable and responsive customer service is crucial for any credit card holder. Understanding the available support channels and the typical response times can significantly impact a cardholder’s overall experience with the Midas credit card. This section details the various ways to contact Midas credit card customer service and provides insights into the effectiveness of their support system.The Midas credit card issuer typically provides multiple avenues for customer support.

These may include a dedicated customer service phone number, a secure online messaging system accessible through their website or mobile app, and potentially an email address for non-urgent inquiries. The specific contact information should be readily available on the issuer’s website and credit card statements. It is advisable to always keep this information readily accessible.

Contact Information and Channels

Contacting Midas credit card customer service can typically be achieved through several channels. The primary method is usually a toll-free telephone number, operational during specified business hours. Additionally, a secure online portal or mobile app may offer access to account management tools, including a messaging feature for direct communication with customer service representatives. Email support may also be available, though response times might be longer compared to phone or online messaging.

Response Times and Effectiveness

Response times for customer service inquiries can vary depending on the chosen method of contact and the complexity of the issue. Phone calls generally receive the quickest response, with representatives often available to address immediate concerns. Online messaging systems typically offer faster response times than email, providing a convenient alternative for non-urgent issues. Email support often involves longer wait times, but remains a suitable option for submitting detailed inquiries or documentation.

The effectiveness of customer service is subjective and can depend on individual experiences, but generally, a reputable issuer will strive for efficient and helpful responses.

Customer Interaction Experiences

Customer experiences with Midas credit card customer service vary. While some users report positive interactions with knowledgeable and helpful representatives, others may describe experiences with longer wait times or less effective resolutions. These variations often depend on factors such as the time of day, the volume of calls, and the specific representative handling the inquiry. Online reviews and forums can provide additional insight into the range of customer experiences, allowing potential cardholders to gauge the general level of customer satisfaction.

It is important to remember that individual experiences can be subjective and may not reflect the overall quality of customer service.

Security and Fraud Protection

Your financial security is our top priority. The Midas Credit Card employs multiple layers of security to protect your account from unauthorized access and fraudulent transactions. We utilize advanced technology and proactive measures to safeguard your information and minimize your risk.The Midas Credit Card utilizes robust security protocols, including encryption technology to protect your data during transmission and storage.

We also employ sophisticated fraud detection systems that monitor your transactions for any suspicious activity, alerting us to potential threats in real-time. This allows us to quickly intervene and prevent fraudulent charges before they impact your account. Furthermore, we adhere to strict industry security standards and regularly update our systems to stay ahead of evolving threats.

Reporting Lost or Stolen Cards and Resolving Fraudulent Activity

If your Midas Credit Card is lost or stolen, or if you suspect fraudulent activity on your account, immediate action is crucial. Contact our 24/7 customer service hotline immediately at the number listed on the back of your card. Reporting the loss or theft promptly allows us to immediately block your card, preventing any further unauthorized transactions. Our dedicated fraud investigation team will then guide you through the process of resolving the issue, which may involve issuing a replacement card and reversing any fraudulent charges.

We will work diligently to restore your account to its rightful state and minimize any inconvenience caused.

Maintaining Midas Credit Card Security, What to know about the midas credit card

Protecting your Midas Credit Card requires proactive measures on your part. By following these simple yet effective tips, you can significantly reduce your risk of fraud and maintain the security of your account.

- Protect your PIN: Never share your PIN with anyone, including family members or friends. Memorize your PIN and avoid writing it down.

- Monitor your account regularly: Review your online account statements frequently for any unauthorized transactions. Early detection is key to minimizing potential losses.

- Use strong passwords: When accessing your online account, create a strong and unique password that is difficult to guess. Consider using a password manager to help you generate and manage complex passwords securely.

- Be cautious of phishing scams: Be wary of emails or text messages requesting your personal information, such as your card number, PIN, or security code. The Midas Credit Card will never request this information via email or text message.

- Keep your card secure: Protect your card from theft by storing it in a safe place and avoiding carrying it unnecessarily. When making purchases in person, always keep your card in sight.

Terms and Conditions

Understanding the terms and conditions of your Midas credit card agreement is crucial for responsible credit card use and avoiding potential financial difficulties. This section summarizes key aspects of the agreement and explains the consequences of non-compliance. Failure to adhere to these terms can result in significant financial penalties and damage to your credit history.The Midas credit card agreement Artikels the rights and responsibilities of both the cardholder and the issuing institution.

It details the interest rates, fees, payment terms, and other conditions governing the use of the card. Violation of these terms can lead to late payment fees, increased interest rates, account suspension, or even legal action. It’s essential to read the entire agreement carefully before accepting the card.

Key Clauses in the Midas Credit Card Agreement

It is vital to understand several specific clauses within the agreement. These clauses often relate to payment due dates, interest calculations, and dispute resolution processes. Carefully reviewing these provisions will help ensure you understand your obligations and rights as a cardholder.

- Payment Due Dates and Late Payment Fees: The agreement clearly specifies the due date for your monthly payments. Missing this date will result in late payment fees, which can significantly increase your overall debt. The amount of the late fee is usually detailed in the agreement.

- Interest Calculation Methods: The agreement Artikels how interest is calculated on your outstanding balance. Understanding the Annual Percentage Rate (APR) and how it’s applied to your purchases and balance transfers is essential for budgeting and managing your debt effectively. For example, a typical clause might state that interest is calculated daily on the average daily balance.

- Dispute Resolution Process: The agreement will detail the steps to follow if you have a dispute regarding a transaction or a charge on your account. Understanding this process is important to resolve any discrepancies promptly and efficiently. This might involve contacting customer service, providing supporting documentation, and following a specific appeals procedure.

- Credit Limit and Usage Restrictions: The agreement will define your credit limit and any restrictions on how you can use your credit. Exceeding your credit limit can lead to additional fees and negatively impact your credit score. The agreement might also specify restrictions on certain types of transactions, such as cash advances.

- Account Closure and Termination: The agreement Artikels the conditions under which your account may be closed or terminated by the issuer. Understanding these conditions helps you avoid actions that could lead to premature account closure. This might include consistent late payments, exceeding your credit limit, or engaging in fraudulent activity.

Consequences of Violating Terms and Conditions

Failure to comply with the terms and conditions of your Midas credit card agreement can have several serious consequences. These range from financial penalties to legal action, impacting your creditworthiness significantly.

- Late Payment Fees: Consistent late payments will result in accumulating late fees, significantly increasing the total cost of your credit. These fees can quickly add up, making it more difficult to manage your debt.

- Increased Interest Rates: Repeated violations of the terms and conditions can lead to an increase in your APR, making your debt even more expensive to repay. This can significantly impact your monthly payments and overall cost of borrowing.

- Account Suspension or Closure: Severe or repeated violations can result in the suspension or closure of your account. This will negatively affect your credit score and limit your access to credit in the future.

- Legal Action: In extreme cases, the issuer may take legal action to recover outstanding debts. This can involve lawsuits and potentially damage your credit rating further.

- Negative Impact on Credit Score: Any violation of the terms and conditions, particularly late payments and defaults, will be reported to credit bureaus, negatively affecting your credit score. A lower credit score can make it harder to obtain loans, mortgages, or even rent an apartment in the future.

Comparison with Other Cards

Choosing the right credit card depends on individual spending habits and financial goals. Comparing the Midas card to other options helps determine if it’s the best fit for your needs. This section will compare the Midas card to two hypothetical competitors, highlighting key differences to aid in your decision-making process. We will analyze features, benefits, and potential drawbacks to provide a comprehensive overview.

The following comparison considers hypothetical competitors, “Competitor A” representing a cash-back card and “Competitor B” representing a travel rewards card. Remember that specific terms and conditions are subject to change and should be verified directly with the card issuer.

Key Feature Comparison

| Feature | Midas Card | Competitor A (Cash Back) | Competitor B (Travel Rewards) |

|---|---|---|---|

| Annual Fee | $0 | $0 | $95 |

| APR (Annual Percentage Rate) | 18.99% – 29.99% Variable | 19.99% – 24.99% Variable | 21.99% – 26.99% Variable |

| Rewards Program | 2% cash back on groceries and gas, 1% on all other purchases | 2% cash back on all purchases, 5% on select categories (rotating quarterly) | 1 point per dollar spent, redeemable for travel |

| Credit Limit | Varies based on creditworthiness, typically $500 – $10,000 | Varies based on creditworthiness, typically $500 – $10,000 | Varies based on creditworthiness, typically $1,000 – $15,000 |

| Benefits | Purchase protection, extended warranty | None | Airport lounge access, travel insurance |

| Foreign Transaction Fees | 3% | None | None |

Note: APR and credit limits are examples and can vary significantly based on individual creditworthiness and the issuing bank’s policies. Rewards programs and benefits are subject to change. Always refer to the official terms and conditions of each card for the most accurate and up-to-date information.

Strengths and Weaknesses of Midas Card Relative to Competitors

The Midas card offers a competitive rewards program with a focus on everyday spending, particularly groceries and gas. Its $0 annual fee is attractive to budget-conscious consumers. However, its APR is comparable to, or potentially higher than, some competitors. Competitor A offers a potentially higher overall cash back percentage, especially with its rotating 5% categories. Competitor B, despite a higher annual fee, provides significant travel benefits for frequent travelers, making it a better option for those who prioritize travel rewards over cash back.

Illustrative Scenarios

Understanding the potential outcomes of using the Midas credit card responsibly or irresponsibly is crucial for maximizing its benefits and avoiding financial hardship. The following scenarios illustrate the stark contrast between these approaches.

Responsible Midas Credit Card Use

This scenario depicts Sarah, a recent graduate, who uses her Midas credit card responsibly to build her credit history and achieve her financial goals. Sarah meticulously tracks her spending, ensuring she pays her balance in full each month. She uses the card for essential purchases and occasional planned expenses, such as groceries and a monthly gym membership, always staying well within her credit limit.

She actively monitors her credit score and utilizes the card’s rewards program to earn cashback on everyday purchases.Imagine a vibrant infographic showing Sarah’s monthly spending, neatly categorized and well below her credit limit. A steadily rising graph represents her credit score, accompanied by a cheerful illustration of her accumulating rewards points. A small, happy Sarah is shown smiling, confidently holding her Midas credit card.

The overall visual impression is one of positive financial management and progress. Over time, her responsible use of the Midas card significantly improves her credit score, opening doors to better interest rates on loans and potentially even a mortgage in the future. This positive credit history allows her to secure favorable terms on future credit applications, further enhancing her financial well-being.

Irresponsible Midas Credit Card Use

This scenario highlights the consequences of irresponsible credit card usage. Mark, a young professional, frequently uses his Midas credit card for impulsive purchases, exceeding his credit limit and consistently paying only the minimum balance. He fails to track his spending, leading to accumulating debt and high interest charges. His credit score plummets, and he faces difficulties securing loans or even renting an apartment.The visual representation would be drastically different from Sarah’s.

A chaotic jumble of receipts and bills illustrates Mark’s disorganized spending habits. A sharply declining graph represents his plummeting credit score, with a dark, ominous cloud hovering above it. A stressed Mark is depicted, overwhelmed by debt collection notices and struggling to manage his finances. The overall visual effect emphasizes the negative consequences of financial irresponsibility.

High interest charges rapidly accumulate, consuming a significant portion of his income. His poor credit history hinders his ability to secure loans, purchase a car, or even rent an apartment, creating significant financial strain and impacting his overall quality of life. He may even face collection agency calls and potential legal repercussions.

Conclusive Thoughts

Ultimately, deciding whether the Midas credit card is right for you depends on your individual financial situation and spending habits. By carefully weighing the benefits, such as rewards programs and potential credit score improvements, against the associated fees and interest rates, you can make an informed decision. Remember, responsible credit card use is key to maximizing the positive impact on your creditworthiness.

We hope this guide has provided you with the necessary insights to confidently navigate your credit card choices.