What is bbcw merchant on credit card statement chase – What is BBCW merchant on Chase credit card statement? This question often arises when reviewing monthly statements, prompting concern and investigation. Understanding the meaning behind “BBCW” is crucial for determining whether a transaction is legitimate or fraudulent. This guide will explore potential meanings of BBCW, steps to investigate suspicious charges, and strategies for preventing future occurrences. We will examine both legitimate and fraudulent scenarios, providing you with the knowledge and tools to confidently manage your Chase credit card account.

The ambiguity surrounding “BBCW” necessitates a thorough examination. It could represent a legitimate business, a miscoded transaction, or even a fraudulent charge. By systematically investigating the transaction details, contacting Chase customer support, and employing robust security measures, you can protect yourself from financial loss and maintain control over your finances. This guide aims to empower you with the information and resources necessary to navigate this situation effectively.

Understanding BBCW Charges on Chase Credit Card Statements

The abbreviation “BBCW” on your Chase credit card statement might seem mysterious, but understanding its potential meanings is crucial for monitoring your account activity and ensuring your financial security. While Chase doesn’t publicly define this specific code, analyzing its context within your transactions is key to determining its legitimacy. This explanation explores various possibilities and helps you identify potentially fraudulent activity.

Possible Meanings of BBCW Charges

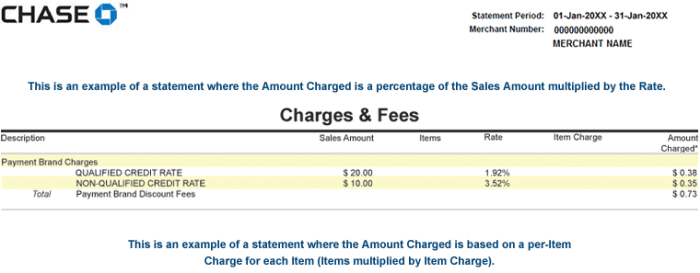

The meaning of “BBCW” depends entirely on the merchant who processed the transaction. It’s highly unlikely to be a standardized code across all merchants. Therefore, carefully reviewing the associated merchant name and transaction details is paramount. Without knowing the specific merchant, “BBCW” could represent an internal merchant code, an abbreviation for a specific product or service, or even a typing error.

It’s crucial to contact Chase customer service directly if you cannot identify the source of the charge.

Examples of Legitimate BBCW Transactions

Imagine a scenario where “BBCW” represents a shortened version of a business name, perhaps “Big Bend Cycle Works,” a bicycle shop. A legitimate charge might appear as follows: “BBCW – Bicycle Repair” for $75. Similarly, if “BBCW” is an internal code used by a larger retailer like a department store, it could represent a specific department or product line.

For example, a purchase of “BBCW – Home Goods” for $150 could be a valid transaction. Another example could be “BBCW – Online Subscription” for $29.99, referring to a subscription service with a shortened code.

Scenarios Indicating Fraudulent BBCW Charges

A fraudulent “BBCW” charge might lack clear identification of the merchant or show inconsistencies. For instance, an unfamiliar merchant name associated with “BBCW” and an unusually high amount should raise immediate suspicion. A charge for an item or service you never purchased or a recurring charge without your authorization are clear red flags. Additionally, a charge with an inaccurate description or an unusual location might indicate fraudulent activity.

For example, a “BBCW – Unknown Charge” for $500 appearing on your statement from a location you haven’t visited recently warrants immediate investigation.

Comparison of Legitimate and Fraudulent BBCW Charges

| Transaction Type | Description | Amount | Potential Indicator of Fraud |

|---|---|---|---|

| Legitimate Purchase | BBCW – Bike Repair | $75.00 | None; recognizable merchant and expected amount. |

| Legitimate Subscription | BBCW – Online Service | $19.99 | None; recurring charge you authorized. |

| Potentially Fraudulent | BBCW – Unknown Charge | $300.00 | Unfamiliar merchant, high amount, and vague description. |

| Potentially Fraudulent | BBCW – International Transaction | $1000.00 | Unauthorized international transaction with an unknown merchant. |

Investigating the Source of BBCW Charges

Uncovering the origin of a “BBCW” charge on your Chase credit card statement requires a systematic approach. This involves carefully reviewing your transactions, contacting the merchant directly, and utilizing Chase’s dispute resolution process if necessary. Remember, acting promptly is crucial in resolving any discrepancies.Understanding the potential sources of this charge is the first step. While the specific meaning of “BBCW” might not be immediately apparent, it’s important to note that it’s likely an abbreviation used by a specific merchant or a payment processor.

By systematically investigating your recent purchases and online activity, you can trace the source of this transaction.

Steps to Investigate BBCW Charges

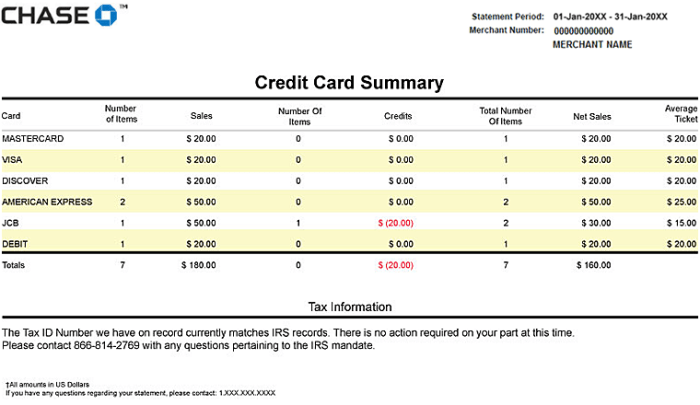

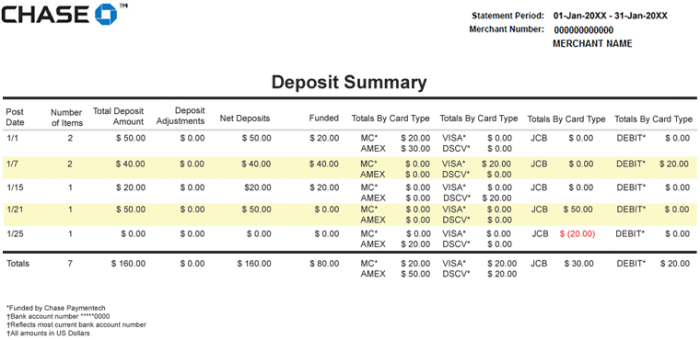

Begin by carefully reviewing your Chase credit card statement, paying close attention to the date, amount, and any available merchant description associated with the BBCW charge. Next, cross-reference this information with your online banking records and any physical receipts you may have. Compare the transaction date and amount to your own records of purchases to identify potential matches.

If you identify a possible merchant, contact them directly via phone or email to inquire about the transaction. Provide them with the transaction date and amount, and any other identifying information from your statement. Should you be unable to identify the source, or if the merchant denies the transaction, proceed to utilize Chase’s dispute resolution resources.

Utilizing Chase’s Dispute Resolution Resources

Chase offers several avenues for disputing unauthorized or unrecognized transactions. You can typically initiate a dispute online through your Chase account, by phone, or via mail. Be prepared to provide detailed information about the BBCW charge, including the date, amount, and any supporting documentation, such as receipts or cancelled checks. Chase will then investigate the matter and will contact you with their findings.

Their response time may vary, so patience is key. Remember to retain copies of all communication with Chase throughout the dispute process.

Flowchart for Reporting a Suspicious BBCW Charge

The following flowchart illustrates the process:[Start] –> [Review Chase Statement & Records] –> [Identify Potential Merchant?] –> [Yes] –> [Contact Merchant] –> [Merchant Confirms Transaction?] –> [Yes] –> [End] –> [No] –> [Contact Chase Dispute Resolution] –> [Chase Investigates] –> [Resolution] –> [End] –> [No] –> [Gather Supporting Documentation] –> [Contact Chase Dispute Resolution] –> [Chase Investigates] –> [Resolution] –> [End]

Importance of Regular Statement Review

Regularly reviewing your credit card statements is paramount in preventing and addressing unauthorized charges. By examining your statement promptly after receiving it, you significantly increase the chances of identifying and disputing any fraudulent or erroneous transactions quickly. Early detection allows for a more efficient resolution process and minimizes potential financial losses. Setting a reminder on your calendar can help ensure you maintain a consistent review schedule.

This proactive approach can save you time, stress, and money in the long run.

Contacting Chase Customer Support Regarding BBCW Charges: What Is Bbcw Merchant On Credit Card Statement Chase

If you’ve discovered unexplained “BBCW” charges on your Chase credit card statement, contacting Chase customer support is crucial to resolving the issue. A prompt and well-organized approach will significantly improve your chances of a successful outcome. This section Artikels a step-by-step process to help you navigate this situation effectively.

Step-by-Step Guide to Contacting Chase Customer Support

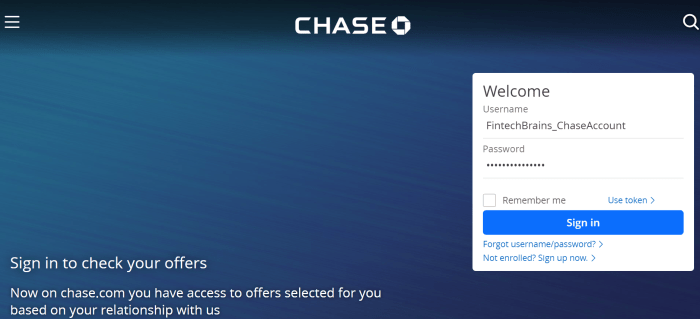

To begin, identify the most convenient method for contacting Chase. Options typically include phone, online chat, or the Chase mobile app. Each method has its own advantages and disadvantages. The phone may offer more immediate assistance, while online chat provides a written record. The mobile app offers convenience for those already using the platform.

Choose the method best suited to your needs and preferences. Once you’ve selected your method, follow the prompts to reach a customer service representative. Be prepared to provide your account information, the date(s) of the transaction(s), and the amount(s) in question. Clearly explain the situation, emphasizing your uncertainty regarding the “BBCW” charges.

Effective Communication Strategies for Potentially Fraudulent Transactions

When discussing potentially fraudulent charges, maintain a calm and professional demeanor. Clearly state your belief that the “BBCW” charges are unauthorized. Provide all relevant details, including the date, amount, and any identifying information associated with the transaction. Avoid accusatory language and instead focus on the facts. For example, instead of saying “This is clearly fraud!”, try “I do not recognize this transaction and believe it may be unauthorized.” Remember to be polite but firm in your request for assistance.

A calm and organized approach will help ensure a productive conversation.

Essential Information to Have Ready

Before contacting Chase, gather the following information: Your Chase credit card account number, the date(s) of the “BBCW” charge(s), the amount(s) of the charge(s), your billing address, your contact information (phone number and email address), and any other relevant documentation, such as screenshots of the transaction details from your online banking portal. Having this information readily available will expedite the process and ensure a smoother interaction with the customer service representative.

Documenting Communication with Chase, What is bbcw merchant on credit card statement chase

Thoroughly document all communication with Chase regarding the “BBCW” charges. This includes noting the date and time of each contact, the name of the representative (if possible), a summary of the conversation, and any actions agreed upon. Keep copies of any emails, chat transcripts, or notes from phone calls. This detailed record will be invaluable if further action is needed to resolve the issue.

Maintaining this detailed record will be crucial for future reference, should further action be required.

Preventing Future BBCW-Type Charges

Protecting yourself from unauthorized credit card charges requires a multi-faceted approach encompassing robust security measures, safe online practices, and vigilance against phishing attempts. By proactively implementing these strategies, you can significantly reduce your risk of experiencing fraudulent transactions like those potentially associated with BBCW charges.Understanding the various avenues through which unauthorized charges can occur is crucial for effective prevention.

These charges often stem from compromised accounts, weak security practices, or falling victim to sophisticated phishing schemes. Implementing the security measures described below will help mitigate these risks.

Strong Password Practices and Regular Software Updates

Strong passwords are the first line of defense against unauthorized access to your online accounts. A strong password is long, complex, and unique to each account. Avoid using easily guessable information such as birthdays, pet names, or common words. Consider using a password manager to generate and securely store strong, unique passwords for all your online accounts. Regularly updating your security software, including antivirus and anti-malware programs, is equally important.

These programs provide real-time protection against viruses, malware, and other threats that can compromise your computer and access your personal information, including credit card details. Ensure that automatic updates are enabled to maintain the highest level of protection.

Best Practices for Online Shopping and Credit Card Usage

When shopping online, only use secure websites, indicated by “https” in the address bar and a padlock icon. Be wary of websites that look unprofessional or have poor reviews. Before entering your credit card information, verify the website’s legitimacy and check for any suspicious activity. Avoid using public Wi-Fi networks for online transactions as these networks are often less secure and vulnerable to hacking.

When possible, use your credit card’s virtual card number for online purchases, providing an extra layer of security. This creates a temporary card number that can be used for online transactions, protecting your actual card number. Regularly review your credit card statements for any unauthorized transactions.

Protecting Personal Information and Avoiding Phishing Scams

Protecting your personal information is paramount. Avoid sharing sensitive data, such as your credit card number, social security number, or password, over unsecured channels like email or social media. Be cautious of unsolicited emails or phone calls requesting personal information. Phishing scams often mimic legitimate organizations to trick individuals into revealing their credentials. Never click on links in suspicious emails or text messages.

Instead, navigate directly to the organization’s website to verify the authenticity of the communication. If you suspect a phishing attempt, report it to the appropriate authorities and the organization being impersonated. Consider enabling two-factor authentication (2FA) for all your online accounts. This adds an extra layer of security, requiring a second form of verification beyond your password to access your account.

Illustrative Examples of BBCW Transactions (Hypothetical)

Understanding the nature of a “BBCW” charge requires examining both legitimate and fraudulent scenarios. The following examples illustrate how a BBCW charge might appear on your Chase credit card statement under different circumstances. While the specific merchant name “BBCW” is hypothetical, the principles apply to any unfamiliar or questionable charge.

The key to distinguishing legitimate from fraudulent transactions lies in recognizing familiar merchant names, verifying purchase dates and amounts against your own records, and carefully reviewing your online banking activity for details of the purchase.

Legitimate BBCW Transaction

This example depicts a scenario where a “BBCW” charge is a genuine purchase. Imagine “BBCW” represents a small, locally-owned bookstore called “Books By the Creek West” which uses a less common payment processor. A transaction of $75.50 was made on October 26, 2024, for the purchase of several books and a gift card. Upon checking your receipts, you confirm the purchase and recognize the bookstore’s name, albeit abbreviated on your statement.

Fraudulent BBCW Transaction

Conversely, a fraudulent “BBCW” charge might appear as follows: A $250.00 charge appears on your statement dated November 15, 2024, from a merchant identified as “BBCW.” You have no recollection of this purchase and cannot identify “BBCW” as a merchant you’ve ever patronized. Further investigation reveals no online presence for a merchant with this name, and your recent purchase history shows no such expense.

Comparison of Legitimate and Fraudulent BBCW Charges

The following table highlights the key differences between a legitimate and a fraudulent “BBCW” transaction:

| Feature | Legitimate Transaction | Fraudulent Transaction |

|---|---|---|

| Merchant Recognition | Recognized (after investigation, possibly an abbreviation) | Unrecognized; no online presence found |

| Transaction Amount | Consistent with typical spending habits | Unusual or significantly higher than typical spending |

| Purchase Date | Matches a known purchase date | No corresponding purchase date found in personal records |

| Purchase Confirmation | Receipts or online confirmation available | No supporting documentation or purchase memory |

Concluding Remarks

In conclusion, encountering a “BBCW” charge on your Chase credit card statement requires prompt attention and careful investigation. While it could represent a legitimate purchase, the potential for fraudulent activity necessitates a proactive approach. By following the steps Artikeld—reviewing transaction details, contacting Chase customer service, and implementing robust security measures—you can effectively address the issue and protect yourself against future unauthorized charges.

Remember, regular monitoring of your credit card statements is crucial for maintaining financial security.