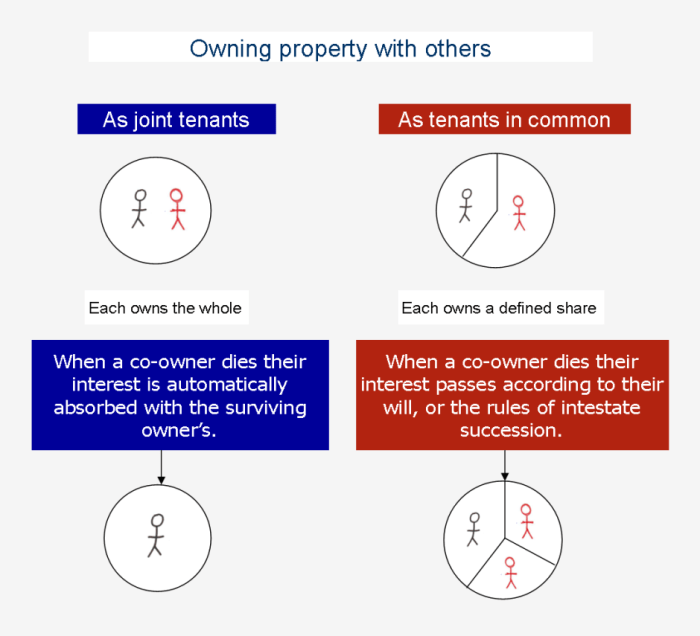

What is joint tenancy in real estate? Understanding this crucial aspect of property ownership is key to navigating the complexities of real estate transactions and estate planning. Joint tenancy, unlike sole ownership or tenancy in common, establishes a unique form of co-ownership where each tenant possesses an undivided interest in the entire property. This shared ownership carries specific rights, responsibilities, and implications for inheritance and future transactions, making it essential to comprehend its intricacies before entering into such an arrangement.

This comprehensive guide will delve into the fundamental characteristics of joint tenancy, exploring the four unities required to establish it – possession, interest, time, and title. We will compare and contrast joint tenancy with tenancy in common, highlighting the key differences and helping you determine which ownership structure best suits your circumstances. Furthermore, we will examine the rights and responsibilities of joint tenants, the implications of severance, and the impact of joint tenancy on estate planning, mortgages, and potential disputes.

Rights and Responsibilities of Joint Tenants

Joint tenancy in real estate grants each owner equal and undivided rights to the entire property. Understanding the rights and responsibilities associated with this form of ownership is crucial for all parties involved. This section will clarify the rights of each joint tenant, Artikel their shared responsibilities, and explain the implications of death on the ownership structure.

Rights of Joint Tenants, What is joint tenancy in real estate

Each joint tenant possesses the right to possess and use the entire property. This means that no single joint tenant can exclude another from using any part of the property. They share equal rights of enjoyment, regardless of the initial contribution to the purchase price. Furthermore, each joint tenant has the right to sell their interest in the property, although this action will typically sever the joint tenancy and convert it into a tenancy in common.

Finally, all joint tenants share equally in any profits derived from the property, such as rental income.

Responsibilities of Joint Tenants Regarding Maintenance and Expenses

Joint tenants share equally in the responsibility for maintaining the property and covering its expenses. This includes paying property taxes, insurance premiums, mortgage payments (if applicable), and the costs of repairs and improvements. Failure by one joint tenant to contribute their fair share can lead to legal disputes and financial hardship for the others. Agreements on how these responsibilities will be managed should be established early in the ownership to prevent future conflicts.

For example, joint tenants might agree to share expenses equally or proportionally to their initial investment.

Implications of One Joint Tenant’s Death

Upon the death of one joint tenant, their interest in the property automatically transfers to the surviving joint tenant(s) by the right of survivorship. This is a defining characteristic of joint tenancy. No probate process is required, simplifying the transfer of ownership and avoiding potential delays and legal fees. The surviving joint tenant(s) inherit the deceased tenant’s share without needing to go through a will or court proceedings.

This process is immediate and avoids the complexities and costs often associated with transferring property after death.

Examples Illustrating Responsibilities and Liabilities

Consider two individuals, Alice and Bob, who are joint tenants of a house. If the roof needs repair, both Alice and Bob are equally responsible for the cost of the repairs. If Bob fails to contribute his share, Alice could be forced to cover the entire cost and then pursue legal action to recover Bob’s share. Similarly, if the property generates rental income, Alice and Bob would share the profits equally, unless they have a prior agreement stating otherwise.

Conversely, if the property incurs debt, such as unpaid property taxes, both Alice and Bob are jointly and severally liable for the debt. A creditor could pursue either Alice or Bob for the full amount owed. This highlights the importance of open communication and shared responsibility in a joint tenancy.

Severance of Joint Tenancy

Severing a joint tenancy means breaking the right of survivorship, altering the ownership structure from a joint tenancy to a tenancy in common. This action fundamentally changes how the property is owned and passed on upon the death of a joint tenant. Understanding the methods and consequences of severance is crucial for anyone involved in a joint tenancy agreement.Severance of a joint tenancy can be achieved through several methods, each involving distinct legal processes and resulting in specific consequences for the ownership of the property.

Methods of Severance

Severance can occur through a variety of actions, each having legal ramifications. These methods effectively end the four unities (possession, interest, time, and title) that define a joint tenancy. The most common methods are Artikeld below.

- Transfer to a Third Party: One joint tenant can transfer their interest in the property to a third party. This immediately severs the joint tenancy, transforming the transferring tenant’s share into a tenancy in common. The remaining joint tenants retain their joint tenancy amongst themselves, but the severed share now belongs to the third party as a tenant in common.

- Mutual Agreement: All joint tenants can mutually agree to sever the joint tenancy. This requires a written agreement that clearly expresses the intention to sever and Artikels the new ownership structure, often converting the joint tenancy into a tenancy in common with defined shares for each former joint tenant.

- Court Order: A court may order the severance of a joint tenancy in certain circumstances, such as during a divorce proceeding or to resolve a dispute between joint tenants. The court’s order will specify the new ownership structure and the rights and responsibilities of each party.

- Unilateral Act of Severance: In some jurisdictions, a joint tenant can unilaterally sever the joint tenancy by executing a document declaring their intention to sever. This method varies significantly by jurisdiction and requires precise legal compliance. The exact form and registration requirements are crucial and often involve specific legal counsel.

Legal Processes Involved in Severance

The legal processes involved in severing a joint tenancy vary depending on the chosen method and the jurisdiction. Generally, they involve preparing and executing legal documents, such as deeds, agreements, or court orders. These documents must accurately reflect the intentions of the parties involved and comply with all relevant legal requirements. Registration of the documents with the appropriate land registry is usually necessary to formally effect the severance and update the official ownership records.

In cases involving court orders, the process may be more complex and involve legal representation.

Consequences of Severance on Ownership Structure

Severance fundamentally alters the ownership structure. The right of survivorship, a defining characteristic of joint tenancy, is extinguished. Upon the death of a tenant, their share does not automatically pass to the surviving joint tenants; instead, it passes according to their will or the rules of intestacy (if they die without a will). The property becomes a tenancy in common, where each owner holds a distinct, undivided share of the property.

This means each owner can independently sell, mortgage, or bequeath their share without the consent of the other owners.

Examples of Situations Leading to Severance

Several situations frequently lead to the severance of a joint tenancy. For instance, a disagreement between joint tenants regarding the property’s management or use might prompt one tenant to seek severance. Divorce proceedings often result in the severance of a joint tenancy, with the court dividing the property between the divorcing parties. Financial difficulties, such as the need for one tenant to access equity in the property, may also lead to severance.

Finally, a simple change in personal circumstances or a shift in the relationship between the joint tenants might lead one party to seek to sever the joint tenancy and establish a separate ownership structure.

Joint Tenancy and Wills

Joint tenancy significantly impacts estate planning and the process of distributing assets after death. Understanding how joint tenancy interacts with a will is crucial for ensuring your wishes are carried out and for minimizing potential tax liabilities. This section explores the relationship between joint tenancy and wills, highlighting key considerations for individuals holding property in this manner.

Impact of Joint Tenancy on Estate Planning and Wills

A joint tenancy with right of survivorship automatically transfers ownership to the surviving joint tenant(s) upon the death of one tenant. This bypasses the probate process, meaning the property isn’t included in the deceased’s will. This can simplify estate administration and reduce costs, but it also means the deceased has no control over who inherits the property after their death.

Careful consideration should be given to the implications of this automatic transfer, especially in cases where the deceased wishes to leave their share of the property to someone other than the surviving joint tenant. For example, if John and Mary own a house as joint tenants, and John dies, the house automatically transfers to Mary, regardless of any instructions in John’s will.

How a Will Affects the Transfer of Property Held in Joint Tenancy

A will has no effect on the transfer of property held in joint tenancy. The right of survivorship dictates that the property automatically passes to the surviving tenant(s). This is a fundamental characteristic of joint tenancy. While a will can determine the distribution of other assets, it cannot override the automatic transfer inherent in a joint tenancy.

This is true even if the will explicitly states a different disposition for the jointly held property. Therefore, planning for the distribution of jointly held assets requires careful consideration before establishing the joint tenancy.

Potential Tax Implications of Joint Tenancy Upon the Death of a Tenant

The tax implications of joint tenancy upon the death of a tenant depend on several factors, including the jurisdiction and the value of the property. Generally, the property’s value is included in the deceased’s estate for tax purposes only to the extent of the deceased’s share. However, the surviving joint tenant receives the entire property without paying any inheritance tax on the deceased’s share, which can lead to significant tax savings compared to properties held in other forms of ownership.

For example, if a property worth $500,000 is held in joint tenancy and one owner dies, the surviving owner inherits the entire property, and only half of the property value is included in the deceased’s estate for tax purposes. This can result in substantial tax savings compared to situations where the property is held solely by the deceased. It is important to consult with a tax professional to determine the specific tax implications in your situation.

Inheritance Process Comparison: Jointly Held Property

The following table compares the inheritance process for jointly held property with and without a will:

| Feature | With a Will | Without a Will |

|---|---|---|

| Transfer of Property | Will has no effect on jointly held property; it passes to the surviving joint tenant(s) automatically. | Property passes to the surviving joint tenant(s) automatically. |

| Probate Involvement | Jointly held property is typically excluded from probate. | Jointly held property is typically excluded from probate. |

| Time to Transfer | Relatively quick, as it bypasses probate. | Relatively quick, as it bypasses probate. |

| Cost | Typically lower costs due to avoidance of probate. | Typically lower costs due to avoidance of probate. |

Joint Tenancy and Mortgages: What Is Joint Tenancy In Real Estate

Mortgages significantly impact joint tenancy, altering the rights and responsibilities of the involved parties. Understanding these implications is crucial for anyone considering purchasing property jointly while using a mortgage. This section will explore how mortgages affect joint tenancy, the process of refinancing, and potential challenges that may arise.Mortgages and Joint Tenancy: An OverviewA mortgage on a property held in joint tenancy means that all joint tenants are jointly and severally liable for the repayment of the loan.

This means that the lender can pursue any one or all of the joint tenants for the full amount of the outstanding debt. This differs from tenancy in common, where liability is typically divided proportionally according to ownership shares. The mortgage does not sever the joint tenancy; the property remains owned equally by all joint tenants, despite the existence of the debt.

Implications of a Mortgage on Joint Tenant Rights

A mortgage placed on a jointly owned property affects the rights of each joint tenant in several ways. Firstly, each tenant’s ability to sell their share independently is limited. While they can sell their interest, the buyer would be subject to the existing mortgage. Secondly, any one joint tenant can be held liable for the entire mortgage debt should others fail to make payments.

This underscores the importance of open communication and shared financial responsibility amongst joint tenants. Finally, the right to occupy the property remains unchanged unless stipulated otherwise in a legal agreement.

Refinancing a Property Held in Joint Tenancy

Refinancing a property held in joint tenancy typically involves all joint tenants applying for the new mortgage together. The lender will assess the creditworthiness of each applicant and consider their combined income and debt levels. The process is similar to obtaining an initial mortgage, requiring documentation such as proof of income, credit reports, and an appraisal of the property.

All joint tenants must agree to the terms of the refinancing. If one joint tenant refuses, the refinancing cannot proceed. This emphasizes the collaborative nature of managing a jointly owned property.

Challenges Arising from Combining Mortgages and Joint Tenancies

Several challenges can arise when combining mortgages and joint tenancies.A list of potential challenges is presented below:

- Disputes over mortgage payments: Disagreements regarding responsibility for mortgage payments can lead to serious financial and legal issues. A clear understanding and agreement on payment responsibilities is crucial.

- Difficulties in refinancing: If one joint tenant experiences a decline in creditworthiness, it can significantly impact the ability to refinance, even if the other joint tenants maintain good credit.

- Impact of death or divorce: The death of one joint tenant typically transfers ownership to the surviving joint tenant(s), freeing them from the mortgage debt only if they continue to make the payments. However, divorce proceedings can lead to the severance of the joint tenancy and potentially complex legal battles regarding mortgage liability.

- Financial hardship for remaining joint tenants: If one joint tenant defaults on the mortgage or faces financial difficulties, the remaining joint tenant(s) bear the full responsibility for the debt.

Joint Tenancy and Disputes

Joint tenancy, while offering a convenient way to own property, can also lead to disagreements among the owners. Understanding the potential for disputes and the methods for resolving them is crucial for anyone considering this form of ownership. This section will explore common causes of disputes, the legal processes involved in their resolution, and provide a hypothetical example to illustrate the process.Disputes among joint tenants can arise from a variety of sources, often stemming from differing opinions on the use, maintenance, or sale of the property.

The lack of clearly defined individual ownership rights inherent in joint tenancy can exacerbate these disagreements. Legal resolution often involves navigating complex property law and potentially costly litigation.

Common Causes of Disputes Among Joint Tenants

Disagreements between joint tenants frequently center around financial contributions, property maintenance, and decisions regarding the sale or refinancing of the property. Unequal contributions to the purchase price, for example, can create tension, particularly if one tenant has significantly invested more than others. Differing views on necessary repairs or improvements can also lead to conflict. Furthermore, disagreements about selling the property, particularly if one tenant wishes to sell while others do not, are common sources of contention.

These disputes can escalate and significantly impact the relationships between the joint tenants.

Legal Procedures for Resolving Disputes Between Joint Tenants

The resolution of disputes between joint tenants can range from informal negotiation and mediation to formal court proceedings. Initially, open communication and attempts at compromise are often the most effective approach. Mediation, facilitated by a neutral third party, can help the parties reach a mutually agreeable solution. If these methods fail, litigation may be necessary. Court proceedings may involve seeking a court order for the sale of the property or a partition, dividing the property amongst the tenants.

The specific legal procedures will depend on the jurisdiction and the nature of the dispute. The legal costs associated with litigation can be substantial, making alternative dispute resolution methods preferable whenever possible.

Hypothetical Scenario and Dispute Resolution

Imagine three siblings, Alex, Ben, and Chloe, who jointly own a family home inherited from their parents. Alex, who lives in a different state, contributes less to the property’s upkeep than Ben and Chloe, who reside in the house. A dispute arises when Ben and Chloe want to renovate the kitchen, a project Alex opposes due to the cost.

Ben and Chloe believe Alex should contribute financially, while Alex argues that their unequal use of the property justifies a reduced contribution.Initially, Ben and Chloe attempt to discuss the matter with Alex, but they are unable to reach an agreement. They then explore mediation, where a neutral mediator helps them communicate effectively and find common ground. The mediator might suggest a compromise, such as Alex contributing a smaller amount towards the renovation in exchange for Ben and Chloe covering a greater portion of future maintenance costs.

If mediation fails, Ben and Chloe could consider filing a lawsuit seeking a court order for the sale of the property or a partition, although this is generally a last resort due to the potential for strained family relationships and legal expenses. The court would weigh the arguments of each sibling, considering their contributions and use of the property, to determine a fair resolution.

Practical Applications of Joint Tenancy

Joint tenancy, with its right of survivorship, offers a powerful tool for managing real estate ownership, particularly in family and business contexts. Understanding its practical applications is crucial to determining its suitability in specific scenarios. This section explores various real estate situations where joint tenancy proves advantageous and highlights situations where alternative ownership structures might be more appropriate.

Joint tenancy simplifies property transfer upon the death of one owner, eliminating the need for probate and potentially saving time and legal costs. However, it’s vital to weigh the implications of the right of survivorship against the potential loss of control and flexibility that can occur.

Joint Tenancy for Married Couples

Joint tenancy is frequently employed by married couples to own their primary residence. This arrangement ensures that upon the death of one spouse, the surviving spouse automatically inherits the property without the complexities and delays of probate. This streamlined process offers significant peace of mind, especially during times of grief. For example, a couple purchasing a home together could choose joint tenancy to ensure the surviving spouse inherits the property outright.

The advantages here are clear: ease of transfer and avoidance of probate costs. However, a disadvantage could be the lack of control if one spouse wishes to sell the property without the other’s consent. The surviving spouse inherits the property free of debt if the mortgage is paid off, however if the mortgage remains, the surviving spouse will be responsible for its continued payments.

Joint Tenancy for Business Partners

In business partnerships, joint tenancy can be used to hold commercial real estate. This simplifies ownership and avoids probate upon the death of a partner. For example, two entrepreneurs opening a restaurant could choose joint tenancy to hold the building. This structure can facilitate a smooth transition of ownership, ensuring business continuity. However, this arrangement can create challenges if the partners disagree on business decisions or if one partner wants to sell their share without the consent of the other.

The right of survivorship might also not be ideal if one partner wishes to bequeath their interest to a specific heir.

Joint Tenancy for Family Members

Families often use joint tenancy to transfer property to children or other relatives. This can be particularly useful for avoiding probate and simplifying estate administration. For example, parents may place a vacation home in joint tenancy with their children. This can provide a clear succession plan and avoid potential disputes amongst heirs. However, tax implications and the loss of control for the original owners should be carefully considered.

If one child is deemed irresponsible or if the family dynamic changes, this could lead to unforeseen complications.

Situations Where Joint Tenancy Might Not Be Suitable

While joint tenancy offers several benefits, it’s not always the best choice. Carefully considering the potential drawbacks is essential before opting for this ownership structure.

- When individual control is desired: If one owner wants the ability to sell or mortgage their share independently, joint tenancy is not ideal, as the consent of all joint tenants is typically required.

- In situations with complex estate planning: Joint tenancy can conflict with other estate planning goals, particularly if specific bequests are desired.

- When significant assets are involved: The right of survivorship in joint tenancy could lead to unintended tax consequences, especially with substantial assets.

- When there’s a potential for conflict between owners: The lack of individual control inherent in joint tenancy can exacerbate disputes among owners.

- When one owner has significant debt: Creditors of one joint tenant may be able to claim an interest in the jointly owned property, even if the other tenant is not involved in the debt.

Ending Remarks

In conclusion, understanding what is joint tenancy in real estate involves recognizing its unique legal framework and its significant implications for co-owners. From the shared rights and responsibilities to the complexities of severance and estate planning, careful consideration is crucial before entering into a joint tenancy agreement. By weighing the advantages and disadvantages, and seeking professional legal advice when necessary, individuals can make informed decisions that protect their interests and ensure a smooth ownership experience.

The information provided here serves as a foundation for understanding this intricate area of real estate law, prompting further research and consultation as needed to navigate specific situations.